Charitable contributions policy (Oregon): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

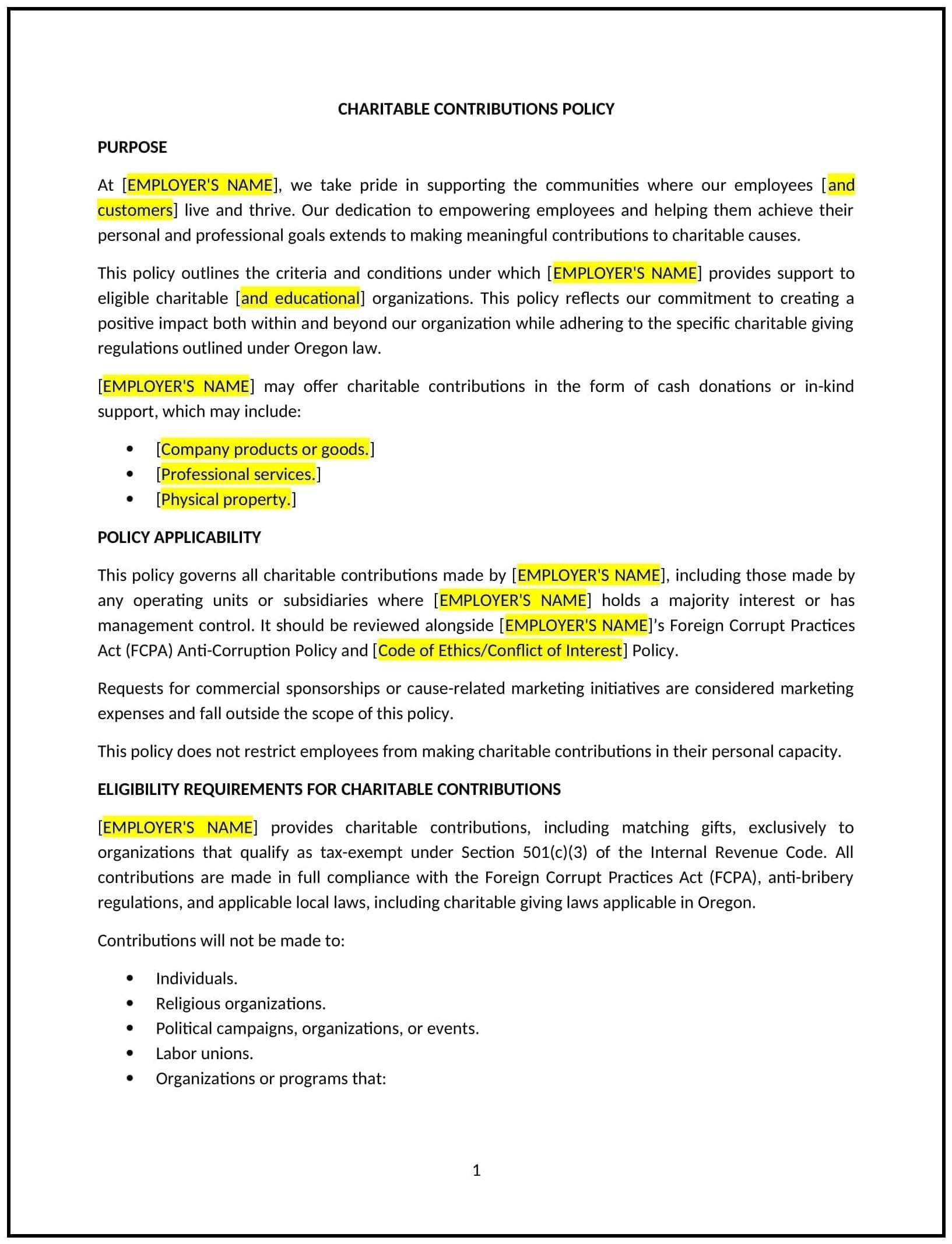

Charitable contributions policy (Oregon)

This charitable contributions policy is designed to help Oregon businesses establish guidelines for donating to charitable organizations. It outlines procedures for selecting charities, approving donations, and tracking contributions.

By adopting this policy, businesses can support community initiatives, enhance their reputation, and align with their corporate social responsibility goals.

How to use this charitable contributions policy (Oregon)

- Define charitable contributions: Clarify what constitutes a charitable contribution, such as monetary donations, in-kind gifts, or volunteer time.

- Establish selection criteria: Outline factors for selecting charitable organizations, such as alignment with business values and community impact.

- Set approval procedures: Specify steps for approving charitable contributions, including budget limits and decision-making authority.

- Track contributions: Provide guidelines for documenting and reporting charitable donations.

- Train managers: Educate supervisors on the policy and their responsibilities when approving contributions.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and community priorities.

Benefits of using this charitable contributions policy (Oregon)

This policy offers several advantages for Oregon businesses:

- Supports community initiatives: Demonstrates a commitment to giving back and supporting local organizations.

- Enhances reputation: Builds goodwill and strengthens the business’s reputation in the community.

- Aligns with corporate social responsibility: Reflects the business’s values and commitment to social impact.

- Provides structure: Offers a clear framework for managing charitable contributions, ensuring consistency and transparency.

- Encourages employee engagement: Inspires employees to participate in charitable activities, boosting morale and teamwork.

Tips for using this charitable contributions policy (Oregon)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate managers on the policy and their responsibilities when approving contributions.

- Monitor compliance: Regularly review charitable contributions to ensure adherence to the policy.

- Address issues promptly: Take corrective action if contributions are made outside the policy guidelines.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs and community priorities.