Charitable contributions policy (Wyoming): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

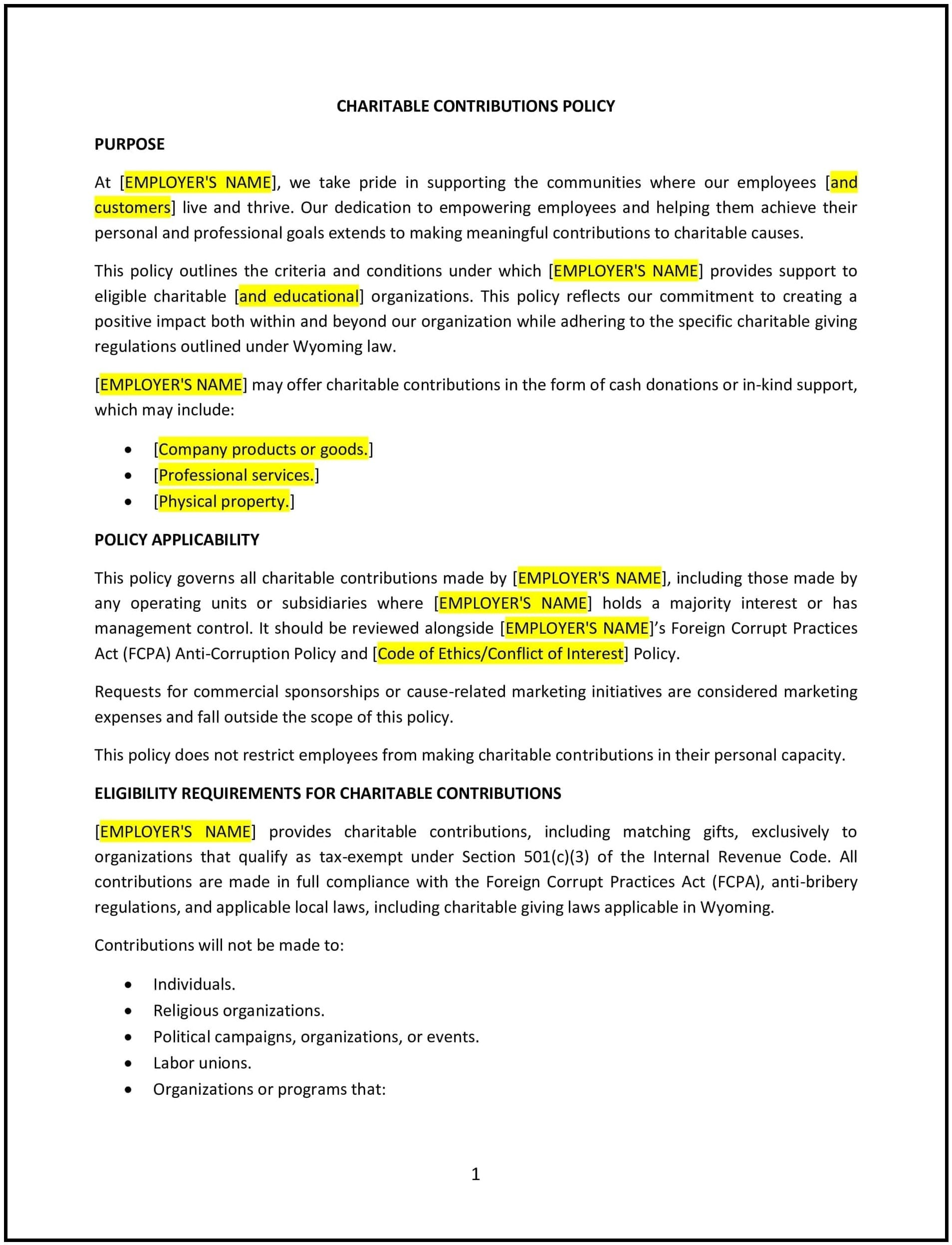

Charitable contributions policy (Wyoming)

In Wyoming, a charitable contributions policy helps businesses manage their philanthropic efforts by establishing guidelines for donating to causes and organizations. This policy demonstrates corporate social responsibility, strengthens community ties, and ensures contributions align with the company’s values and goals. It is especially important in Wyoming, where local communities often rely on businesses to support initiatives in education, healthcare, and environmental conservation.

This policy outlines eligibility criteria for donations, the approval process, and the types of charitable activities supported, ensuring transparency and consistency in decision-making.

How to use this charitable contributions policy (Wyoming)

- Define eligible organizations: Specify the types of charities and causes your company will support, such as local nonprofits, educational programs, or environmental initiatives. Ensure alignment with your business’s values and Wyoming’s community needs.

- Set contribution limits: Establish clear limits for monetary and in-kind donations, including annual budgets or per-project caps, to maintain financial accountability.

- Outline the approval process: Provide a step-by-step guide for submitting and reviewing charitable contribution requests, including required documentation and decision-making timelines.

- Include employee involvement: Encourage employees to suggest charities or participate in volunteer activities, fostering a culture of giving within your organization.

- Ensure compliance: Verify that all contributions comply with state and federal laws, including tax regulations and reporting requirements.

Benefits of using a charitable contributions policy (Wyoming)

A clear charitable contributions policy provides several benefits for Wyoming businesses:

- Strengthens community relationships: Demonstrates your company’s commitment to supporting local communities and initiatives.

- Promotes transparency: Establishes clear guidelines for decision-making, reducing potential conflicts of interest or favoritism.

- Encourages employee engagement: Fosters a sense of pride and involvement by allowing employees to participate in charitable activities.

- Supports compliance: Aligns with tax and legal requirements, minimizing risks associated with improper contributions.

- Enhances corporate reputation: Builds goodwill with customers, partners, and stakeholders by showcasing your business as a responsible corporate citizen.

Tips for using a charitable contributions policy (Wyoming)

- Tailor to community needs: Focus on causes that resonate with Wyoming’s unique challenges and opportunities, such as rural education, wildlife conservation, or healthcare access.

- Track contributions: Maintain detailed records of all donations to ensure transparency and simplify tax reporting.

- Encourage partnerships: Collaborate with local nonprofits or government initiatives to maximize the impact of your contributions.

- Review annually: Reassess the policy periodically to ensure it remains relevant and effective in achieving your organization’s philanthropic goals.

- Promote the policy: Share the policy internally and externally to highlight your commitment to social responsibility.