Charitable contributions policy (Wisconsin): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

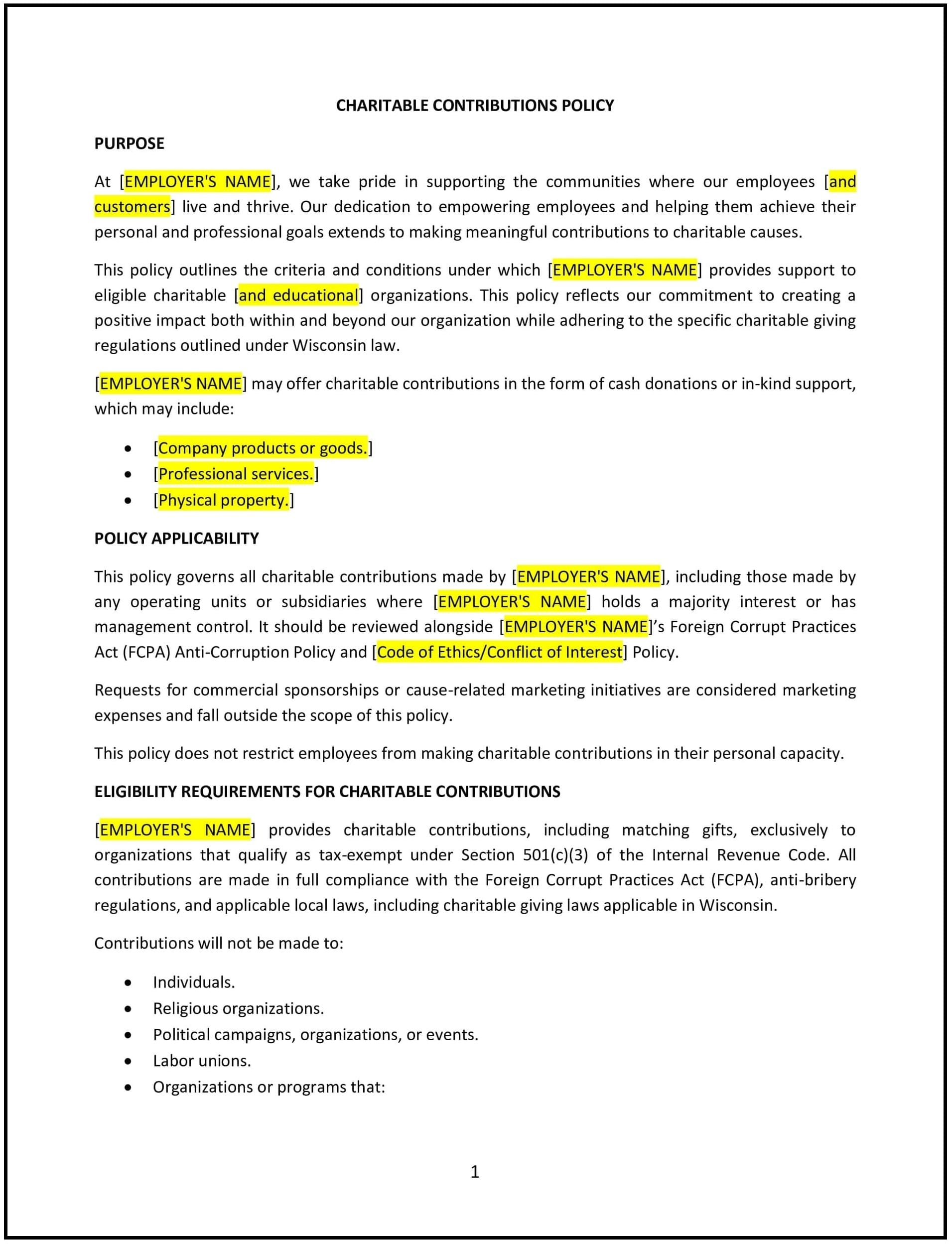

Charitable contributions policy (Wisconsin)

A charitable contributions policy helps Wisconsin businesses define the guidelines for employees’ involvement in charitable giving and fundraising activities, both personally and through the company. This policy outlines how employees can contribute to charitable causes, the company’s role in matching or supporting contributions, and the process for donating time, money, or resources to community organizations.

By implementing this policy, businesses can foster a culture of giving, demonstrate corporate social responsibility, and provide employees with clear guidelines for supporting causes they care about while aligning with the company’s values.

How to use this charitable contributions policy (Wisconsin)

- Define eligible charitable organizations: Specify the types of organizations that qualify for charitable contributions, such as registered 501(c)(3) organizations, educational institutions, or community-based non-profits. Ensure that contributions align with the company’s values and objectives.

- Outline company contributions: Clarify whether the company will match employee donations, provide direct financial support, or contribute resources (e.g., goods or services) to charitable causes. Specify the match rate and any limits on contributions.

- Set guidelines for employee donations: Provide employees with clear instructions on how to make personal charitable contributions through the company, including how to submit donation requests for matching, if applicable.

- Address paid time off for volunteer work: Define whether employees are eligible for paid time off or flexible hours to volunteer for charitable causes. Specify the maximum number of volunteer hours employees can use per year.

- Promote employee participation: Encourage employees to engage in charitable activities by creating opportunities for group volunteering, organizing fundraisers, or setting company-wide goals for giving.

- Establish a process for approval: Set a process for reviewing and approving company-supported donations or volunteer efforts, including any required documentation or pre-approval steps for employees who wish to contribute time or money.

- Ensure compliance with tax laws: Ensure that the company’s charitable contributions comply with IRS rules and regulations and provide employees with the necessary documentation for tax deductions related to their contributions.

Benefits of using this charitable contributions policy (Wisconsin)

This policy offers several benefits for Wisconsin businesses:

- Enhances corporate social responsibility: The policy helps businesses demonstrate their commitment to the community and contribute to causes that align with their values, improving the company’s reputation and public image.

- Increases employee engagement: Offering opportunities for employees to donate time and money, or matching their contributions, fosters a sense of purpose and engagement, which can lead to higher employee satisfaction and loyalty.

- Supports community development: By encouraging charitable contributions, the policy helps support local and global communities, addressing important social causes and giving back to those in need.

- Boosts company morale: A culture of giving can improve morale and strengthen the bond between employees and the company, creating a positive and collaborative work environment.

- Strengthens employee retention: Providing employees with opportunities to participate in charitable initiatives helps create a more attractive workplace, leading to higher retention rates.

Tips for using this charitable contributions policy (Wisconsin)

- Communicate the policy clearly: Ensure that all employees are aware of the policy, including how to contribute to charitable causes and the process for receiving matching donations or volunteer time off.

- Encourage participation: Actively promote charitable giving and volunteer opportunities within the company, perhaps by organizing company-wide events, fundraisers, or volunteer days.

- Set clear expectations for eligibility: Clearly define which organizations are eligible for support, whether through donations or volunteer work, to ensure alignment with company values and compliance with IRS guidelines.

- Monitor and track contributions: Regularly track the total contributions made by employees and the company, and share results to highlight the collective impact the company and its employees are making.

- Review periodically: Regularly review the policy to ensure it aligns with Wisconsin laws, federal tax laws, and reflects the company’s evolving values and goals.