Charitable contributions policy (Montana): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Charitable contributions policy (Montana)

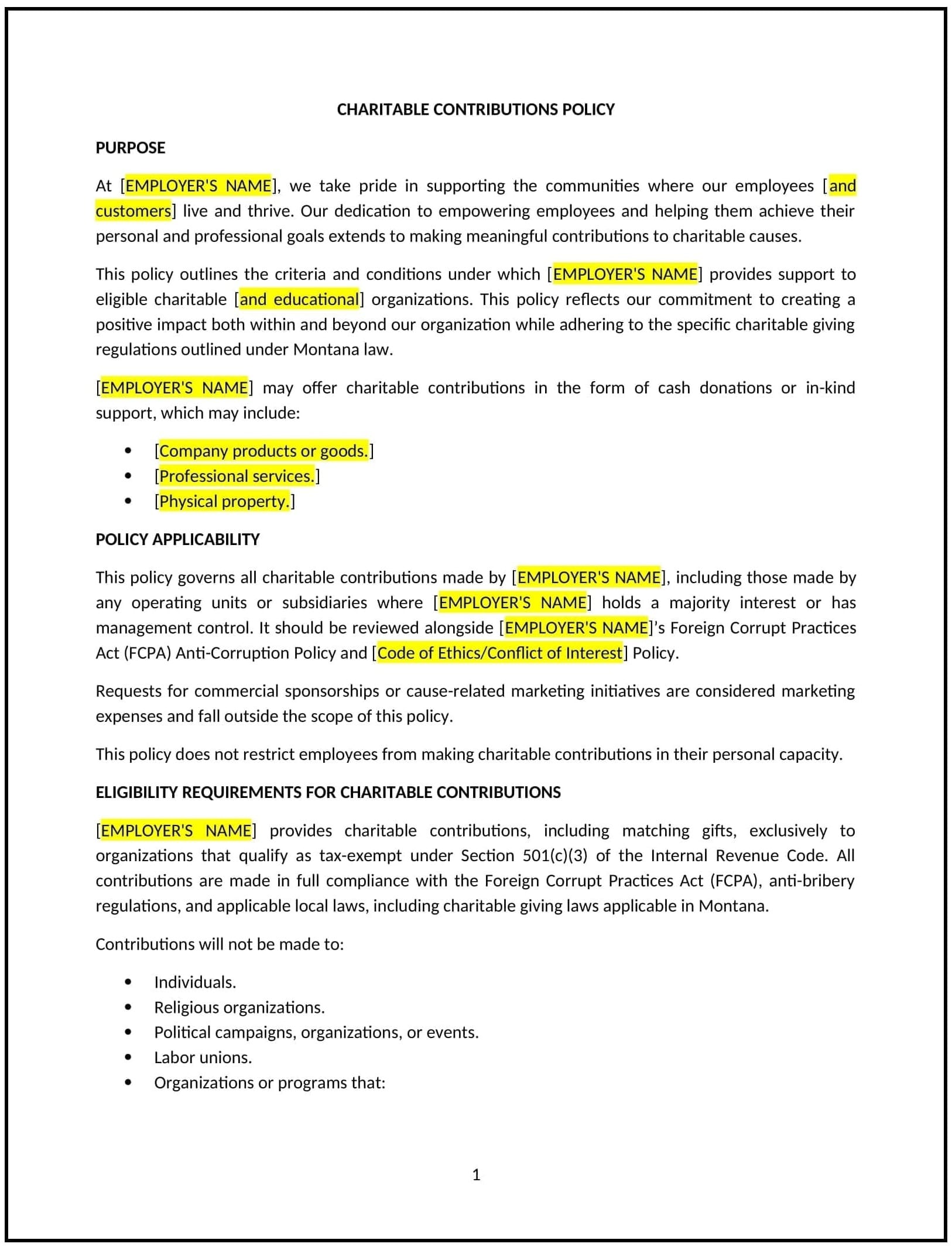

A charitable contributions policy helps Montana businesses establish clear guidelines for supporting charitable organizations, community projects, and causes. This policy outlines how businesses can make donations, whether through monetary contributions, volunteer efforts, or matching employee donations. It also sets expectations for employees seeking business support for personal charitable endeavors.

By implementing this policy, businesses can contribute to the community, strengthen relationships with employees, and demonstrate a commitment to social responsibility.

How to use this charitable contributions policy (Montana)

- Define types of charitable contributions: Businesses should specify the forms of charitable contributions they will support, such as financial donations, in-kind gifts, or employee volunteer programs.

- Set eligibility criteria for organizations: Businesses should establish criteria for selecting charitable organizations, such as nonprofit status, alignment with company values, or focus on local Montana causes.

- Determine donation limits and frequency: Businesses should set clear guidelines for donation amounts, whether they offer one-time gifts, annual donations, or ongoing contributions.

- Address employee involvement: Businesses should outline how employees can participate in charitable initiatives, whether through volunteering, fundraising, or nominating organizations for donations.

- Establish a matching gift program: Businesses should specify whether they will match employee donations to qualifying charities and establish matching contribution limits.

- Ensure transparency and accountability: Businesses should provide a transparent process for reviewing donation requests and reporting on charitable activities.

- Review and update regularly: Businesses should periodically review the policy to ensure it aligns with company goals and community needs.

Benefits of using this charitable contributions policy (Montana)

This policy provides several key benefits for Montana businesses:

- Strengthens community relationships: Charitable contributions demonstrate a business’s commitment to supporting local causes and improving community well-being.

- Enhances employee engagement: Employees are more likely to feel proud of working for a company that actively supports social causes.

- Improves brand reputation: Businesses known for their charitable efforts gain positive visibility in the community and the marketplace.

- Increases employee retention: Businesses that encourage volunteerism or match donations contribute to a culture of giving, which can improve employee loyalty.

- Provides tax benefits: Charitable donations are often tax-deductible, providing financial benefits to the business.

- Fosters a culture of social responsibility: A charitable contributions policy aligns business activities with broader ethical and community-focused goals.

Tips for using this charitable contributions policy (Montana)

- Communicate the policy clearly: Businesses should ensure employees are aware of the company’s charitable giving guidelines and how they can participate.

- Track charitable contributions: Businesses should maintain accurate records of donations made, volunteer hours, and matching contributions for transparency and reporting purposes.

- Encourage employee involvement: Businesses should foster a culture where employees are encouraged to nominate causes, volunteer, or fundraise for charity.

- Evaluate the impact of donations: Businesses should periodically assess how their charitable contributions are benefiting the community and the company’s objectives.

- Review policy annually: Businesses should review and update the policy regularly to ensure it reflects current values and community needs.