Charitable contributions policy (West Virginia): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Charitable contributions policy (West Virginia)

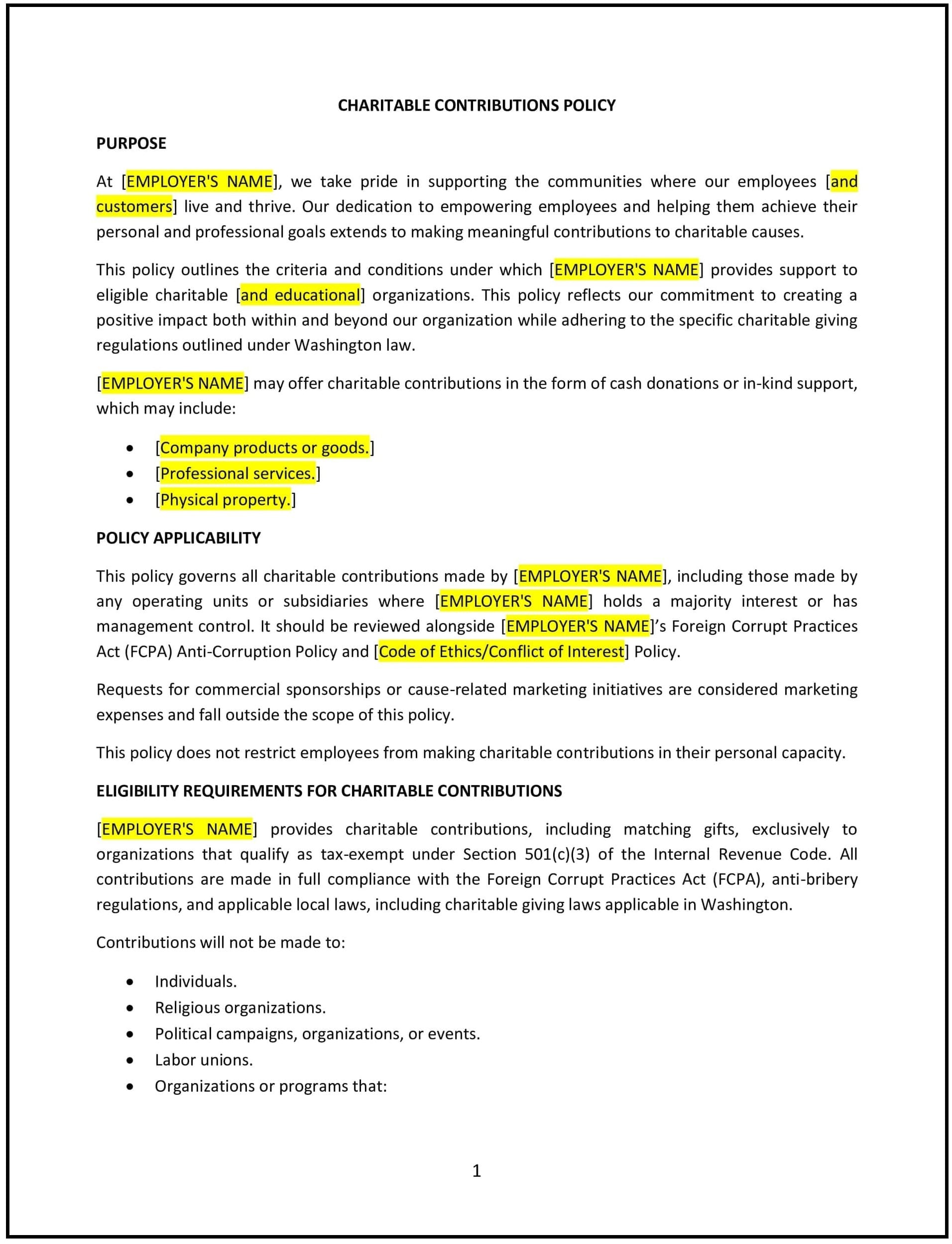

A charitable contributions policy helps West Virginia businesses establish guidelines for making donations to nonprofit organizations and supporting charitable causes. This policy outlines the company’s approach to charitable giving, including eligibility criteria for organizations, the process for making contributions, and any limits or conditions associated with corporate donations.

By implementing this policy, businesses can demonstrate their commitment to social responsibility, foster employee engagement, and ensure that charitable contributions align with the company’s values and objectives.

How to use this charitable contributions policy (West Virginia)

- Define charitable contributions: Clearly define what constitutes a charitable contribution, such as monetary donations, in-kind donations, or volunteer time, and specify whether the company supports local, national, or international causes.

- Set eligibility criteria: Specify the types of organizations eligible for donations, such as registered 501(c)(3) nonprofits, educational institutions, or community service groups, and whether there are any restrictions on the types of causes supported.

- Outline the donation process: Provide a step-by-step procedure for submitting requests for donations, including who to contact, how to apply for a contribution, and any required documentation (e.g., a copy of the organization’s tax-exempt status).

- Set contribution limits: Define any limits on the amount or frequency of donations, whether the company makes donations on an annual, quarterly, or ad-hoc basis, and how contributions will be allocated across different causes.

- Promote employee involvement: Encourage employees to nominate charitable organizations for donations, participate in fundraising events, or volunteer their time to supported causes. Specify if employees can use work hours for volunteering or if there are matching gift programs for employee donations.

- Monitor and evaluate donations: Establish a process for reviewing and approving donation requests, ensuring that contributions align with the company’s values and goals. Track the impact of donations to evaluate their effectiveness.

Benefits of using this charitable contributions policy (West Virginia)

This policy offers several benefits for West Virginia businesses:

- Strengthens company reputation: Supporting charitable causes demonstrates corporate social responsibility and enhances the company’s public image, fostering goodwill with customers, employees, and the community.

- Engages employees: Encouraging employees to participate in charitable initiatives or nominate organizations for donations boosts morale, promotes teamwork, and fosters a sense of pride in working for a socially responsible company.

- Supports local and global causes: Charitable contributions allow businesses to give back to the community or support important global issues, helping to create positive social change.

- Enhances tax benefits: By supporting qualified charitable organizations, businesses can take advantage of tax deductions under federal and state laws, potentially lowering their tax liabilities.

- Aligns with company values: A well-defined charitable contributions policy ensures that donations align with the company’s values and priorities, creating a more authentic and impactful approach to giving.

Tips for using this charitable contributions policy (West Virginia)

- Communicate the policy clearly: Ensure that all employees are aware of the company’s charitable contributions policy, how to participate, and how to nominate organizations for donations.

- Set clear guidelines: Provide employees and nonprofit organizations with clear expectations for donation requests, eligibility, and the review process to ensure fairness and consistency.

- Encourage employee involvement: Create opportunities for employees to engage with charitable initiatives, such as volunteer days, matching gift programs, or fundraising events, to promote a culture of giving within the company.

- Track donations: Keep accurate records of all charitable contributions to evaluate their impact, ensure compliance with company guidelines, and assess whether the company’s donations are meeting its social responsibility goals.

- Review regularly: Periodically review the policy to ensure it aligns with changes in company priorities, legal requirements, or community needs.