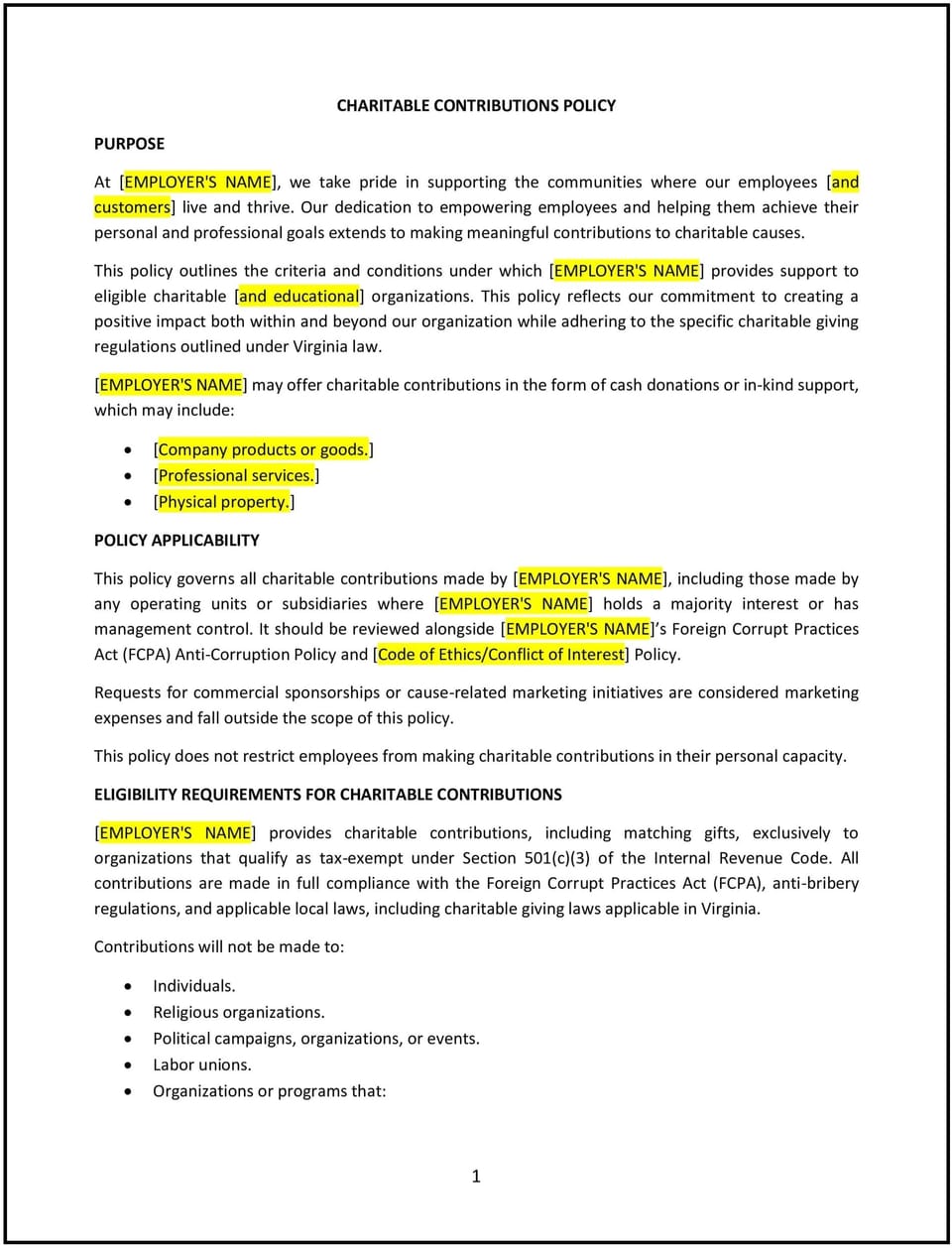

Charitable contributions policy (Virginia): Free template

This charitable contributions policy is designed to help Virginia businesses manage employee donations to charitable organizations and the company’s own contributions to charitable causes. The policy outlines guidelines for making charitable donations, including eligibility for tax deductions, the process for requesting matching donations, and the company’s stance on supporting charitable organizations. The policy ensures that charitable activities align with the company’s values and regulatory requirements, while encouraging employees to participate in meaningful social causes.

By adopting this policy, businesses can demonstrate their commitment to corporate social responsibility, promote community involvement, and foster a culture of giving among employees.

How to use this charitable contributions policy (Virginia)

- Define eligible charitable organizations: The policy should specify which organizations qualify for donations under the company’s charitable contributions program. This may include 501(c)(3) organizations or other groups that align with the company’s values and goals.

- Outline the donation process: The policy should describe how employees can make donations, whether through payroll deductions, one-time contributions, or other methods. It should also specify whether the company will match donations and the process for submitting matching requests.

- Establish guidelines for matching donations: If the company offers a matching gift program, the policy should set clear guidelines, including the maximum amount that can be matched, the types of eligible donations, and the process for employees to request matching contributions.

- Specify the company's contributions: The policy should also outline the company’s role in charitable contributions, including whether the company provides monetary donations, volunteer hours, or support for employee-organized charitable events. It may include guidelines on how the company selects the causes it supports.

- Address employee involvement: The policy should encourage employee participation in charitable activities and specify any volunteer leave or time off for employees who want to participate in charity events or initiatives.

- Ensure compliance with Virginia state and federal laws: The policy should ensure that charitable contributions comply with all applicable tax laws, including eligibility for tax deductions under IRS regulations, and any relevant Virginia state laws.

- Review and update regularly: Periodically review and update the policy to ensure it is compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this charitable contributions policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Promotes corporate social responsibility: By supporting charitable causes, the policy helps businesses give back to the community, demonstrating a commitment to social responsibility and contributing to the company’s positive image.

- Encourages employee engagement: Offering opportunities for employees to participate in charitable giving fosters a sense of pride and satisfaction, enhancing employee morale and engagement.

- Enhances company reputation: A company that actively supports charitable organizations and encourages employees to do the same is viewed positively by the public and potential employees, improving the company’s reputation as a socially responsible employer.

- Reduces financial impact of donations: By matching employee contributions, the company amplifies the impact of charitable donations without requiring employees to shoulder the entire financial burden.

- Complies with tax regulations: The policy helps businesses ensure that charitable contributions are made in accordance with Virginia state laws and federal tax regulations, reducing the risk of tax-related issues.

- Strengthens community ties: Supporting local or national charitable causes helps businesses build relationships within the community, strengthening the company’s ties and reputation as a valuable community partner.

Tips for using this charitable contributions policy (Virginia)

- Communicate the policy clearly: Ensure that all employees are aware of the charitable contributions policy and understand how they can participate in donation programs. Include the policy in the employee handbook, review it during onboarding, and provide periodic reminders.

- Encourage employee participation: Promote the company’s charitable programs through internal communications, such as emails, newsletters, or meetings. Encourage employees to suggest causes to support or organize charitable events.

- Monitor and track donations: Keep accurate records of donations made by employees and the company. Ensure that the matching contributions process is tracked properly, and ensure compliance with tax regulations by documenting all contributions.

- Provide recognition for contributions: Consider recognizing employees who actively participate in charitable programs or who contribute significantly to the success of a charity event. Recognition can help foster a culture of giving and motivate others to participate.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.

Q: How do employees participate in the charitable contributions program?

A: Employees can participate in the charitable contributions program by making personal donations or through payroll deductions. The policy outlines the methods for making donations and whether the company matches those contributions.

Q: Does the company match employee donations?

A: The policy specifies whether the company matches employee donations and the process for submitting matching requests. It may include guidelines on the maximum match amount and eligibility for matching donations.

Q: Which charitable organizations are eligible for donations?

A: The policy defines which types of organizations qualify for donations, typically 501(c)(3) organizations or those that align with the company’s values. Employees can donate to organizations that meet these criteria.

Q: How can employees request matching contributions?

A: The policy outlines the process employees must follow to request matching contributions. Employees typically need to submit proof of their donation, such as a receipt, and request the match through HR or the designated department.

Q: Will the company provide paid time off for charity events?

A: The policy may specify whether the company provides volunteer leave or paid time off for employees who participate in charity events. This varies by company and is outlined in the policy.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it is compliant with Virginia state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.