Charitable contributions policy (Ohio): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Charitable contributions policy (Ohio)

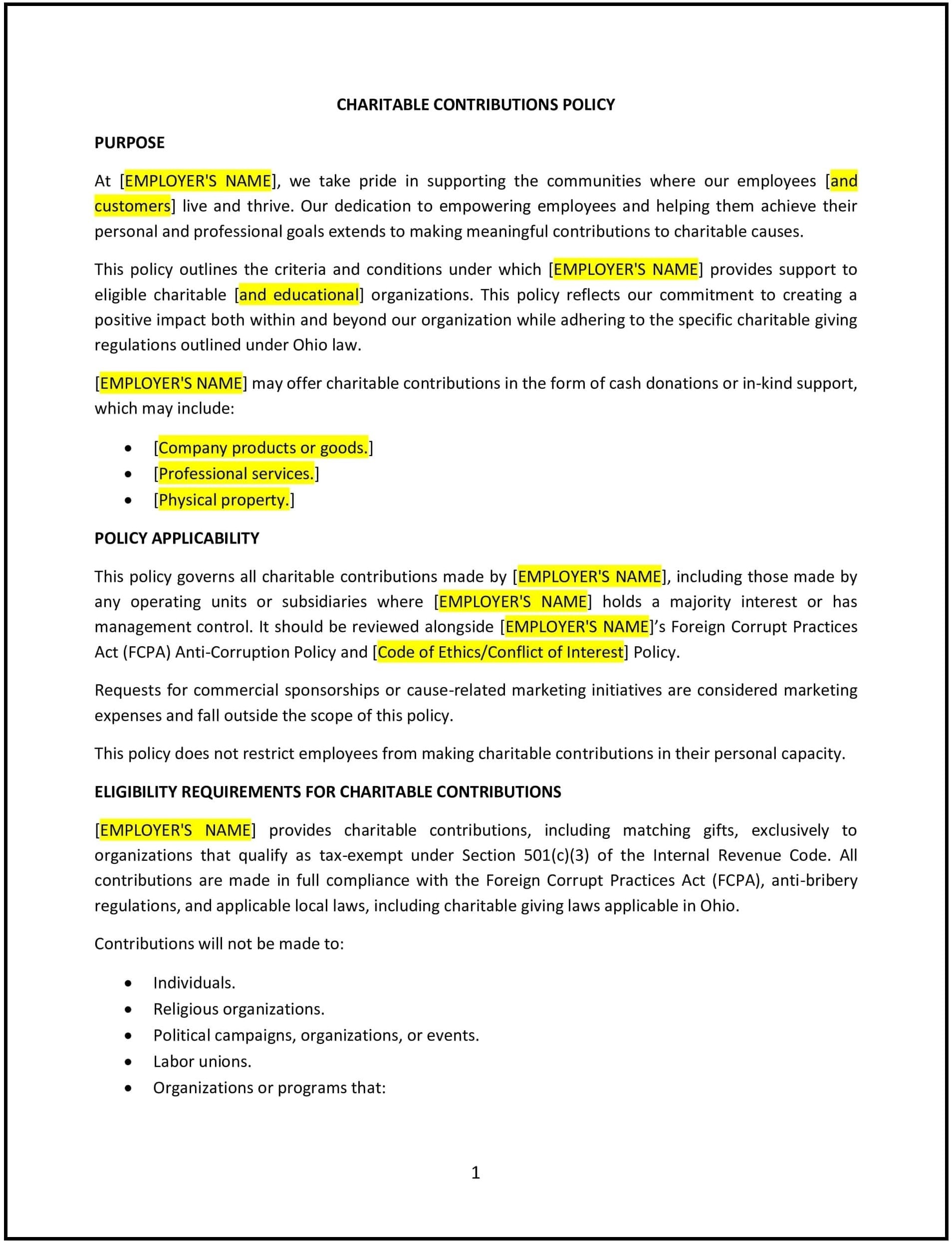

A charitable contributions policy outlines the guidelines for Ohio businesses regarding charitable donations, employee participation in charitable activities, and matching gift programs. This policy encourages businesses to support charitable causes by providing financial assistance, matching employee donations, or organizing volunteer activities. It sets the standards for how employees can request charitable contributions, details the process for approving donations, and specifies the types of organizations eligible for donations. It also addresses tax considerations and how businesses can ensure their contributions align with their values and corporate social responsibility goals.

By implementing this policy, Ohio businesses can enhance their corporate image, support meaningful community initiatives, and provide employees with an opportunity to contribute to causes they care about, which can improve morale and strengthen employee engagement.

How to use this charitable contributions policy (Ohio)

- Define eligible charitable organizations: The policy should specify which types of charitable organizations are eligible for donations, such as non-profits, educational institutions, and community organizations. It may include criteria such as the organization’s status as a registered 501(c)(3) nonprofit.

- Set donation limits: The policy should specify any limits on the amount the business will contribute, either as a one-time donation or an annual limit. It may also address matching gifts for employee donations.

- Establish a donation approval process: Outline the procedure employees should follow to request a charitable donation from the business, including any forms, deadlines, and the approval process. Specify who in the business is responsible for approving donations.

- Provide matching gift opportunities: If the business offers a matching gift program, the policy should explain how it works, including any restrictions on matching gift amounts and the types of organizations eligible.

- Include volunteer opportunities: The policy can also specify if the business supports employees volunteering for charitable causes during work hours, and if so, the guidelines for approval, time off, or recognition for volunteer service.

- Define the impact on taxes: Clarify the tax implications of charitable contributions, including any potential deductions for the business or employees, and whether donations are made on a pre-tax or after-tax basis.

- Ensure compliance with Ohio state laws: The policy should ensure that all charitable contributions comply with Ohio state laws and federal regulations, particularly regarding the tax-exempt status of organizations and any applicable tax credits or deductions.

- Review and update regularly: Regularly review and update the policy to ensure it remains aligned with Ohio state laws, changing business priorities, and evolving community needs.

Benefits of using this charitable contributions policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Enhances corporate reputation: By supporting charitable causes, businesses can improve their reputation in the community and position themselves as socially responsible, which can enhance brand loyalty and attract customers who value corporate responsibility.

- Boosts employee engagement and morale: Providing opportunities for employees to engage in charitable activities or donate to causes they care about can increase job satisfaction, loyalty, and overall morale, leading to higher retention rates.

- Promotes a positive company culture: Encouraging charitable contributions and volunteerism fosters a sense of community and shared purpose among employees, which strengthens workplace relationships and promotes a positive company culture.

- Expands community impact: By donating to charitable organizations and participating in volunteer efforts, businesses can have a tangible impact on local communities, supporting causes that improve the lives of others.

- Offers potential tax benefits: Charitable contributions may be tax-deductible for businesses, which can reduce their overall tax liability. The policy should clearly outline how tax deductions work and the process for claiming them.

- Aligns with corporate social responsibility goals: A charitable contributions policy helps businesses meet their corporate social responsibility (CSR) objectives, demonstrating their commitment to supporting important causes and making a positive difference in society.

- Encourages employee giving: By offering matching gifts and recognizing employee volunteer efforts, businesses can encourage more employees to contribute to charitable causes, multiplying the impact of their giving.

Tips for using this charitable contributions policy (Ohio)

- Communicate the policy clearly: Ensure that all employees are aware of the charitable contributions policy by including it in the employee handbook, during onboarding, and in any employee newsletters or updates.

- Provide options for giving: Offer employees a variety of ways to get involved, such as through direct donations, volunteer opportunities, or participating in fundraising events.

- Be transparent about the approval process: Clearly outline how employees can request charitable contributions and the steps required to receive approval. Ensure transparency in how decisions are made to foster fairness.

- Track donations and volunteer hours: Keep detailed records of all charitable donations, volunteer hours, and matching gifts to ensure compliance with the policy and for tax purposes.

- Recognize employees’ contributions: Consider publicly recognizing employees who make significant charitable contributions, whether through donations or volunteering, to encourage a culture of giving.

- Regularly review the policy: Periodically review and update the policy to ensure it aligns with Ohio state laws, changes in business priorities, and employee feedback. Adjust the policy as necessary to stay relevant to current needs.