Charitable contributions policy (New Hampshire): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

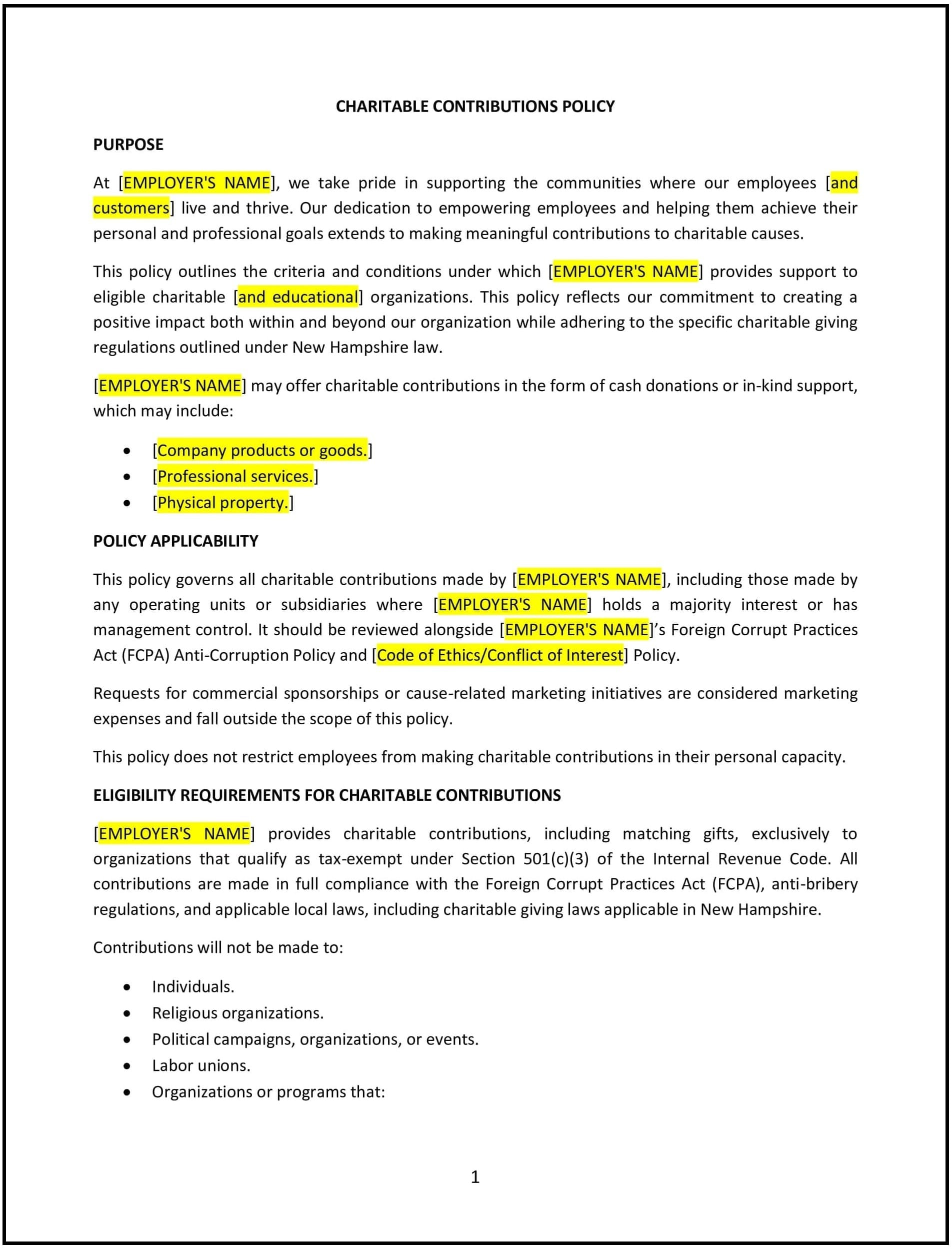

Charitable contributions policy (New Hampshire)

A charitable contributions policy helps New Hampshire businesses establish clear guidelines for making donations to charitable organizations and supporting community initiatives. This policy outlines the criteria for selecting charities, the process for approving and making donations, and how employees can be involved in charitable activities.

By adopting this policy, businesses in New Hampshire can encourage employee engagement, strengthen relationships with the community, and demonstrate corporate social responsibility.

How to use this charitable contributions policy (New Hampshire)

- Define eligible charities: Specify which types of charities or causes the company is willing to support, such as local nonprofits, educational institutions, or international humanitarian organizations.

- Set donation limits: Establish guidelines for the maximum donation amounts that can be made, whether per organization, per year, or per employee.

- Outline the donation approval process: Define the procedure for approving donations, including who within the company is responsible for reviewing and authorizing charitable contributions.

- Offer matching donations: Consider offering a matching donation program where the company matches employee contributions to qualifying charitable organizations, fostering a culture of giving.

- Encourage employee participation: Provide employees with the opportunity to nominate charities for company support or organize company-wide charitable initiatives, such as volunteering events or fundraisers.

- Provide tax information: Clarify any tax benefits or deductions employees or the company may receive for charitable contributions, ensuring transparency around financial matters.

- Ensure transparency and accountability: Track and report on charitable donations made by the company, sharing the impact of these contributions with employees and stakeholders.

- Review and update: Regularly review the policy to ensure it reflects New Hampshire regulations and the company’s evolving philanthropic goals.

Benefits of using this charitable contributions policy (New Hampshire)

This policy provides several benefits for New Hampshire businesses:

- Strengthens community relationships: Supporting local charities helps businesses build strong connections within the community and demonstrates corporate social responsibility.

- Enhances employee morale: Offering opportunities for charitable contributions or volunteer work can improve employee engagement, satisfaction, and a sense of purpose.

- Improves company reputation: Businesses that contribute to charitable causes enhance their reputation, attracting customers and employees who value companies with a strong social mission.

- Provides tax advantages: Charitable contributions can offer tax deductions for the company, providing financial benefits while supporting worthy causes.

- Encourages employee involvement: By involving employees in the charitable decision-making process, businesses foster a sense of ownership and pride in the company’s community efforts.

Tips for using this charitable contributions policy (New Hampshire)

- Communicate the policy clearly: Ensure that all employees understand the charitable contributions policy, including how they can get involved and how donations are approved and made.

- Track contributions and impact: Keep detailed records of all charitable contributions and provide employees with updates on the positive outcomes of the donations.

- Be transparent about the process: Ensure that employees and external stakeholders understand how charitable donations are selected and how funds are allocated.

- Offer employee engagement opportunities: Consider creating initiatives like volunteer days or charity drives that allow employees to contribute directly to causes they care about.

- Review the policy regularly: Update the policy as needed to reflect changes in New Hampshire state laws, company practices, or employee feedback regarding charitable efforts.