Charitable contributions policy (Oklahoma): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

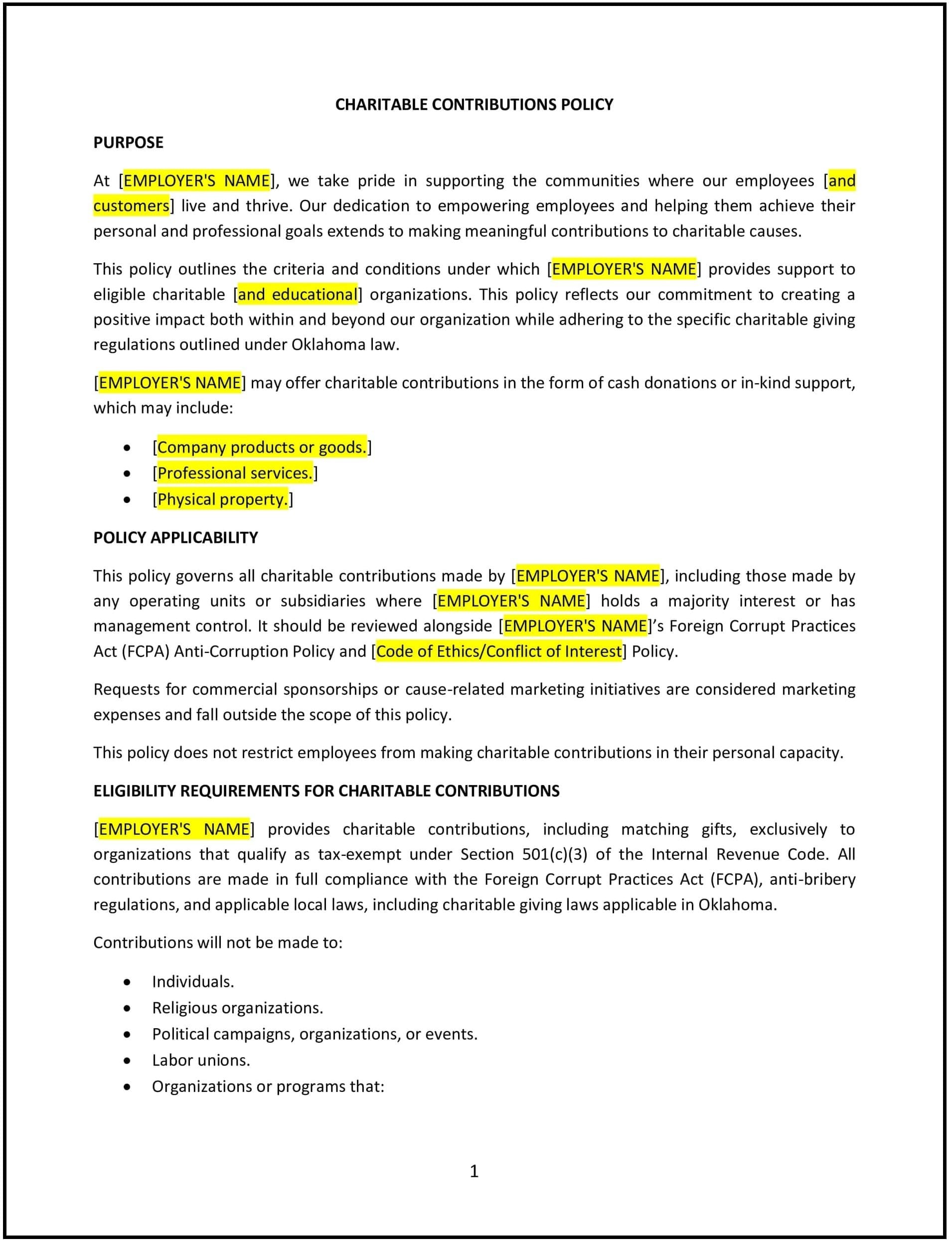

Charitable contributions policy (Oklahoma)

This charitable contributions policy is designed to help Oklahoma businesses establish clear guidelines for making financial or in-kind donations to charitable organizations. The policy outlines eligibility criteria, approval processes, and compliance requirements to ensure transparency and alignment with business values.

By implementing this policy, businesses can support community engagement while maintaining accountability in charitable giving.

How to use this charitable contributions policy (Oklahoma)

- Define eligible organizations: Specify which charities, non-profits, or community groups qualify for contributions based on business priorities.

- Establish approval procedures: Require employees or departments to submit formal requests for charitable donations, subject to management review.

- Outline contribution limits: Set annual or per-donation limits to ensure financial oversight and budgeting.

- Address compliance requirements: Ensure contributions comply with local, state, and federal laws, including tax-exempt status verification.

- Provide documentation guidelines: Require proper record-keeping of donations for transparency and reporting purposes.

- Encourage employee participation: Outline programs such as donation matching, volunteer grants, or payroll deductions for charitable giving.

- Review regularly: Periodically assess the policy to reflect business goals, legal requirements, and Oklahoma-specific charitable opportunities.

Benefits of using this charitable contributions policy (Oklahoma)

Implementing this policy provides several advantages for Oklahoma businesses:

- Enhances corporate social responsibility: Demonstrates a commitment to giving back to the community.

- Ensures financial accountability: Provides structured oversight for donation approvals and allocations.

- Strengthens business reputation: Builds goodwill with customers, employees, and community organizations.

- Encourages employee engagement: Supports workplace culture by involving employees in charitable initiatives.

- Reflects Oklahoma-specific philanthropic opportunities: Tailoring contributions to local causes ensures a meaningful impact.

Tips for using this charitable contributions policy (Oklahoma)

- Align with business values: Support causes that align with company goals, industry relevance, or community needs.

- Verify organizations: Ensure that recipients are legitimate non-profits with proper tax-exempt status.

- Communicate internally: Inform employees about donation opportunities and company-supported charities.

- Monitor impact: Track contributions to measure effectiveness and community benefit.

- Adjust as needed: Update the policy based on feedback, legal changes, or shifting business priorities.