Charitable contributions policy (Vermont): Free template

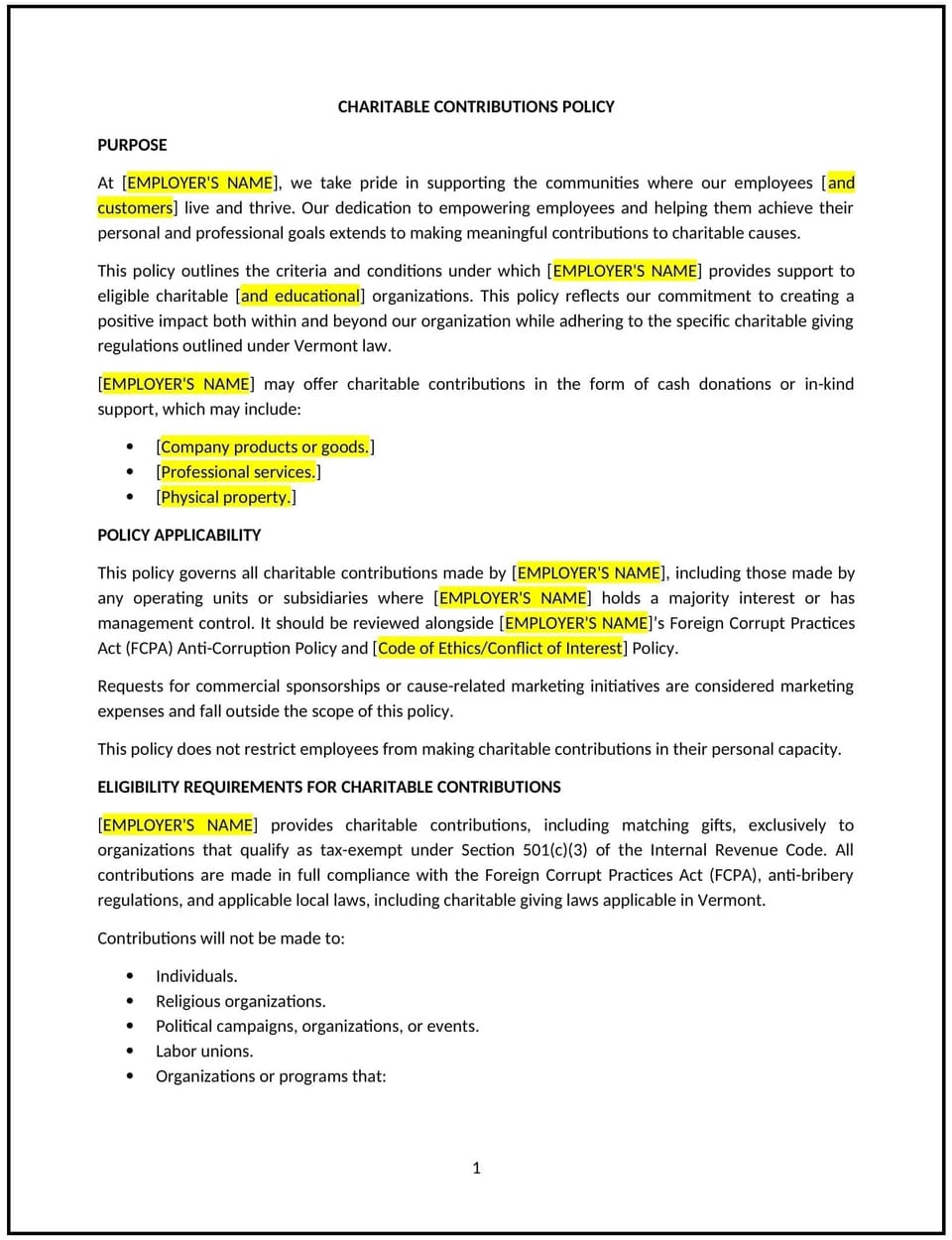

Charitable contributions policy (Vermont)

This charitable contributions policy is designed to help Vermont businesses manage and guide their approach to supporting charitable organizations. It outlines eligibility criteria, approval processes, and guidelines for employee involvement in charitable activities while maintaining compliance with Vermont regulations and fostering corporate social responsibility.

By adopting this policy, businesses can support meaningful causes, enhance community engagement, and align with their organizational values.

How to use this charitable contributions policy (Vermont)

- Define eligible contributions: Specify the types of charitable contributions the company supports, such as monetary donations, in-kind contributions, or employee volunteer hours.

- Establish criteria for organizations: Include eligibility requirements for organizations, such as nonprofit status, alignment with the company’s mission, and adherence to Vermont laws.

- Outline the approval process: Provide steps for submitting requests for charitable contributions, including required documentation and timelines for review.

- Address employee involvement: Encourage employees to participate in company-sponsored charitable events and detail any time-off policies for volunteer work.

- Set annual limits: Specify any budgetary limits or caps on charitable contributions to ensure alignment with the company’s financial goals.

- Emphasize transparency: Require proper documentation and recordkeeping for all charitable contributions to maintain accountability.

- Monitor compliance: Regularly review the company’s charitable giving practices to ensure adherence to Vermont laws and ethical standards.

Benefits of using this charitable contributions policy (Vermont)

This policy provides several benefits for Vermont businesses:

- Enhances community engagement: Strengthens relationships with local organizations and communities through targeted contributions.

- Promotes social responsibility: Aligns the company’s actions with its values and commitment to supporting meaningful causes.

- Improves employee morale: Encourages employee participation in charitable activities, fostering a sense of pride and purpose.

- Ensures accountability: Provides a structured approach to charitable giving, reducing the risk of misuse or mismanagement.

- Aligns with legal requirements: Promotes compliance with Vermont laws governing charitable contributions and nonprofit activities.

Tips for using this charitable contributions policy (Vermont)

- Communicate the policy: Share the policy with employees and make it accessible in the employee handbook or on the company intranet.

- Encourage employee participation: Promote company-sponsored charitable events and provide opportunities for employees to contribute.

- Maintain records: Keep detailed documentation of all contributions, including donation receipts and approvals, to ensure transparency and compliance.

- Evaluate impact: Regularly assess the effectiveness of the company’s charitable giving initiatives and their alignment with organizational goals.

- Update regularly: Revise the policy to reflect changes in Vermont laws, workplace practices, or community needs.

Q: What types of charitable contributions are supported under this policy?

A: Supported contributions may include monetary donations, in-kind contributions, and employee volunteer hours, as outlined in the policy.

Q: How can employees request support for a charitable organization?

A: Employees can submit a formal request, including details about the organization and proposed contribution, for review and approval.

Q: Are there limits on charitable contributions?

A: The policy may specify annual budgetary limits or caps on contributions to align with the company’s financial goals.

Q: Can employees take time off for volunteer work?

A: Yes, employees may be eligible for time off to participate in company-sponsored charitable events, as outlined in the policy.

Q: How does the company ensure contributions are used appropriately?

A: Contributions are directed to eligible organizations that meet the company’s criteria, and proper documentation is maintained for accountability.

Q: What organizations are eligible for contributions?

A: Eligible organizations typically include registered nonprofits that align with the company’s mission and adhere to Vermont laws.

Q: How often is this policy reviewed?

A: This policy is reviewed annually or whenever significant changes occur in Vermont laws or company practices.

Q: Does the company match employee donations?

A: Matching donation programs, if available, are detailed in the policy, including eligibility and application procedures.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.