Charitable contributions policy (Nevada): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

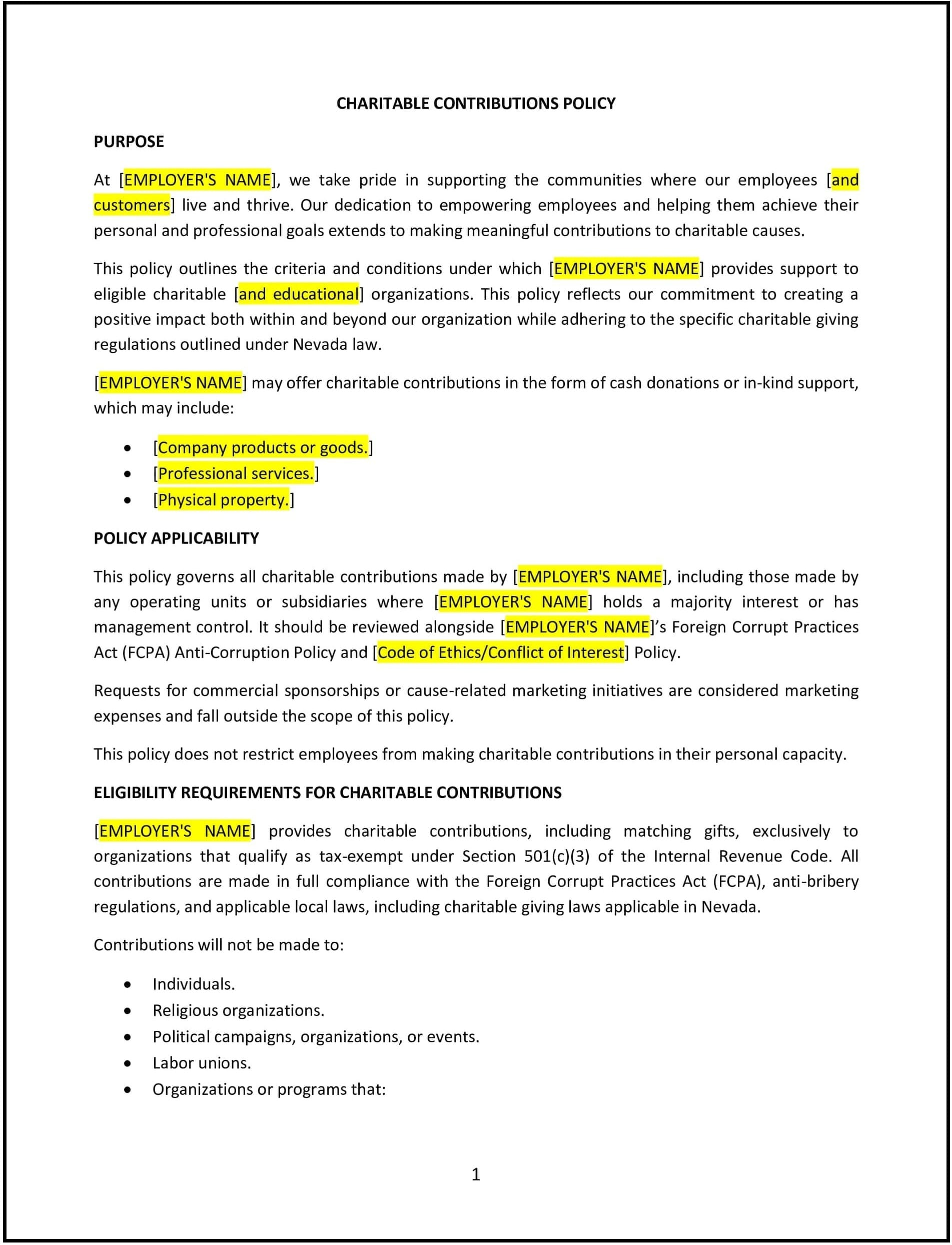

Charitable contributions policy (Nevada)

This charitable contributions policy is designed to help Nevada businesses establish guidelines for making charitable donations or contributions. It outlines the company’s approach to supporting charitable organizations, including how employees can participate in donation matching, volunteer programs, and other charitable initiatives.

By adopting this policy, businesses can demonstrate their commitment to social responsibility, support the communities they operate in, and encourage employees to participate in philanthropic activities.

How to use this charitable contributions policy (Nevada)

- Define eligible charitable organizations: Specify what types of organizations are eligible for donations, such as nonprofit organizations, registered charities, and educational institutions. The policy may set criteria for the organizations' charitable status.

- Outline donation matching: If the company matches employee donations, clearly state the matching process, including limits on donation amounts, eligible organizations, and how employees can request matching funds.

- Set guidelines for employee participation: Encourage employees to participate in charitable activities, including volunteering, fundraising, or participating in company-sponsored events.

- Specify the process for requesting donations: Define how employees can request company donations to charitable causes, including any necessary documentation or approvals required.

- Clarify budget and donation limits: Specify any donation limits, whether per employee, per year, or per cause. Include details about how the donation amount will be determined.

- Address tax implications: Provide information on the potential tax implications of charitable donations, ensuring that employees and the company remain compliant with Nevada state and federal tax laws.

- Promote transparency: Ensure that all charitable contributions are documented and transparent, and that employees understand how their donations are being used by the company.

Benefits of using this charitable contributions policy (Nevada)

This policy provides several key benefits for Nevada businesses:

- Strengthens corporate social responsibility: Demonstrates the company’s commitment to supporting charitable causes and making a positive impact on the community.

- Encourages employee engagement: Offers employees opportunities to contribute to causes they care about, fostering a sense of community and employee engagement.

- Enhances company reputation: Showcases the company’s dedication to philanthropy, which can improve its reputation and relationships with customers, clients, and the public.

- Improves employee morale: Engaging in charitable activities can boost employee morale and satisfaction by allowing them to participate in meaningful causes.

- Supports tax benefits: Ensures that the company and employees are informed about the potential tax advantages of charitable contributions.

Tips for using this charitable contributions policy (Nevada)

- Communicate the policy effectively: Make sure employees are aware of the charitable contributions policy and know how to participate, including any available matching funds or volunteer opportunities.

- Ensure alignment with business values: Align the company’s charitable contributions with its values and the causes that resonate with employees and stakeholders.

- Track contributions: Keep a record of all charitable donations made by the company, including employee contributions and matching funds, for transparency and reporting purposes.

- Review regularly: Periodically review the policy to ensure it aligns with any changes in Nevada state law or company priorities and practices.

- Encourage collaboration: Consider partnering with other organizations or local charities to increase the impact of the company’s charitable contributions.