Charitable contributions policy (Massachusetts): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

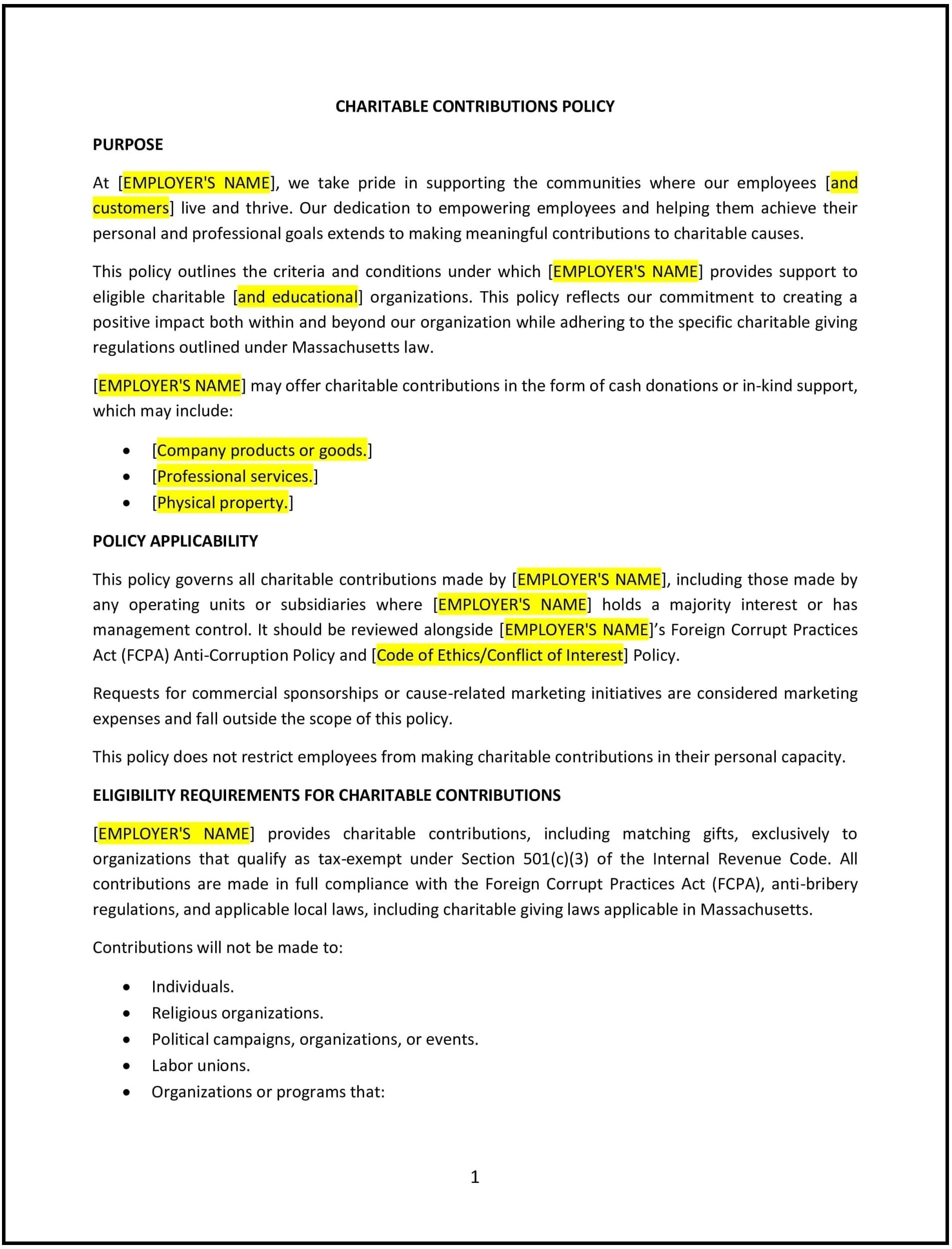

This charitable contributions policy is designed to help Massachusetts businesses establish guidelines for supporting charitable causes and community engagement. The policy outlines how employees can contribute to charitable organizations through payroll deductions, matching gifts, or volunteer efforts. It also specifies the company’s approach to charitable giving, including any company-sponsored initiatives or events and the types of organizations eligible for contributions.

By adopting this policy, businesses can promote corporate social responsibility, enhance employee engagement, and demonstrate their commitment to giving back to the community while ensuring that contributions align with company values and goals.

How to use this charitable contributions policy (Massachusetts)

- Define eligible charitable organizations: Specify which types of organizations are eligible for charitable contributions, including registered non-profits, local community groups, or other recognized charitable causes. The policy may include specific criteria for what qualifies as a charitable organization, such as tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

- Outline donation methods: Clearly explain the available methods for employees to make charitable contributions. This may include payroll deductions, one-time donations, or volunteering hours. Specify any platforms or systems through which donations can be made.

- Offer matching gift programs: If the company offers matching contributions, outline the program's details, including the maximum match amount, eligible donation types, and any restrictions. Provide clear instructions on how employees can submit their donations for matching.

- Promote volunteerism: Encourage employees to volunteer their time by offering paid volunteer hours, organizing company-sponsored volunteer events, or partnering with local organizations for volunteer opportunities. Specify how many paid volunteer hours employees are eligible for annually.

- Set limits and guidelines for donations: Define any limits or guidelines for charitable contributions, including restrictions on the amount that can be donated through payroll deductions, any restrictions on the types of causes the company will support, and how contributions should align with company values.

- Establish the approval process: Specify how employees can request charitable contributions or propose new causes for the company to support. The policy should include the steps employees need to take to submit donation requests or suggest new partnerships with charitable organizations.

- Ensure compliance with Massachusetts and federal laws: The policy should comply with Massachusetts state laws and federal regulations regarding charitable donations, including tax deductions, matching gift requirements, and guidelines for corporate donations.

Benefits of using this charitable contributions policy (Massachusetts)

This policy offers several benefits for Massachusetts businesses:

- Encourages corporate social responsibility: By offering employees opportunities to contribute to charitable causes, businesses can strengthen their commitment to community engagement and support for social responsibility initiatives.

- Boosts employee morale and engagement: Providing employees with ways to give back to the community can increase job satisfaction, foster a sense of purpose, and improve employee engagement.

- Enhances company reputation: Supporting charitable causes can improve the company’s public image, demonstrate its commitment to giving back, and position the company as a responsible, ethical employer in the eyes of employees, customers, and the public.

- Promotes a positive workplace culture: A policy that encourages charitable contributions and volunteerism can help foster a culture of kindness, generosity, and community within the workplace.

- Provides tax benefits: Charitable contributions made by the company may be eligible for tax deductions, providing a financial benefit to the business. Employees who donate may also benefit from tax incentives for charitable giving, in accordance with federal and state tax laws.

- Strengthens community ties: By contributing to local organizations and causes, the company can build stronger relationships with the surrounding community and enhance its visibility as a positive force in the area.

Tips for using this charitable contributions policy (Massachusetts)

- Communicate the policy clearly: Ensure that all employees are aware of the charitable contributions policy, how to participate, and the company’s expectations for donation involvement. This can be done through employee handbooks, newsletters, or meetings.

- Encourage employee involvement: Actively encourage employees to take part in the charitable giving programs, whether through payroll deductions, one-time donations, or volunteering. Consider creating incentive programs to further motivate employees to participate.

- Ensure consistency in giving: Apply the matching gift and donation processes consistently to ensure fairness among employees and maintain transparency in how contributions are processed and matched.

- Review eligible causes regularly: Periodically review the types of charitable causes and organizations that are eligible for support to ensure they align with company values and priorities.

- Monitor the impact: Track the impact of charitable contributions and volunteer efforts to assess how much the company is giving back and to highlight the positive outcomes of the program.

- Review and update regularly: Regularly review the policy to ensure it is compliant with Massachusetts state laws, federal regulations, and any changes in the company’s giving practices or priorities.