Anti-corruption and foreign corrupt practices policy (North Carolina): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Anti-corruption and foreign corrupt practices policy (North Carolina)

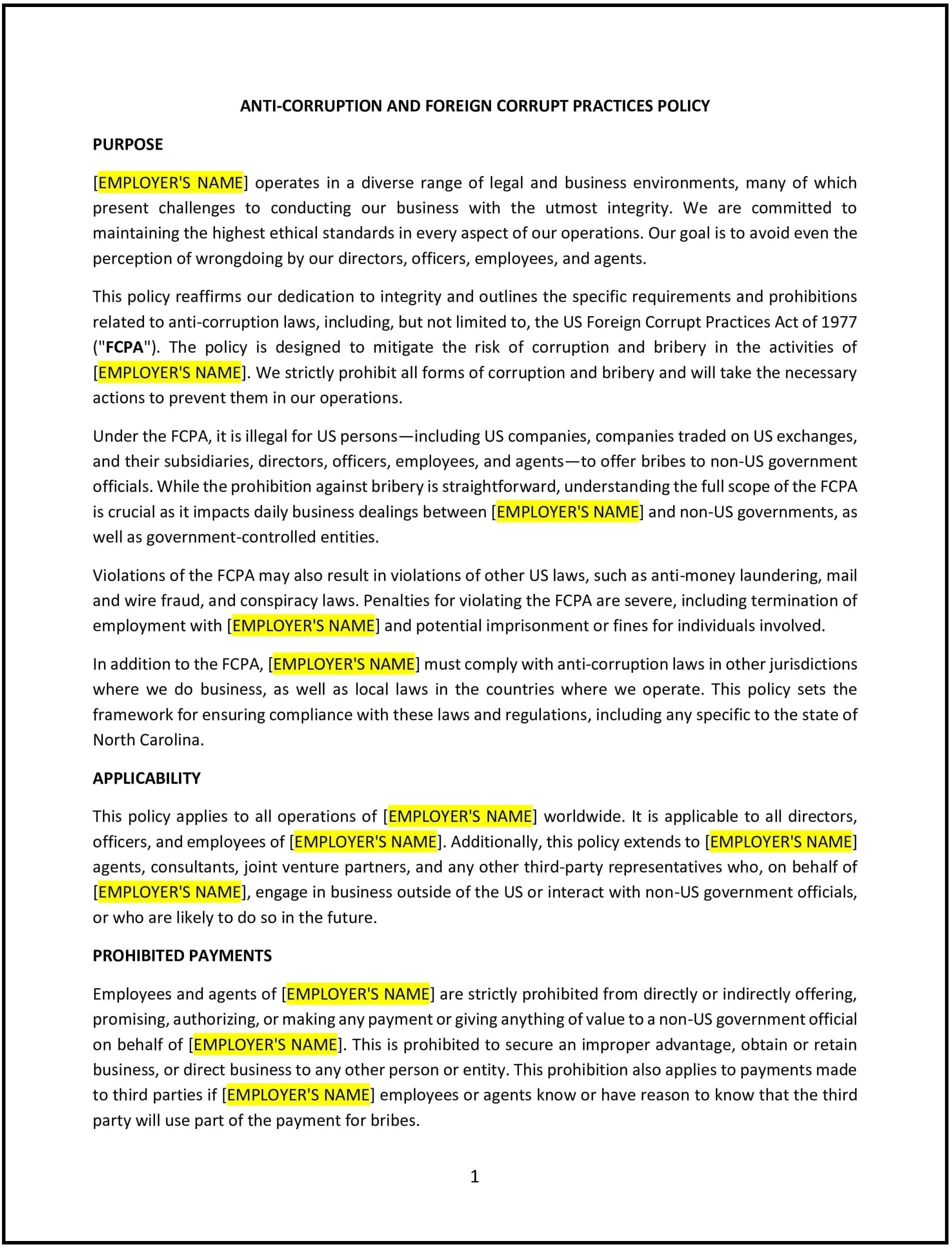

An anti-corruption and foreign corrupt practices policy helps North Carolina businesses establish clear guidelines to prevent corruption, bribery, and unethical conduct within both the domestic and international business environments. The policy outlines the company’s commitment to adhering to anti-corruption laws, including the U.S. Foreign Corrupt Practices Act (FCPA), as well as North Carolina’s state-specific regulations on bribery and corruption.

By adopting this policy, North Carolina businesses can reduce the risk of illegal activities, promote transparency and integrity in their operations, and protect the business from potential legal liabilities and reputational damage.

How to use this anti-corruption and foreign corrupt practices policy (North Carolina)

- Define corrupt practices: Clearly outline what constitutes corruption, bribery, and unethical conduct, including offering or receiving bribes, kickbacks, or any other form of illicit payments or benefits.

- Set expectations for employee behavior: Establish guidelines for employees regarding prohibited actions such as offering, accepting, or soliciting bribes, kickbacks, or improper payments in both domestic and international business dealings.

- Provide guidance on gifts and hospitality: Specify acceptable and unacceptable forms of gifts, entertainment, and hospitality, ensuring that these do not influence business decisions or create conflicts of interest.

- Address third-party relationships: Outline the company’s stance on working with third-party agents, contractors, or vendors who may be involved in corrupt practices. Emphasize due diligence and monitoring to ensure compliance with anti-corruption standards.

- Ensure transparency and reporting: Set up a transparent reporting mechanism for employees to report suspected corrupt activities without fear of retaliation.

- Reflect North Carolina-specific considerations: Incorporate any state-specific regulations related to anti-corruption and bribery laws, ensuring the policy aligns with local legal requirements and industry standards.

Benefits of using this anti-corruption and foreign corrupt practices policy (North Carolina)

This policy provides several benefits for North Carolina businesses:

- Reduces legal and financial risks: By complying with anti-corruption laws, businesses can avoid fines, penalties, and potential lawsuits associated with corruption and bribery.

- Protects the company’s reputation: A commitment to ethical business practices enhances the company’s reputation and fosters trust with clients, partners, and stakeholders.

- Promotes a culture of integrity: The policy sets a clear standard of integrity for employees and contractors, supporting ethical behavior in all business dealings.

- Increases transparency: The policy encourages transparency in business operations, reducing the likelihood of hidden or illegal activities.

- Ensures compliance: By adhering to anti-corruption laws and regulations, businesses ensure they comply with both U.S. federal and North Carolina state-specific anti-corruption laws, helping to mitigate legal risks.

Tips for using this anti-corruption and foreign corrupt practices policy (North Carolina)

- Communicate the policy clearly: Ensure that all employees understand the importance of the anti-corruption policy and their responsibility to comply. The policy should be included in the employee handbook, and staff should be trained on anti-corruption laws and reporting mechanisms.

- Conduct due diligence: Perform thorough background checks and due diligence on third-party agents, contractors, and vendors to ensure they adhere to the company’s anti-corruption standards.

- Monitor and enforce the policy: Regularly monitor the implementation of the policy through audits, compliance checks, and performance reviews to ensure that it is being followed across the business.

- Provide training: Offer regular training to employees on recognizing and avoiding corrupt practices, including the legal consequences of engaging in such activities.

- Review the policy regularly: Review the policy periodically to ensure it aligns with North Carolina’s laws, industry best practices, and changes in global anti-corruption regulations.