Charitable contributions policy (North Carolina): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Charitable contributions policy (North Carolina)

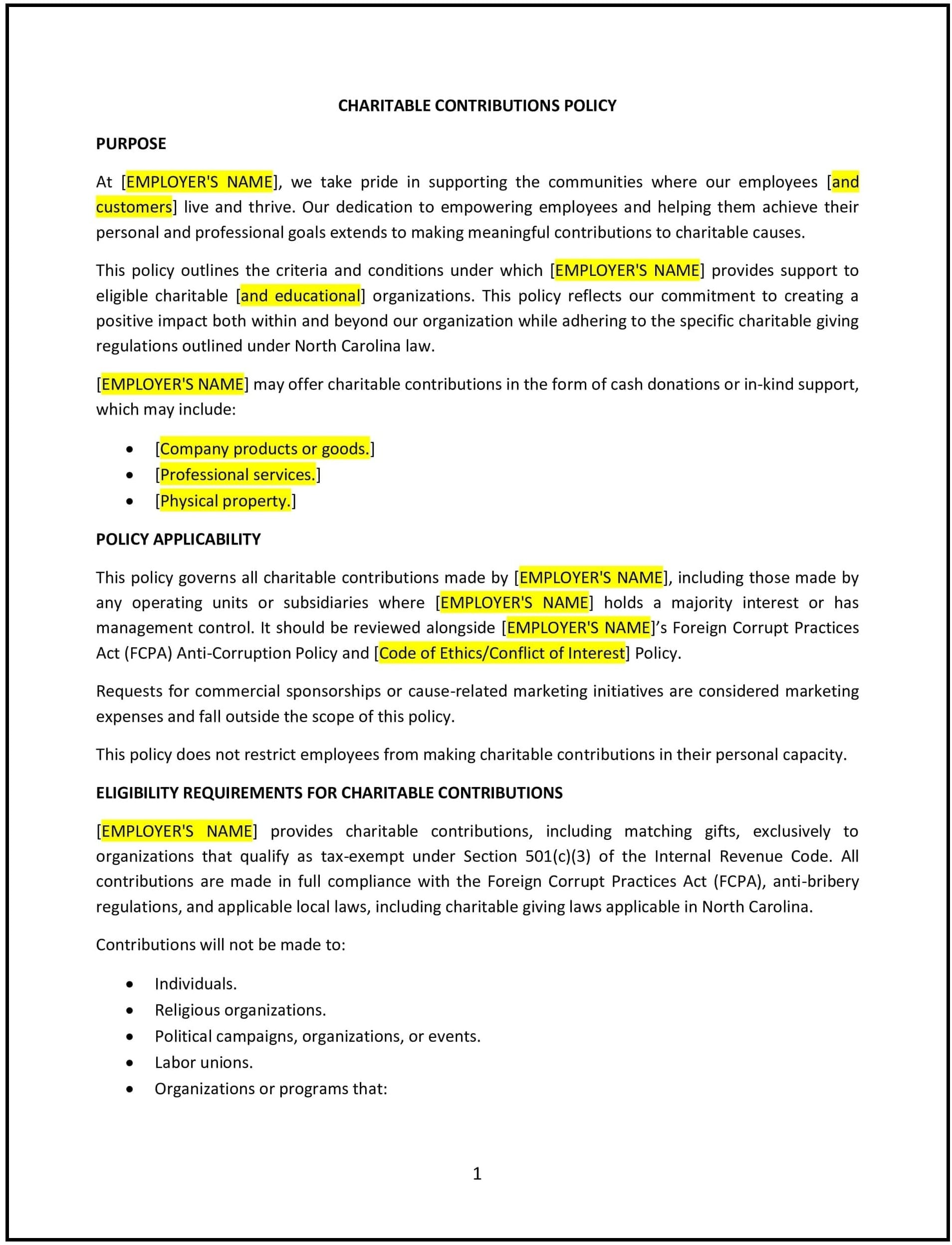

A charitable contributions policy helps North Carolina businesses outline the guidelines for making charitable donations or supporting nonprofit organizations. This policy establishes the company’s commitment to community involvement, defines the process for selecting charities to support, and provides guidelines for employee participation in charitable giving and fundraising activities.

By adopting this policy, businesses in North Carolina can demonstrate social responsibility, enhance their public image, and promote employee engagement in meaningful causes.

How to use this charitable contributions policy (North Carolina)

- Define eligible contributions: Specify the types of charitable contributions the business will make, including monetary donations, in-kind donations, volunteer hours, or matching gift programs.

- Set guidelines for charitable selection: Establish a process for selecting the organizations or causes to support, ensuring that the company’s contributions align with its values and mission.

- Define employee involvement: Outline how employees can participate in charitable activities, including options for payroll deductions, volunteering, or organizing fundraising events.

- Establish approval procedures: Specify the process for approving charitable contributions, including who is responsible for approving donations and how requests for contributions will be evaluated.

- Reflect North Carolina-specific considerations: Ensure the policy complies with North Carolina’s tax laws, charitable giving regulations, and any state-specific requirements for corporate donations.

Benefits of using this charitable contributions policy (North Carolina)

This policy provides several benefits for North Carolina businesses:

- Enhances company reputation: A clear commitment to charitable giving enhances the company’s reputation as a responsible and community-focused organization.

- Boosts employee morale: Employees are more likely to feel engaged and motivated when they see their employer supporting meaningful causes and providing opportunities for involvement.

- Promotes employee volunteerism: The policy encourages employees to participate in volunteer opportunities, contributing to a positive workplace culture and community impact.

- Offers tax benefits: Charitable contributions can provide tax deductions for the company, depending on North Carolina’s laws and the type of contributions made.

- Strengthens community ties: Supporting local causes and nonprofit organizations helps businesses build strong connections with the community, fostering goodwill and brand loyalty.

Tips for using this charitable contributions policy (North Carolina)

- Communicate the policy clearly: Ensure employees understand the opportunities available for charitable contributions, including any matching gift programs, volunteer initiatives, or donation procedures.

- Encourage employee involvement: Promote employee participation in charitable activities by offering incentives, recognition, or organizing company-wide volunteer events.

- Monitor and evaluate contributions: Regularly assess the effectiveness of the company’s charitable giving program, ensuring that donations align with the company’s values and that they positively impact the community.

- Review the policy regularly: The policy should be reviewed periodically to ensure it complies with North Carolina’s laws and remains in line with the company’s evolving charitable goals.