Charitable contributions policy (North Dakota): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

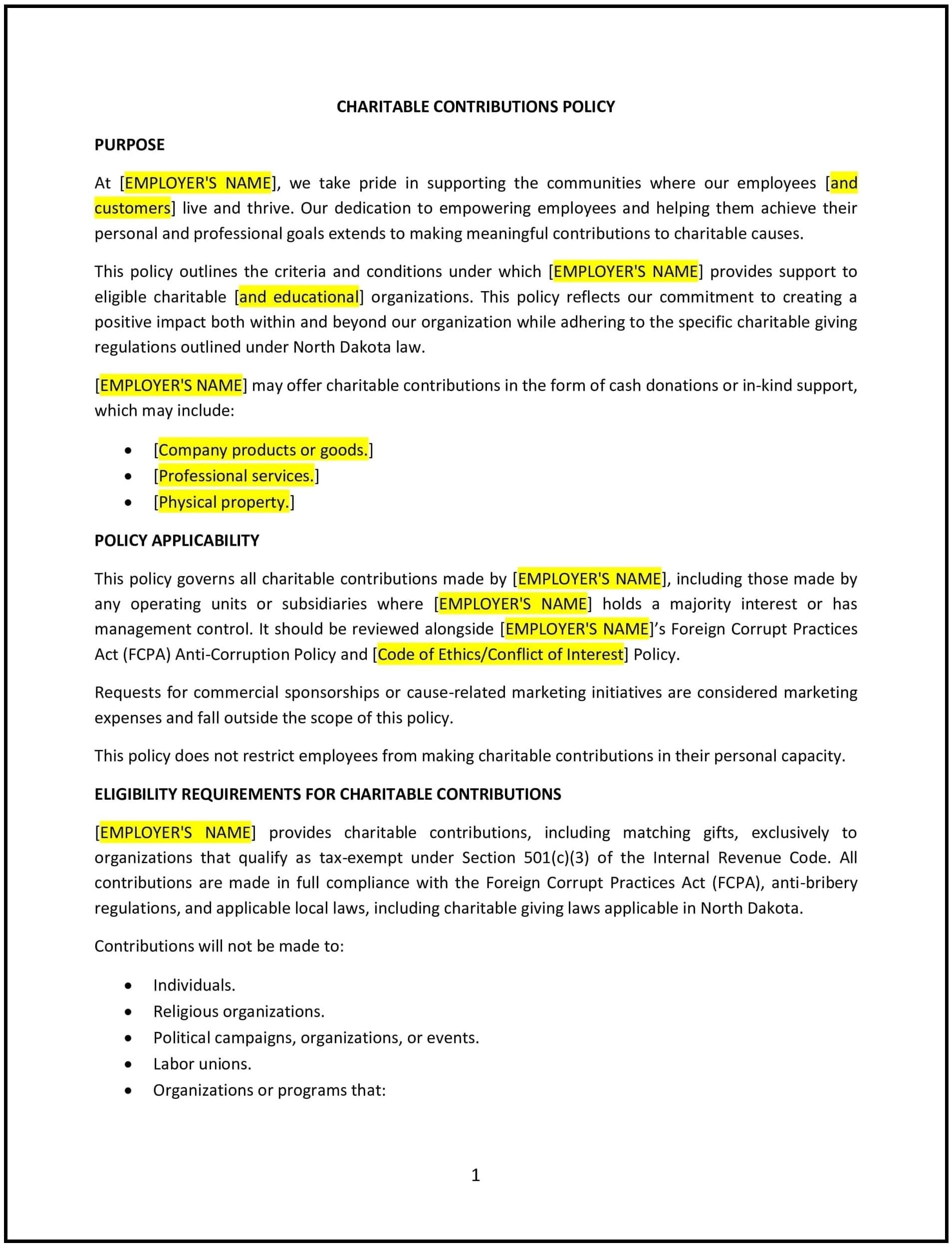

Charitable contributions policy (North Dakota)

This charitable contributions policy is designed to help North Dakota businesses establish guidelines for corporate giving, employee donation matching, and nonprofit partnerships. The policy outlines eligibility criteria, approval processes, and financial limits for charitable contributions to ensure responsible and strategic giving.

By implementing this policy, businesses can promote social responsibility while maintaining financial transparency and accountability.

How to use this charitable contributions policy (North Dakota)

- Define contribution scope: Specify the types of charities or nonprofit organizations eligible for company support.

- Establish approval procedures: Require a formal request process for charitable contributions.

- Set funding limits: Clarify maximum donation amounts and budget allocations for charitable giving.

- Address employee matching programs: Outline how businesses will match employee donations and set contribution caps.

- Ensure financial transparency: Maintain accurate records of all donations and nonprofit partnerships.

- Promote community involvement: Encourage employees to participate in company-sponsored volunteer initiatives.

- Review regularly: Update the policy based on business priorities and community needs.

Benefits of using this charitable contributions policy (North Dakota)

Implementing this policy provides several advantages for North Dakota businesses:

- Strengthens corporate social responsibility: Demonstrates commitment to supporting local and global causes.

- Enhances brand reputation: Builds goodwill and positive public relations for the company.

- Encourages employee engagement: Provides opportunities for staff to contribute to meaningful causes.

- Ensures financial accountability: Prevents misuse of company funds through structured donation guidelines.

- Reflects North Dakota-specific considerations: Supports local nonprofits and community initiatives.

Tips for using this charitable contributions policy (North Dakota)

- Align contributions with company values: Focus on causes that reflect business priorities and community impact.

- Set clear donation limits: Establish budget allocations for charitable giving.

- Require nonprofit verification: Ensure recipients are registered and meet eligibility criteria.

- Promote employee participation: Encourage staff involvement in donation-matching and volunteer initiatives.

- Adjust as needed: Update policies based on community needs and company giving strategies.