Charitable contributions policy (Arizona): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Charitable contributions policy (Arizona)

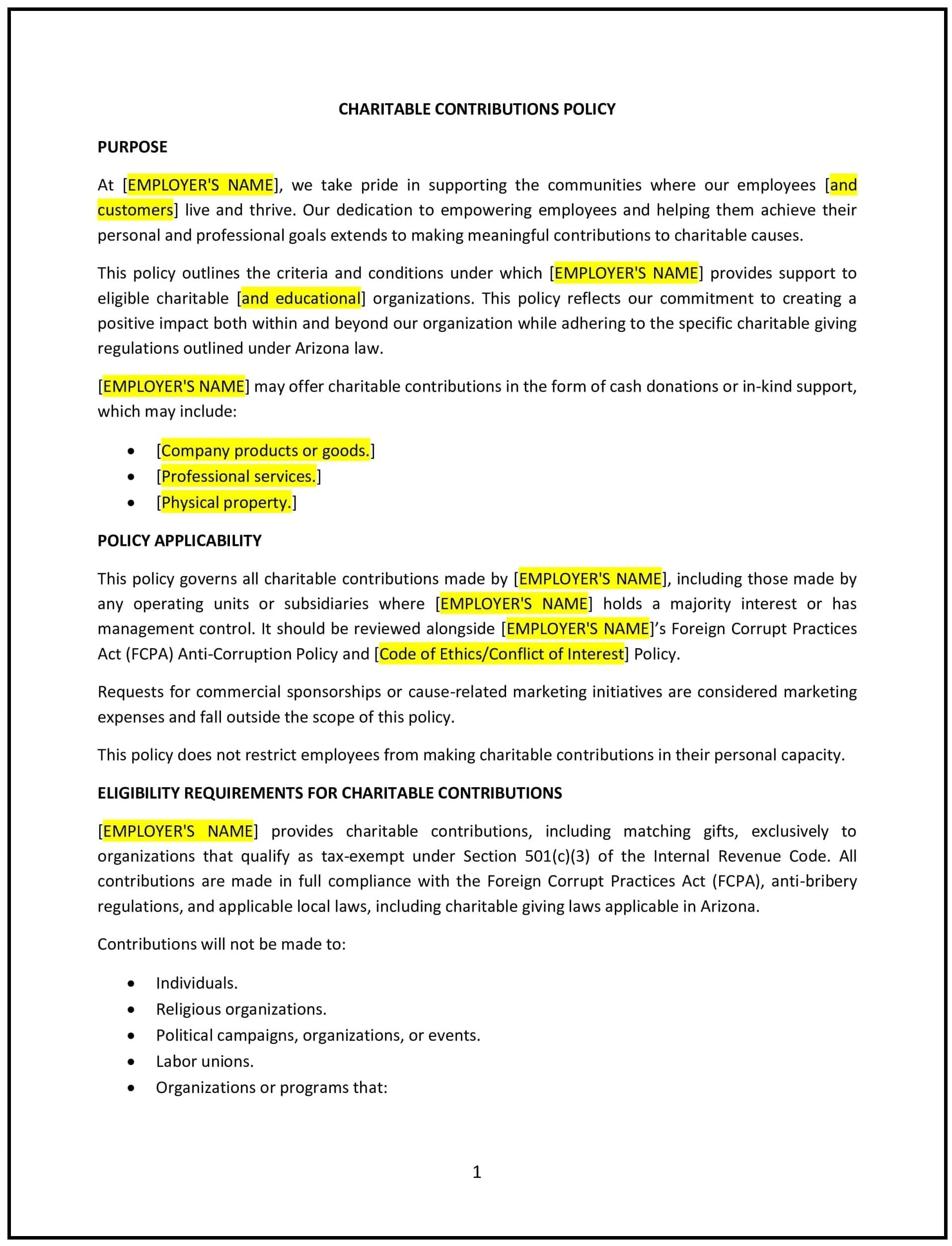

In Arizona, a charitable contributions policy provides businesses with guidelines for supporting nonprofit organizations, community initiatives, or other charitable causes. This policy ensures transparency, consistency, and alignment with company values when making contributions or encouraging employee participation in charitable activities.

This policy outlines eligibility criteria for donations, the process for approving contributions, and guidelines for employee involvement in charitable initiatives. By implementing this policy, Arizona businesses can strengthen their community impact while managing resources effectively.

How to use this charitable contributions policy (Arizona)

- Define contribution types: Clearly specify the types of support provided, such as monetary donations, in-kind contributions, or employee volunteer time.

- Align with company values: Ensure all contributions align with the organization’s mission and goals, reflecting its commitment to specific causes or communities.

- Establish approval processes: Outline procedures for evaluating and approving charitable requests, including criteria for eligibility and required documentation.

- Promote employee involvement: Encourage employees to participate in charitable activities through volunteer programs or donation matching initiatives.

- Monitor and report contributions: Maintain records of all charitable activities to ensure transparency and assess the impact of contributions.

Benefits of using a charitable contributions policy (Arizona)

This policy provides key advantages for Arizona businesses:

- Strengthens community ties: Enhances relationships with local organizations and communities, fostering goodwill and trust.

- Demonstrates corporate responsibility: Showcases the business’s commitment to making a positive social impact.

- Encourages employee engagement: Increases morale and teamwork by involving employees in charitable initiatives.

- Supports compliance: Ensures contributions align with Arizona and federal tax laws, avoiding potential legal or financial risks.

- Enhances brand reputation: Builds a positive image for the organization, attracting customers and partners who value social responsibility.

Tips for using a charitable contributions policy (Arizona)

- Focus on Arizona-specific causes: Prioritize contributions that address local needs, such as support for underserved communities or environmental conservation in the region.

- Engage employees: Implement programs like donation matching or paid volunteer days to increase employee participation in charitable efforts.

- Review tax implications: Consult with tax professionals to ensure all contributions meet state and federal requirements for deductibility.

- Measure impact: Evaluate the outcomes of charitable activities to understand their effectiveness and refine future efforts.

- Communicate contributions: Share details of charitable efforts with employees and stakeholders to build transparency and encourage participation.