Charitable contributions policy (Texas): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

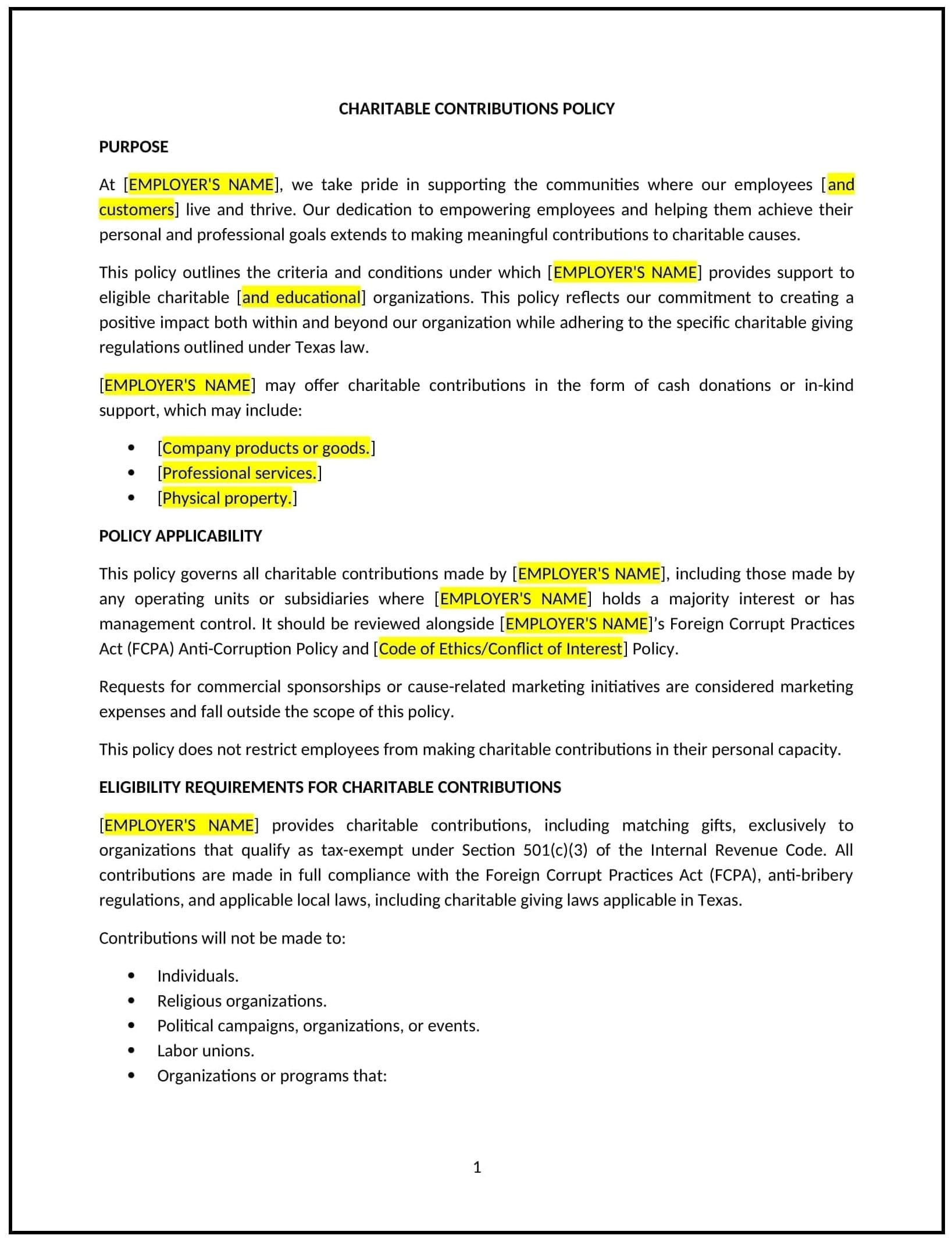

Charitable contributions policy (Texas)

This charitable contributions policy is designed to help Texas businesses establish clear guidelines for making charitable donations and encouraging employee participation in charitable activities. Whether businesses are contributing to local causes, matching employee donations, or organizing charitable events, this template provides a structured approach to managing corporate philanthropy.

By adopting this template, businesses can demonstrate their commitment to social responsibility, enhance their community engagement, and encourage employees to support meaningful causes.

How to use this charitable contributions policy (Texas)

- Define eligible charitable organizations: Specify the types of organizations that qualify for donations, such as non-profits, educational institutions, health organizations, or community-based groups, ensuring they align with the company’s values and goals.

- Set contribution limits: Outline the maximum amount the company will contribute annually to charitable organizations or the maximum match available for employee donations.

- Address employee participation: Encourage employees to get involved in charitable activities by specifying any programs the company offers, such as donation matching, volunteer time off (VTO), or sponsored charity events.

- Establish approval processes: Specify the steps for submitting donation requests, including who to contact, the necessary documentation, and how the company will approve charitable contributions.

- Define tax considerations: Provide information on any tax benefits related to charitable contributions and explain the process for receiving receipts or confirmation for tax purposes.

Benefits of using this charitable contributions policy (Texas)

This policy offers several benefits for Texas businesses:

- Enhances community engagement: A clear policy encourages businesses to contribute to the well-being of their communities, building stronger local relationships and improving the company’s public image.

- Improves employee morale: Encouraging employees to engage in charitable activities can improve job satisfaction, as employees feel they are part of a company that values social responsibility.

- Supports business reputation: A commitment to philanthropy enhances the company’s reputation as a responsible and ethical employer, attracting like-minded employees and customers.

- Fosters corporate responsibility: A structured charitable contributions policy demonstrates the company’s commitment to corporate social responsibility (CSR), aligning the business with broader social goals.

- Promotes teamwork: Organizing charitable events or donation matching can foster teamwork and collaboration among employees, strengthening company culture and unity.

Tips for using this charitable contributions policy (Texas)

- Communicate clearly: Ensure all employees are aware of the policy and understand the process for participating in charitable contributions, including eligibility, donation limits, and the approval process.

- Encourage employee involvement: Offer incentives such as matching donations or organizing group volunteer activities to motivate employees to engage in charitable efforts.

- Track contributions: Keep accurate records of charitable donations, employee participation, and the amounts contributed, to ensure proper accounting and reporting.

- Align with company values: Ensure that the charitable organizations supported through the policy align with the company’s values and goals, promoting causes that resonate with employees and customers alike.

- Review regularly: Update the policy periodically to reflect changes in business objectives, employee needs, or Texas state laws regarding charitable contributions and tax benefits.