Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

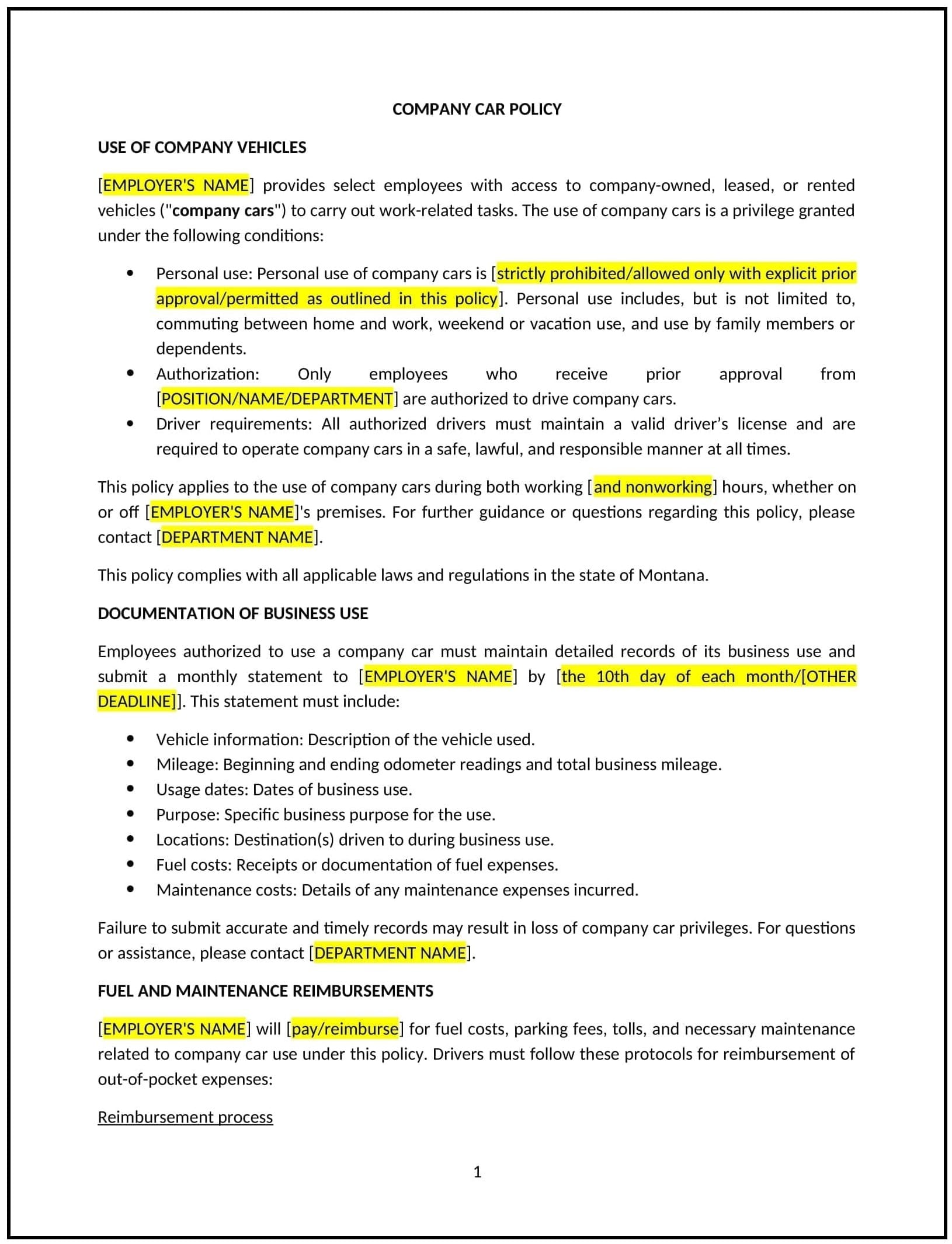

Company car policy (Montana)

A company car policy helps Montana businesses establish clear guidelines for the use, maintenance, and management of vehicles provided to employees for business purposes. This policy outlines eligibility criteria, acceptable usage, responsibilities for vehicle upkeep, and insurance requirements to protect both the business and employees.

By implementing this policy, businesses can manage their fleet efficiently, ensure employee safety, and reduce liability associated with company car usage.

How to use this company car policy (Montana)

- Define eligibility: Businesses should specify which employees are eligible for a company car, such as those in senior positions, employees who travel frequently for work, or those whose job requires the use of a vehicle.

- Set acceptable vehicle use: Businesses should outline acceptable uses for company cars, including business-related travel, commuting, or personal use if allowed. The policy should clarify restrictions on non-business-related travel or use for personal errands.

- Clarify maintenance and fuel responsibilities: Employees should understand their responsibility for maintaining the vehicle, such as regular servicing, tire checks, and cleaning. The business should clarify whether fuel expenses are covered and if employees must submit receipts for reimbursement.

- Outline insurance requirements: Businesses should ensure that company cars are insured for business use and specify whether employees are responsible for additional insurance for personal use. The policy should include guidelines for reporting accidents or damages.

- Define vehicle return procedures: Businesses should specify when and how company cars should be returned, including if the employee leaves the company, the car is no longer needed, or upon the completion of a job role.

- Address tax implications: Businesses should explain any tax implications for employees who use a company car for personal purposes, including how it may impact their income tax filings.

- Review and update regularly: Businesses should periodically assess the policy to ensure it remains aligned with operational needs and relevant legal regulations.

Benefits of using this company car policy (Montana)

This policy provides several key benefits for Montana businesses:

- Streamlines fleet management: Clear guidelines help businesses track and manage their company cars effectively, reducing administrative burdens.

- Reduces liability: A structured policy minimizes risks related to misuse, accidents, or legal disputes involving company vehicles.

- Promotes employee safety: Proper vehicle maintenance and clear usage guidelines ensure employees are using vehicles in a safe and responsible manner.

- Enhances tax efficiency: Clear communication about the tax implications of company car use can help businesses and employees manage their finances and reporting.

- Increases employee satisfaction: Offering company cars as a benefit can improve employee retention and job satisfaction, especially for employees who travel frequently for work.

- Supports compliance with legal requirements: The policy helps ensure that vehicles are used in accordance with Montana state regulations and federal guidelines.

Tips for using this company car policy (Montana)

- Communicate expectations clearly: Employees should fully understand the responsibilities associated with using a company car, including maintenance, insurance, and acceptable use.

- Track vehicle usage: Businesses should maintain a log of how and when company cars are used to monitor compliance with the policy.

- Provide regular vehicle maintenance: Businesses should implement a system for scheduling regular checkups and maintenance for company cars to ensure safety and reliability.

- Offer driver safety training: Employees who drive company vehicles should receive training on safe driving practices, including handling accidents, emergency procedures, and road safety.

- Review the policy regularly: Businesses should review the company car policy annually to ensure it remains up-to-date with changes in the business, legal landscape, or employee needs.