Charitable contributions policy (New Mexico): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

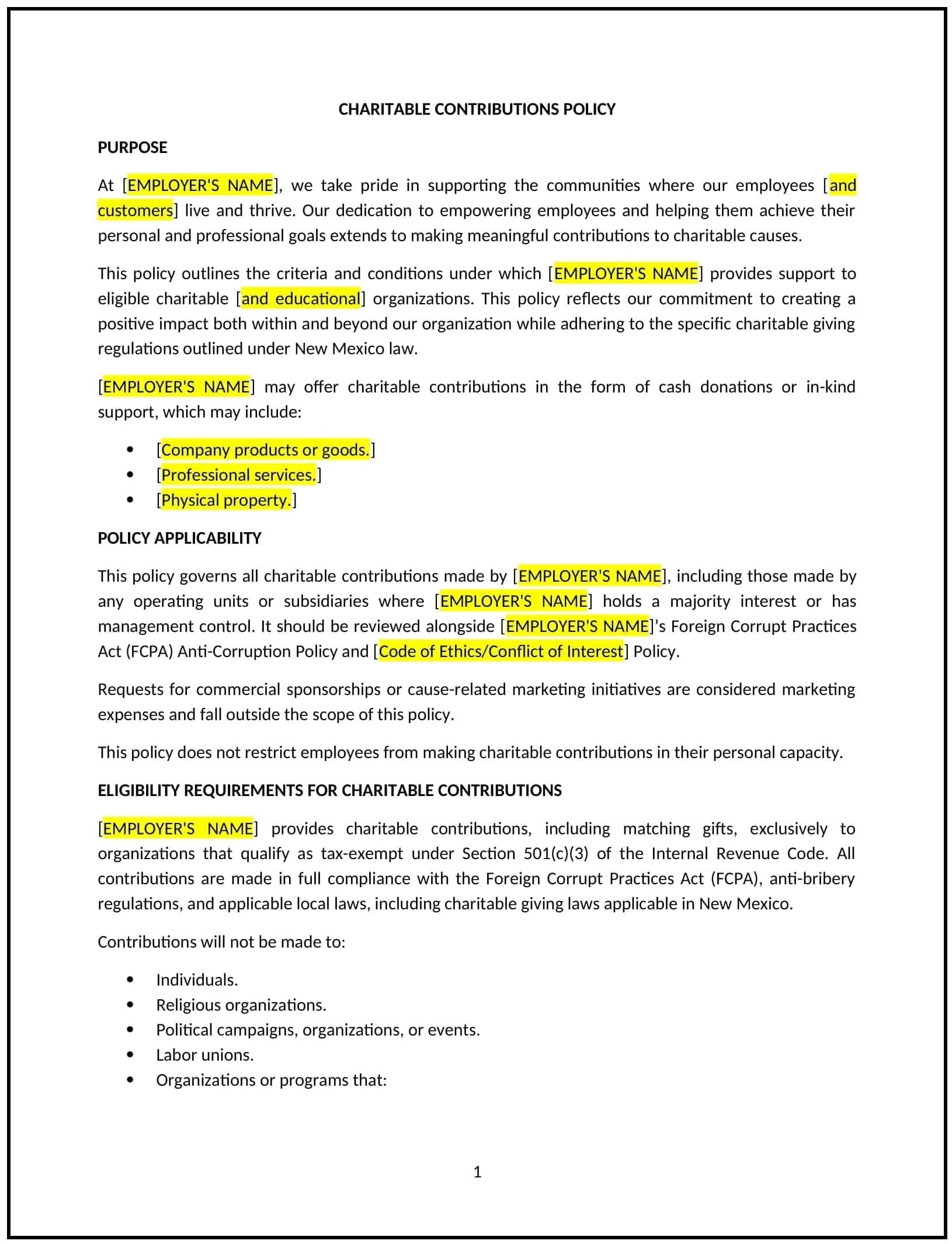

Charitable contributions policy (New Mexico)

A charitable contributions policy helps New Mexico businesses establish clear guidelines for donating to charitable organizations and community initiatives. This policy is designed to support businesses in making meaningful contributions that align with their values, mission, and the needs of New Mexico’s diverse communities. By formalizing the process for charitable giving, businesses can ensure transparency, accountability, and alignment with their goals.

By implementing this policy, businesses in New Mexico can strengthen their community ties, enhance their reputation, and contribute to the well-being of the state’s residents.

How to use this charitable contributions policy (New Mexico)

- Define charitable contributions: Clearly outline what qualifies as a charitable contribution, such as monetary donations, in-kind gifts, or volunteer support.

- Establish eligibility criteria: Specify the types of organizations or causes the business will support, such as education, health, or environmental initiatives.

- Set a budget: Determine the annual budget for charitable contributions and allocate funds accordingly.

- Create an approval process: Develop a clear process for reviewing and approving donation requests, including who is responsible for making decisions.

- Document contributions: Maintain records of all charitable contributions, including the recipient organization, amount, and purpose of the donation.

- Communicate the policy: Share the policy with employees, stakeholders, and the public to demonstrate the business’s commitment to community support.

- Monitor and evaluate impact: Regularly assess the impact of charitable contributions and ensure they align with the business’s goals and values.

- Review and update the policy: Periodically revise the policy to reflect changes in community needs, business priorities, or legal requirements.

Benefits of using this charitable contributions policy (New Mexico)

This policy offers several advantages for New Mexico businesses:

- Strengthens community ties: Charitable contributions help businesses build strong relationships with local organizations and residents.

- Enhances reputation: Demonstrating a commitment to community support can improve the business’s public image and credibility.

- Supports local causes: Contributions can address critical needs in New Mexico, such as education, health, and environmental sustainability.

- Aligns with business values: A formal policy ensures that charitable giving reflects the business’s mission and priorities.

- Encourages employee engagement: Involving employees in charitable initiatives can boost morale and foster a sense of purpose.

- Provides tax benefits: Properly documented charitable contributions may qualify for tax deductions, benefiting the business financially.

- Promotes transparency: Clear guidelines and documentation ensure accountability in the use of resources for charitable purposes.

Tips for using this charitable contributions policy (New Mexico)

- Communicate the policy effectively: Share the policy with employees, stakeholders, and the public through internal communications and the business’s website.

- Engage employees: Involve employees in selecting charitable causes or organizing volunteer activities to increase engagement and impact.

- Partner with local organizations: Collaborate with New Mexico-based nonprofits to ensure contributions address local needs effectively.

- Measure impact: Track the outcomes of charitable contributions and share success stories with stakeholders to demonstrate the policy’s value.

- Be transparent: Publish an annual report or summary of charitable contributions to maintain accountability and build trust.

- Review the policy periodically: Update the policy as needed to reflect changes in community needs, business priorities, or legal requirements.

- Celebrate contributions: Recognize and celebrate the positive impact of charitable giving through internal and external communications.