Charitable contributions policy (Michigan): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

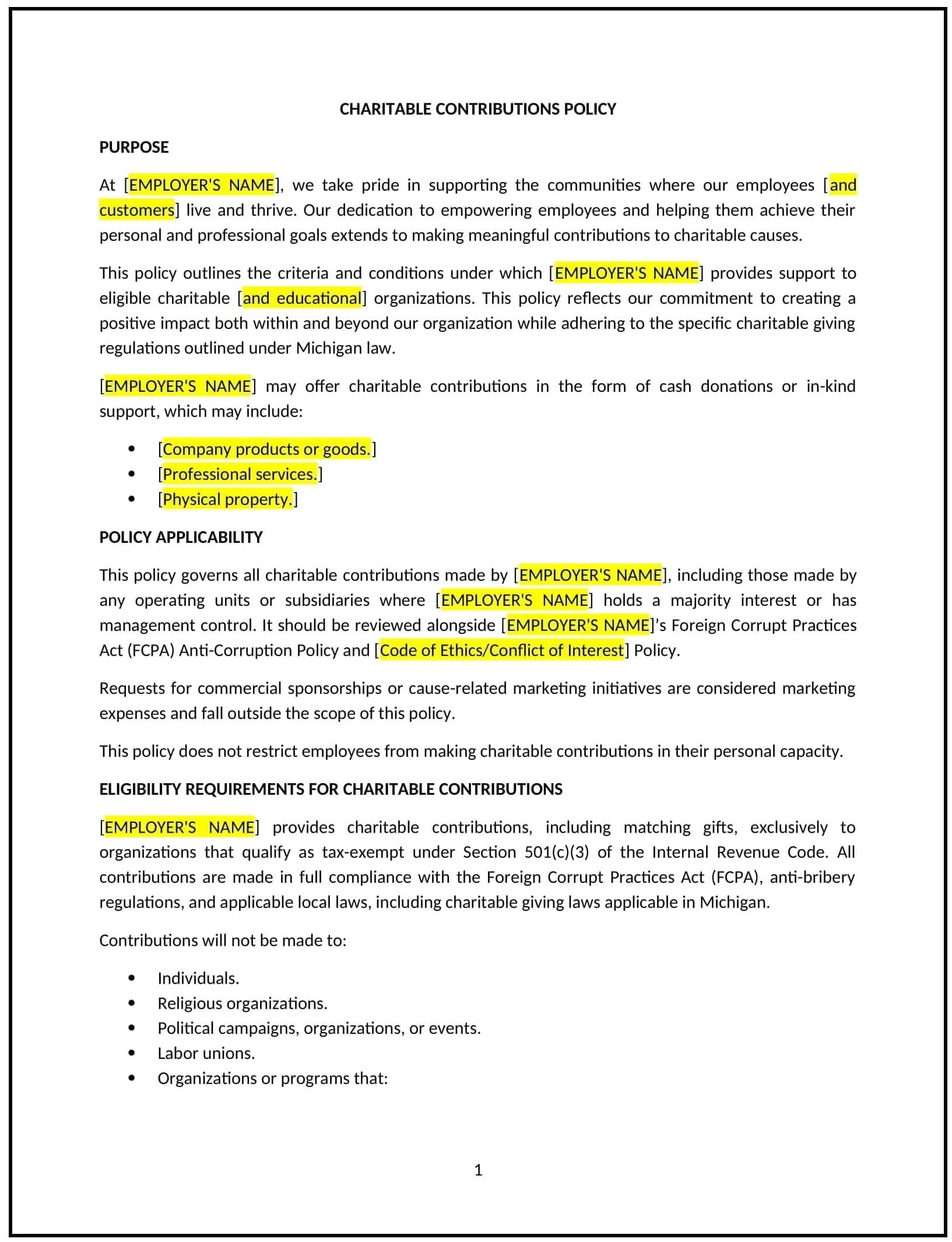

Charitable contributions policy (Michigan)

A charitable contributions policy provides Michigan businesses with guidelines for making donations to charitable organizations, whether through financial contributions, in-kind donations, or volunteer time. This policy ensures that charitable giving aligns with the company's values, is transparent, and supports causes that have a positive impact on the community.

By adopting this policy, businesses can demonstrate corporate social responsibility, engage employees in community service, and promote positive social change.

How to use this charitable contributions policy (Michigan)

- Define eligible recipients: Specify the types of charitable organizations that are eligible for donations, such as nonprofits, educational institutions, or causes aligned with the company’s mission or values.

- Set donation limits: Outline the maximum financial contribution that can be made per year or per employee, including any matching gift programs or limitations on the types of donations accepted.

- Establish approval procedures: Clarify the process for approving donations, including who within the organization is authorized to approve charitable contributions and any necessary documentation required.

- Encourage employee participation: Outline any programs that allow employees to participate in charitable giving, such as matching donation programs, volunteer days, or payroll deduction options.

- Address in-kind donations: Specify how in-kind donations, such as goods or services, will be handled and whether they are subject to the same approval procedures as financial contributions.

- Ensure transparency: Provide guidelines for reporting charitable contributions, ensuring that donations are properly documented and that there is transparency in how funds or resources are allocated.

- Promote community engagement: Encourage employees to get involved in charitable causes and support the company’s philanthropic initiatives, fostering a culture of giving back to the community.

Benefits of using this charitable contributions policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Demonstrates corporate social responsibility: By contributing to charitable causes, businesses show their commitment to the community and social good.

- Enhances company reputation: Supporting charitable organizations can boost the company’s public image and demonstrate leadership in corporate responsibility.

- Engages employees: Offering opportunities for employees to participate in charitable giving fosters a sense of community and pride in the workplace, improving morale and job satisfaction.

- Strengthens community ties: By supporting local and global charitable efforts, businesses can build stronger relationships with the community, customers, and other stakeholders.

- Provides tax benefits: Charitable contributions may be eligible for tax deductions, helping businesses reduce their taxable income while supporting worthwhile causes.

Tips for using this charitable contributions policy (Michigan)

- Communicate the policy: Ensure that employees are aware of the charitable contributions policy by including it in the employee handbook, during onboarding, and through internal communications.

- Encourage employee involvement: Promote opportunities for employees to participate in charitable giving and volunteering, and consider offering incentives for their involvement, such as matching donations or recognition programs.

- Monitor donations: Keep track of charitable contributions, including the amount, recipient, and purpose, to ensure the policy is being followed and that donations align with company values.

- Provide clear guidelines for approval: Ensure there is a clear process for submitting donation requests and obtaining approval, and ensure that decisions are made based on consistency and transparency.

- Review periodically: Update the policy regularly to reflect changes in Michigan laws, company priorities, and employee feedback.