Forming a joint venture (JV) can be a powerful way to expand your business, but it’s essential to ensure that every step is carefully planned and executed. This joint venture checklist guides you through the process, from conducting joint venture due diligence to drafting the joint venture agreement.

Following this due diligence checklist for a joint venture will help you avoid common pitfalls and build a solid foundation for your partnership.

By following this joint venture checklist, you'll be well-prepared to form a successful and legally sound partnership.

Checklist

Parties

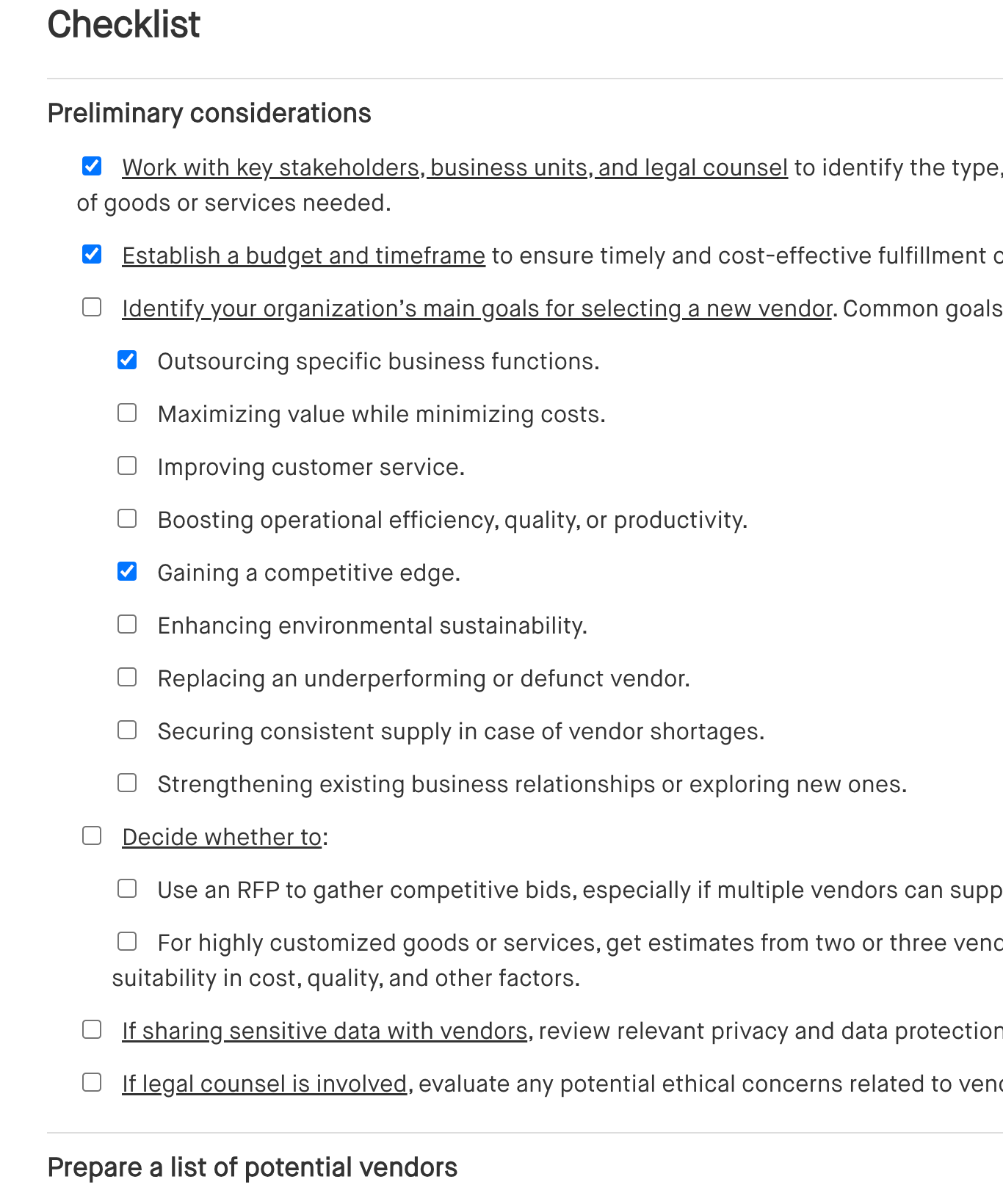

Preliminary documents

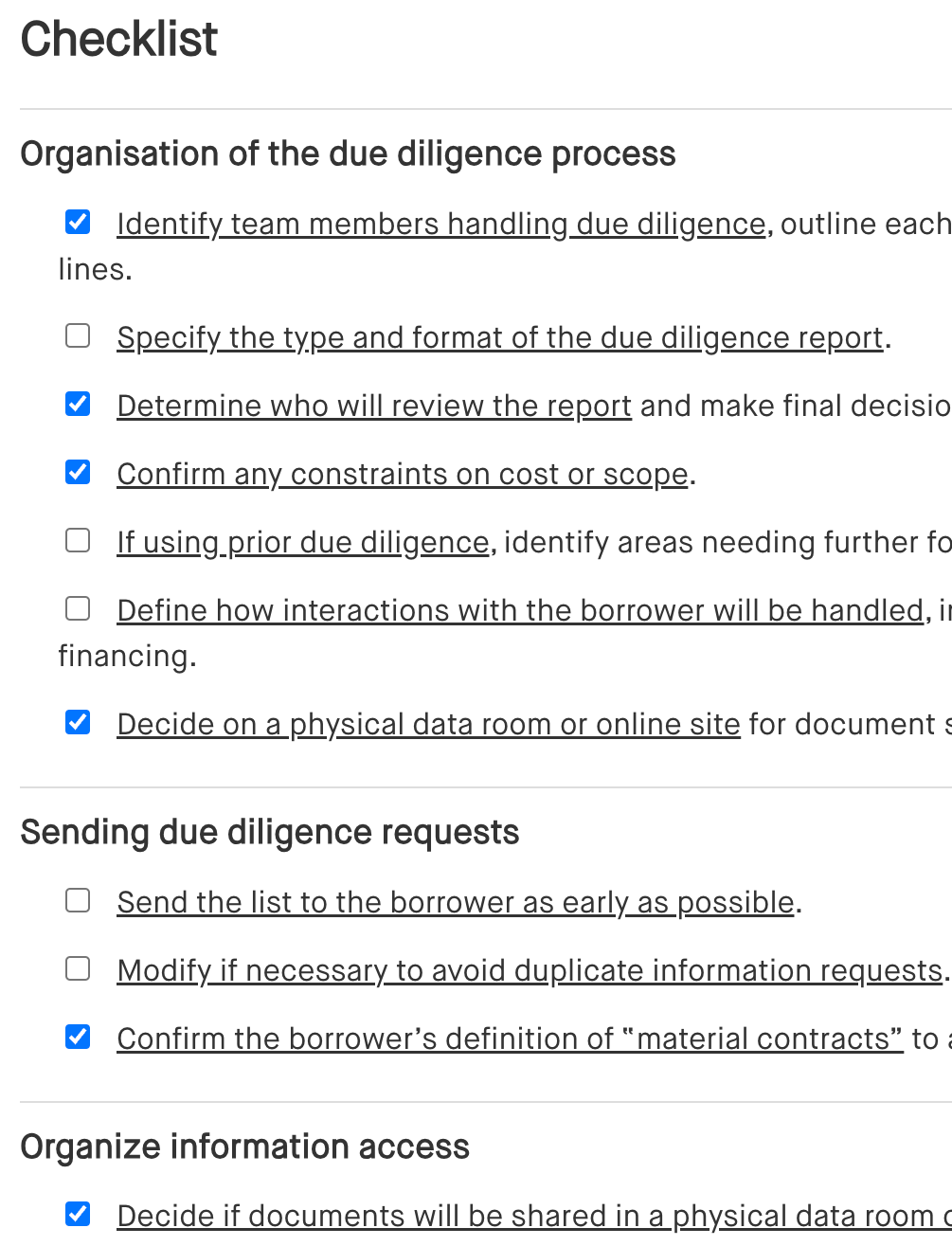

Due diligence, consents and approvals

Purpose and scope

Structuring the joint venture

Equity structure and financing

Contributions

Intellectual property

Governance and checklist

Minority protections

Restrictive covenants

Dispute resolution and deadlock

Defaults, exits and termination

Financial reporting

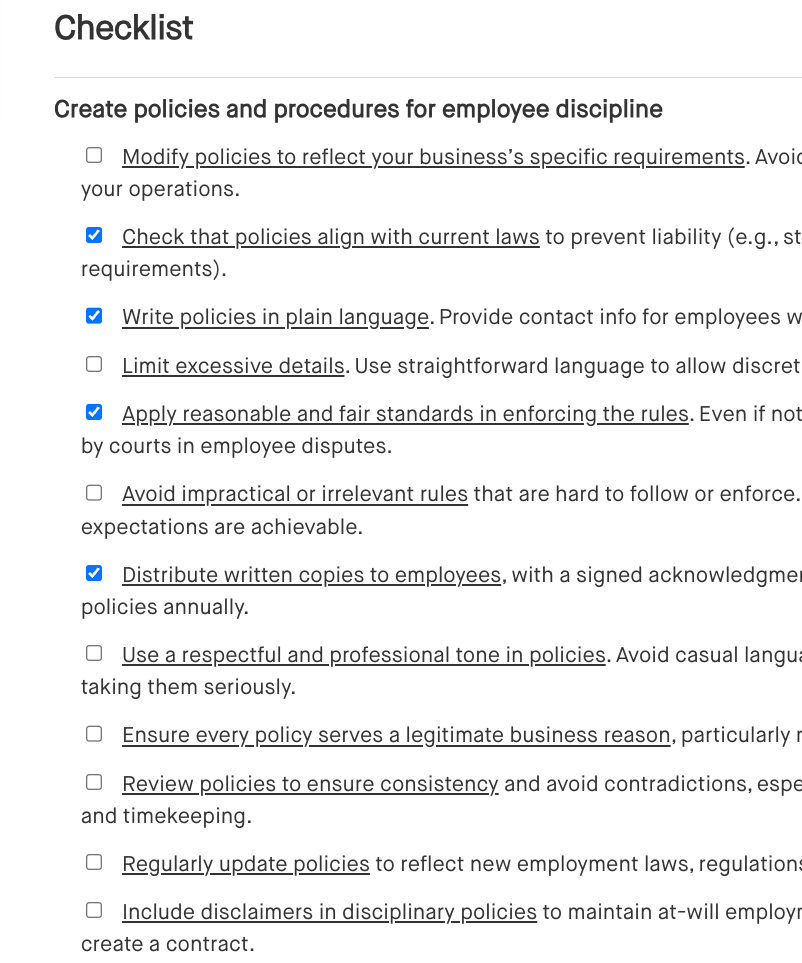

Employees

Additional entity formation and administrative matters

Using a joint venture checklist ensures that you take a structured approach when creating your partnership. Here’s why it’s helpful:

This article contains general legal information and does not contain legal advice. Cobrief is not a

law firm or a substitute for an attorney or law firm. The law is complex and changes often. For

legal

advice, please ask a lawyer.