Charitable contributions policy (Pennsylvania): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

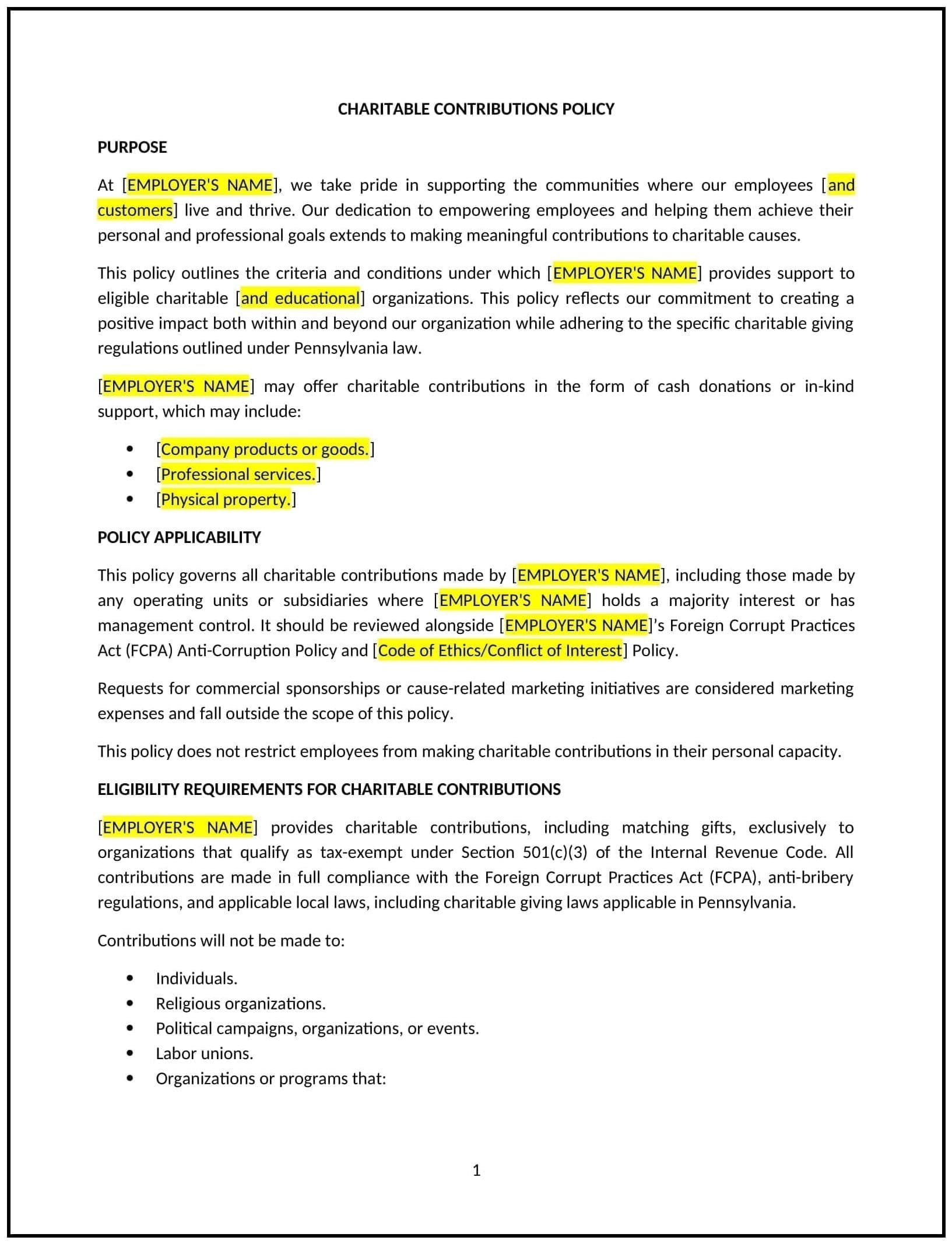

Charitable contributions policy (Pennsylvania)

This charitable contributions policy is designed to help businesses in Pennsylvania manage and align their philanthropic efforts with organizational values and community needs. Whether supporting local nonprofits, statewide initiatives, or national causes, this template provides clear guidelines for donating funds, goods, or services in a consistent and transparent manner.

By using this template, businesses can establish clear donation practices, foster goodwill, and strengthen relationships with the Pennsylvania communities they serve.

How to use this charitable contributions policy (Pennsylvania)

- Define contribution types: Specify the types of charitable contributions allowed under the policy, such as monetary donations, in-kind donations, or employee volunteer programs.

- Set eligibility criteria: Outline the requirements for organizations or causes to qualify for donations, ensuring alignment with business values and Pennsylvania-specific priorities.

- Establish approval procedures: Provide steps for approving contributions, including required documentation, review processes, and designated approvers.

- Include budgeting guidelines: Clarify how charitable contributions are budgeted and tracked to ensure transparency and accountability.

- Reflect Pennsylvania-specific considerations: Tailor the policy to address local needs, such as supporting Pennsylvania-based nonprofits, disaster relief efforts, or community development programs.

Benefits of using a charitable contributions policy (Pennsylvania)

A well-structured charitable contributions policy supports transparency and community engagement. Here's how it helps:

- Promotes consistency: Ensures all contributions align with the business’s values and priorities, reducing ad hoc decisions.

- Enhances community relationships: Builds goodwill by supporting Pennsylvania communities and local initiatives.

- Encourages accountability: Establishes clear guidelines for tracking and reporting contributions, ensuring transparency.

- Strengthens employee engagement: Fosters a sense of pride and involvement among employees through support of meaningful causes.

- Reflects local values: Aligns charitable efforts with Pennsylvania-specific needs, such as education, healthcare, or environmental conservation.

Tips for using a charitable contributions policy (Pennsylvania)

- Communicate expectations: Share the policy with employees to ensure clarity on the company’s charitable contribution processes and priorities.

- Encourage employee input: Involve employees in selecting causes to support, fostering greater engagement and alignment with workplace culture.

- Partner with local organizations: Focus on Pennsylvania-based nonprofits and initiatives to strengthen community ties and maximize impact.

- Monitor contributions: Maintain detailed records of all donations to ensure transparency and compliance with tax regulations.

- Review periodically: Update the policy to reflect changes in Pennsylvania laws, organizational priorities, or community needs.