Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

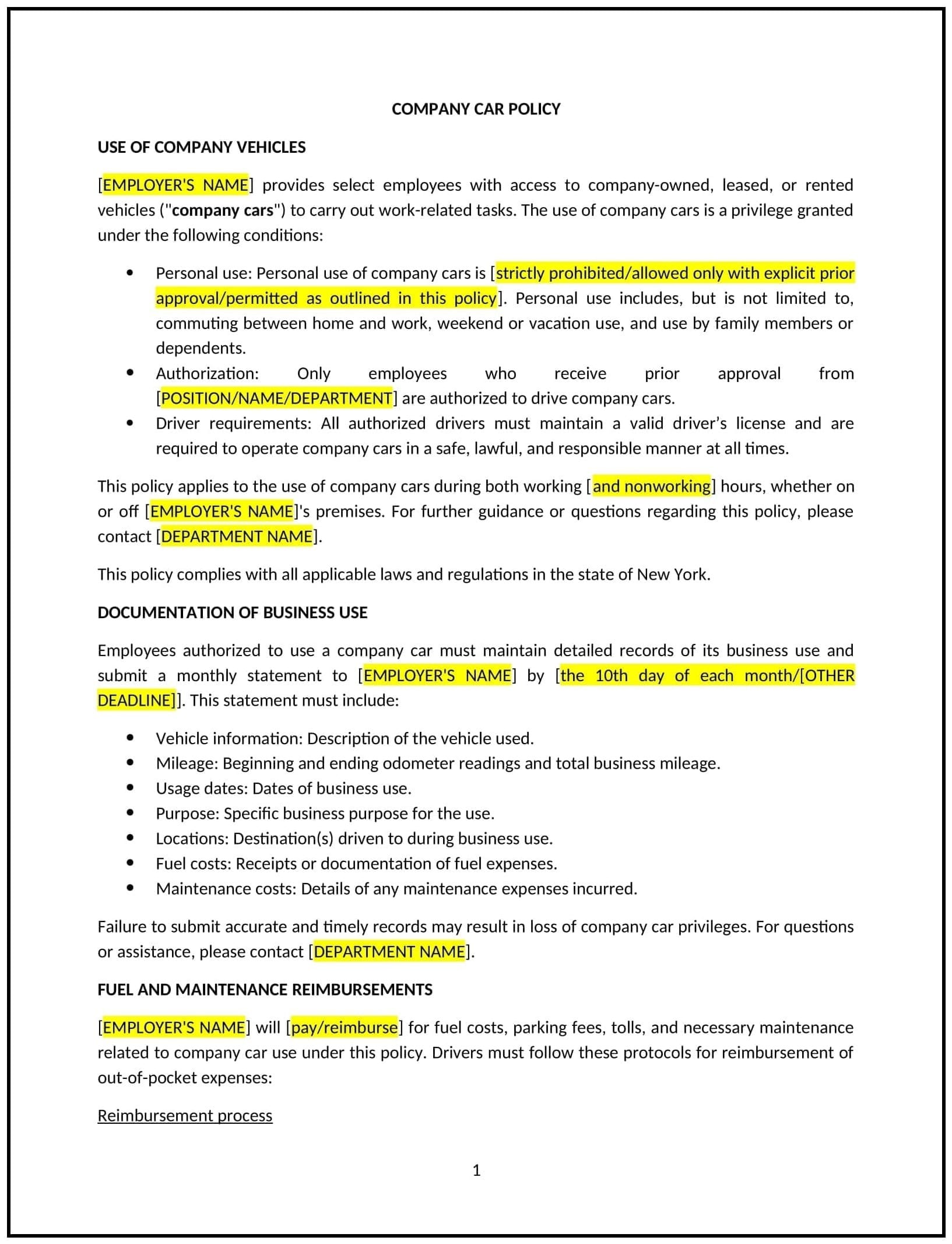

Company car policy (New York)

A company car policy helps New York businesses define the terms and conditions under which employees may use company-owned vehicles. This policy outlines the eligibility criteria for employees to receive a company car, the allowed uses of the vehicle, the responsibilities of employees for maintenance and care, and the procedures for reporting accidents or damage. The policy also includes any tax implications for employees who use company cars for personal purposes and details the business's expectations for how vehicles should be used.

By implementing this policy, businesses can effectively manage the allocation and use of company cars, ensure compliance with legal requirements, and protect their assets while providing employees with the tools they need to perform their jobs.

How to use this company car policy (New York)

- Define eligibility for company cars: Clearly outline which employees are eligible to receive a company car based on their role, job responsibilities, and seniority. The policy should specify any criteria that determine eligibility and outline how company cars are assigned.

- Specify permitted uses of the vehicle: Define the allowable uses for company cars, such as business-related travel, commuting to work, and personal use. The policy should specify whether personal use is allowed and any restrictions or limitations on such use.

- Outline employee responsibilities: Establish the employee’s responsibility for the care, maintenance, and cleaning of the company car. The policy should also specify how employees should report any accidents, damage, or mechanical issues with the vehicle.

- Address tax implications: Clearly explain any tax obligations related to the personal use of a company car, such as how it will affect the employee’s taxable income. The policy should ensure that employees are aware of any potential tax consequences and provide guidance on how these are handled.

- Define vehicle return and maintenance procedures: Specify the process for returning the company car when the employee no longer requires it, whether due to a change in role, termination, or any other reason. Include guidelines for maintenance, inspections, and repair responsibilities.

- Comply with New York state and federal regulations: Ensure that the policy complies with all relevant New York state and federal laws related to vehicle use, insurance, and safety requirements.

Benefits of using this company car policy (New York)

This policy offers several benefits for New York businesses:

- Clarifies expectations: The policy provides clear guidelines on the use and care of company vehicles, ensuring that employees understand their responsibilities and the limitations of using company cars.

- Protects business assets: By outlining the proper use and maintenance of company cars, the policy helps prevent misuse, damage, and unnecessary expenses, protecting the business's assets.

- Promotes accountability: Employees are held accountable for the proper use and care of company vehicles, reducing the likelihood of accidents, damage, or misuse.

- Reduces tax and legal risks: Clear communication about the tax implications and legal requirements related to company car use helps the business and employees comply with tax laws and avoid legal liabilities.

- Enhances recruitment and retention: Offering a company car as a benefit can be an attractive perk for employees, helping businesses retain top talent and enhance their compensation packages.

Tips for using this company car policy (New York)

- Communicate the policy clearly: Ensure that all employees who are eligible for a company car understand the policy, including their responsibilities for using and maintaining the vehicle. Provide this information during onboarding, in employee handbooks, and as part of regular reviews.

- Regularly inspect company cars: Establish a process for inspecting company cars to ensure that they are well-maintained and in good working condition. This helps reduce the risk of breakdowns, accidents, and excessive repair costs.

- Review tax implications: Periodically review the tax implications for employees using company cars for personal purposes to ensure that they are being accurately assessed and comply with current tax laws.

- Set clear procedures for accidents and damages: Define the steps that employees must take in the event of an accident or damage to a company vehicle. This includes who to report to, what information to collect, and how the business will handle repairs or replacements.

- Provide ongoing training: Ensure that employees are trained on safe driving practices and the proper use of company cars. This helps reduce the risk of accidents and ensures that vehicles are being used appropriately for business purposes.

- Review and update the policy regularly: Periodically review the company car policy to ensure it remains compliant with New York laws, reflects the needs of the business, and remains effective in managing company vehicle use.