Charitable contributions (New Jersey) policy: Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

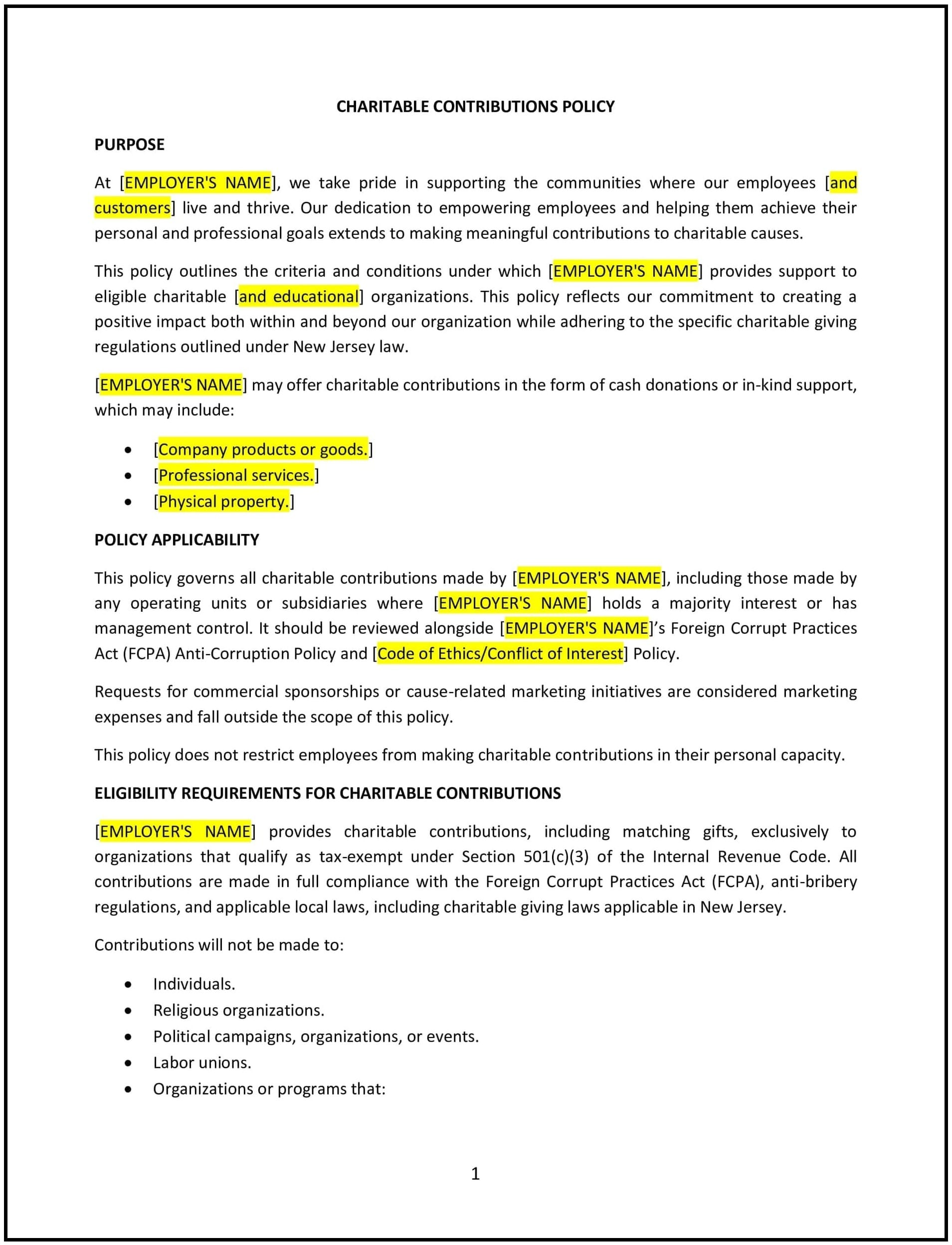

Charitable contributions (New Jersey)

A charitable contributions policy helps New Jersey businesses establish guidelines for donating funds, goods, or services to nonprofit organizations and community initiatives. This policy outlines the company’s commitment to social responsibility, the process for evaluating donation requests, and the criteria for selecting charitable partners. It also sets expectations for employee involvement in charitable giving programs.

By adopting this policy, businesses in New Jersey can support community engagement while maintaining transparency and consistency in their charitable efforts.

How to use this charitable contributions policy (New Jersey)

- Define the company’s approach to charitable giving: Outline the business’s commitment to philanthropy, including focus areas such as education, healthcare, environmental initiatives, or local community programs.

- Establish eligibility criteria for donations: Specify the types of organizations eligible for contributions, such as registered 501(c)(3) nonprofits, schools, or local charities, and any exclusions.

- Set the approval process: Detail how donation requests are reviewed, including required documentation and the decision-making authority within the company.

- Determine donation types: Clarify whether contributions will be in the form of financial donations, in-kind gifts, sponsorships, or volunteer support.

- Address employee participation: Provide guidance on how employees can request company donations for causes they support, as well as whether payroll deductions, donation matching, or volunteer opportunities are available.

- Outline ethical considerations: Establish guidelines to prevent conflicts of interest, political affiliations, or contributions that could impact the company’s reputation.

- Document and track contributions: Require businesses to maintain records of all donations for financial transparency and corporate responsibility reporting.

- Review and update: Regularly assess the policy to ensure it reflects the company’s philanthropic priorities and aligns with New Jersey’s charitable giving landscape.

Benefits of using this charitable contributions policy (New Jersey)

This policy provides several benefits for New Jersey businesses:

- Strengthens community relationships: Encourages meaningful partnerships with local nonprofits and social initiatives.

- Enhances company reputation: Demonstrates corporate social responsibility and commitment to positive social impact.

- Promotes employee engagement: Encourages employees to participate in charitable giving and volunteer opportunities.

- Ensures transparency: Establishes clear guidelines for evaluating and approving donations, reducing the risk of favoritism or misuse of funds.

- Aligns charitable efforts with business values: Helps businesses direct contributions toward causes that reflect company values and mission.]

Tips for using this charitable contributions policy (New Jersey)

- Communicate the policy clearly: Ensure employees, leadership, and nonprofit partners understand the company’s charitable giving criteria.

- Encourage employee involvement: Offer payroll deduction programs, volunteer days, or donation matching initiatives to engage employees in giving back.

- Maintain financial oversight: Keep records of all contributions and ensure donations align with company-approved causes.

- Partner with reputable organizations: Verify nonprofit status and impact before making contributions.

- Review the policy regularly: Update the policy as needed to reflect changes in corporate giving priorities and New Jersey nonprofit regulations.