Charitable contributions policy (New York): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Charitable contributions policy (New York)

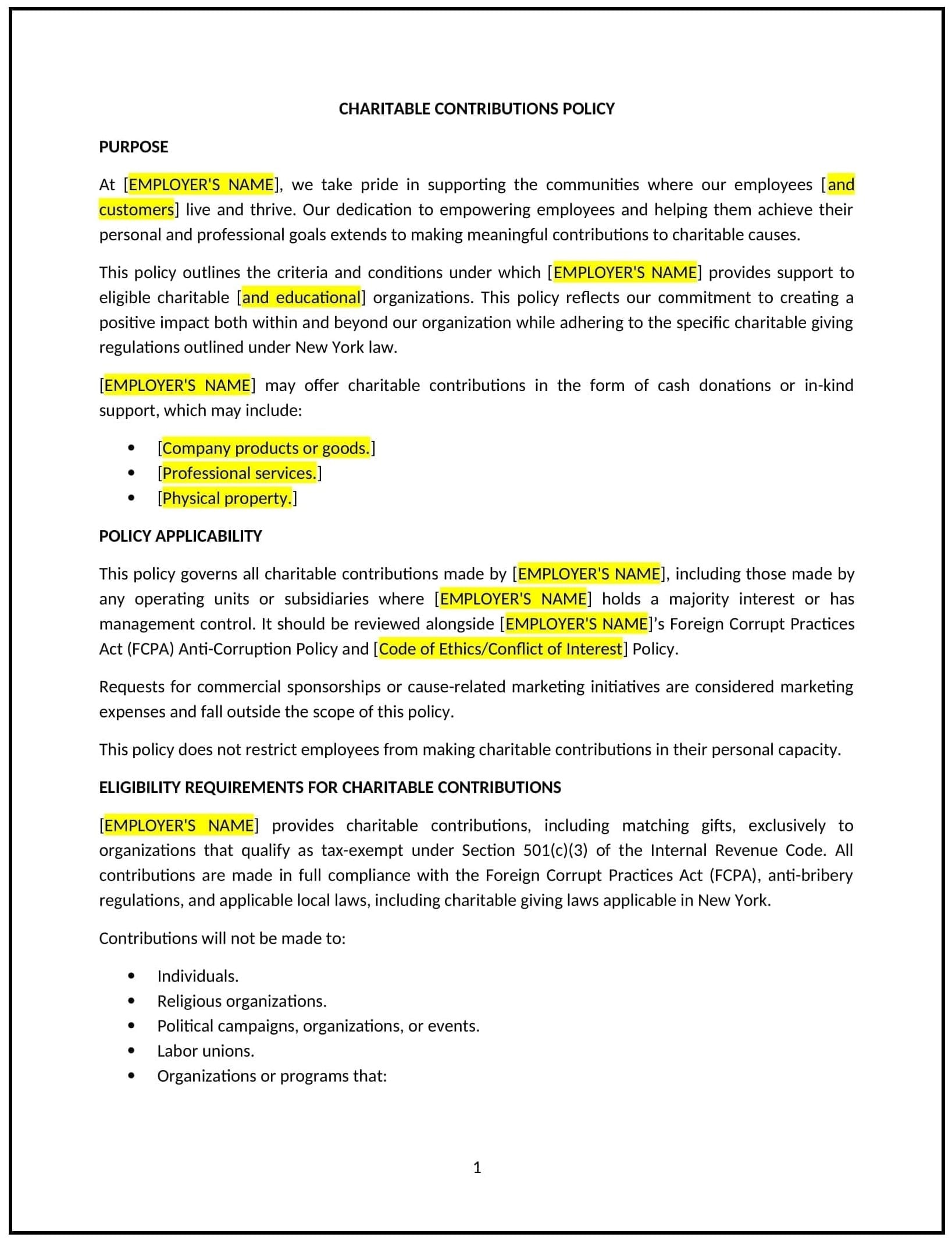

A charitable contributions policy helps New York businesses manage and support employee contributions to charitable organizations, fostering a culture of social responsibility. This policy outlines how businesses will handle charitable donations, the eligibility for matching contributions, and the process for approving and distributing funds. It also ensures that charitable activities align with the business’s values and that contributions are managed fairly and transparently. The policy may include guidelines on how employees can participate in fundraising events, donate to charities, or take time off for volunteer work.

By implementing this policy, businesses can demonstrate their commitment to social causes, enhance employee engagement, and potentially benefit from tax incentives related to charitable contributions.

How to use this charitable contributions policy (New York)

- Define eligibility for contributions: Specify who is eligible for charitable contributions, such as employees, contractors, or the business itself. The policy should also outline the types of charitable organizations that are eligible to receive donations, ensuring they align with the business’s values.

- Establish contribution guidelines: Set clear guidelines for the amount and frequency of charitable contributions, whether they are made in the form of monetary donations, goods, or services. The policy should include information on how contributions are determined and approved.

- Outline matching gift programs: If applicable, explain how the business will match employee donations, including the matching gift process, limits, and any restrictions on the types of charities that qualify.

- Define volunteering opportunities: Outline how employees can contribute through volunteering, including how they can request time off for volunteer work and whether the business will offer paid time off or other incentives for volunteering.

- Set expectations for transparency: Ensure that the charitable contributions process is transparent, with clear documentation on how donations are managed, tracked, and reported. This helps employees and other stakeholders trust the business’s commitment to charitable causes.

- Ensure compliance with New York state laws: Ensure that the policy complies with relevant state and federal regulations regarding charitable contributions, including tax deductions and reporting requirements.

Benefits of using this charitable contributions policy (New York)

This policy offers several benefits for New York businesses:

- Enhances employee engagement: A well-defined charitable contributions policy allows employees to get involved with causes they care about, fostering a sense of purpose and pride in their workplace.

- Boosts company reputation: By supporting charitable causes, businesses can enhance their reputation as socially responsible employers, which can attract top talent and strengthen relationships with customers and the community.

- Supports community impact: This policy helps businesses make a positive impact on local and global communities, addressing important causes and contributing to social good.

- Promotes tax benefits: Businesses that contribute to charity may be eligible for tax deductions, providing financial benefits while supporting worthy causes.

- Improves employee retention: Offering employees the opportunity to participate in charitable activities and supporting causes they care about can enhance job satisfaction and improve retention rates.

Tips for using this charitable contributions policy (New York)

- Communicate the policy clearly: Ensure that all employees are aware of the charitable contributions policy, including how they can participate in donation and volunteer programs. Provide this information during onboarding, in the employee handbook, and through periodic reminders.

- Align contributions with business values: Ensure that charitable donations and volunteer opportunities align with the business’s values and mission. This ensures that the company’s charitable activities are meaningful and supported by employees.

- Track contributions and volunteer hours: Keep accurate records of employee donations, volunteer hours, and matching gift contributions to ensure that all activities are documented and tracked appropriately. This will also help with reporting and meeting any tax or regulatory requirements.

- Encourage employee participation: Promote charitable programs through employee engagement activities, such as donation drives or volunteering events. Encourage employees to suggest charities or causes they are passionate about supporting.

- Review and update the policy regularly: Periodically review the charitable contributions policy to ensure it remains relevant, compliant with New York state laws, and aligned with the business’s goals and values.