Charitable contributions policy (Washington): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

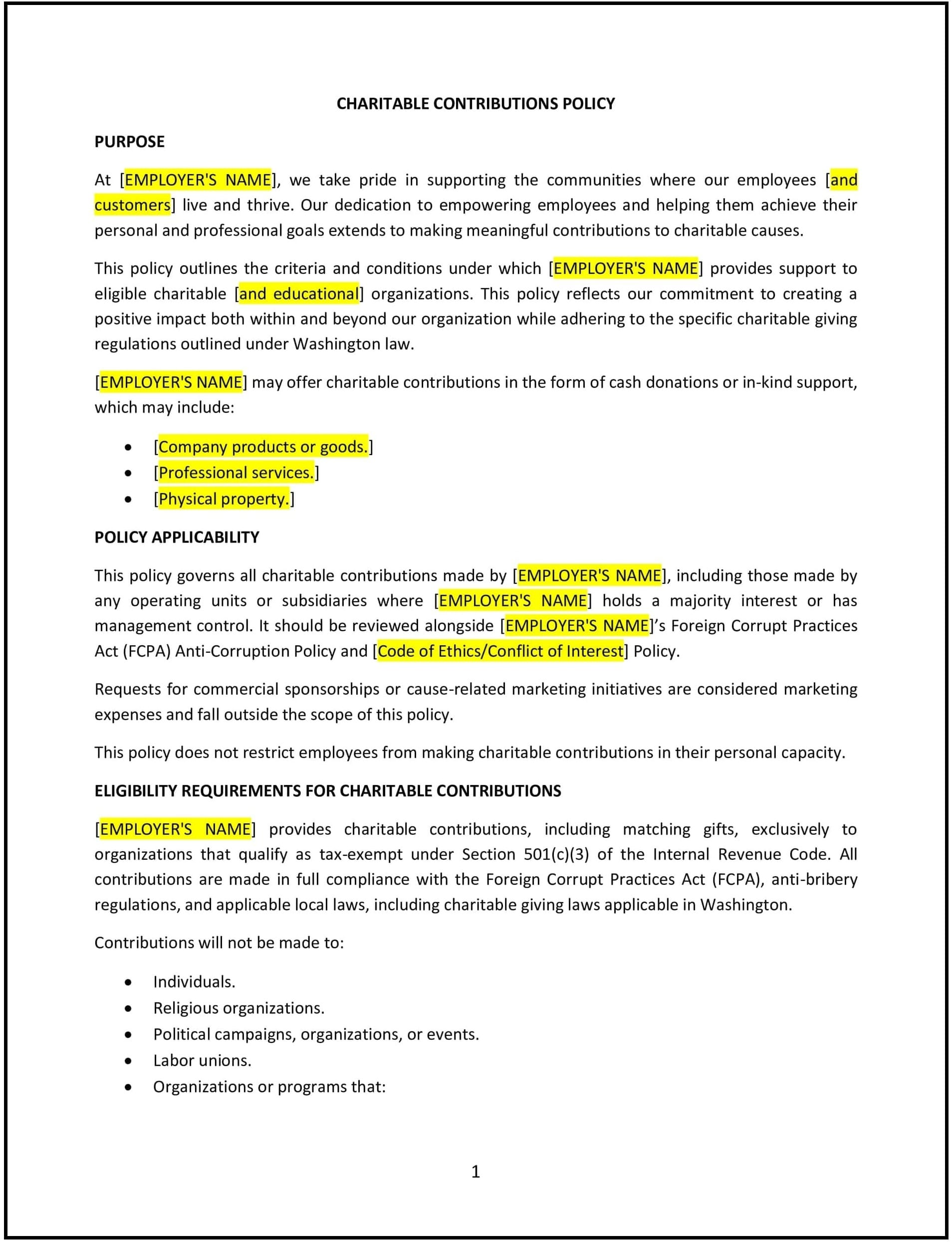

This charitable contributions policy is designed to help Washington businesses establish guidelines for making charitable donations and supporting community involvement. The policy outlines the company’s approach to employee donations, corporate matching programs, and other forms of charitable giving, ensuring that all contributions align with the company’s values and objectives. It also defines the criteria for selecting charitable organizations, the process for submitting donation requests, and the company’s expectations regarding employee involvement in charitable activities.

By adopting this policy, businesses can strengthen their corporate social responsibility (CSR) efforts, improve employee engagement, and contribute to meaningful causes in the community.

How to use this charitable contributions policy (Washington)

- Define eligible charitable organizations: The policy should specify which types of organizations are eligible for charitable contributions, including nonprofit organizations, educational institutions, and community groups. It should also clarify whether contributions are limited to certain areas, such as health, education, or the environment.

- Establish donation guidelines: Outline the company’s approach to charitable donations, including whether contributions will be made in the form of cash, goods, services, or volunteer time. Specify if donations will be made on a one-time or recurring basis.

- Define employee participation: If the company offers employee donation matching or sponsorships for charity events, the policy should explain how employees can participate. The policy should include any eligibility requirements, such as tenure or donation thresholds, for participating in these programs.

- Set a donation request process: The policy should detail how employees or organizations can submit requests for charitable contributions. This may include a formal application or request process, documentation requirements, and deadlines for submission.

- Provide guidelines for corporate matching programs: If the company offers a corporate matching program, the policy should specify the matching process, including any limits on the amount the company will match, the types of donations eligible for matching, and how employees can apply for matching donations.

- Address employee involvement in charitable activities: The policy should define the company’s stance on employee participation in charitable activities during work hours. For example, the company may allow employees to volunteer during paid work hours or offer paid time off for volunteering at certain organizations.

- Define reporting and recordkeeping: The company should specify how donations and volunteer hours will be tracked and reported, ensuring transparency and accountability in the company’s charitable giving efforts.

- Ensure compliance with Washington and federal laws: The policy must comply with Washington state laws and federal regulations related to charitable donations, tax-exempt status, and corporate giving. It should also address any legal requirements for reporting charitable contributions and ensuring donations are made to eligible organizations.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s charitable giving strategy or employee engagement practices.

Benefits of using this charitable contributions policy (Washington)

This policy offers several benefits for Washington businesses:

- Enhances corporate social responsibility: By formalizing charitable contributions and community involvement, the company demonstrates its commitment to social responsibility and gives back to the community in a meaningful way.

- Increases employee engagement: Offering employees opportunities to contribute to causes they care about, through donation matching or volunteer programs, can increase job satisfaction and foster a sense of pride in the company.

- Strengthens company reputation: A business known for its charitable giving and community involvement is more likely to attract and retain top talent and build stronger relationships with customers and stakeholders.

- Encourages team building: Employee participation in charitable activities can foster teamwork, strengthen relationships among colleagues, and improve morale.

- Supports tax benefits: The policy helps businesses navigate the tax benefits of charitable giving by providing clear guidelines for making eligible donations and supporting compliance with Washington state and federal tax laws.

- Improves community impact: By supporting a variety of charitable organizations, businesses can make a tangible impact in the community, contributing to causes that align with their values and objectives.

Tips for using this charitable contributions policy (Washington)

- Communicate the policy clearly: Ensure that all employees are aware of the charitable contributions policy and understand how they can participate in donation matching or volunteer opportunities. Include the policy in the employee handbook and review it during onboarding or at regular team meetings.

- Encourage employee involvement: Promote the company’s charitable contributions program by encouraging employees to get involved in community service or suggest charitable organizations to support. Consider offering incentives for employees who volunteer or donate regularly.

- Track and report contributions: Ensure that all charitable donations and volunteer hours are tracked and reported accurately. Regularly communicate the company’s charitable contributions to employees, highlighting the positive impact of their efforts.

- Align contributions with company values: Ensure that the charitable organizations and causes supported by the company align with its core values and mission. This strengthens the company’s brand and reinforces its commitment to making a positive difference.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s operations or charitable giving strategy. Regular updates will help maintain the policy’s relevance and effectiveness.