Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

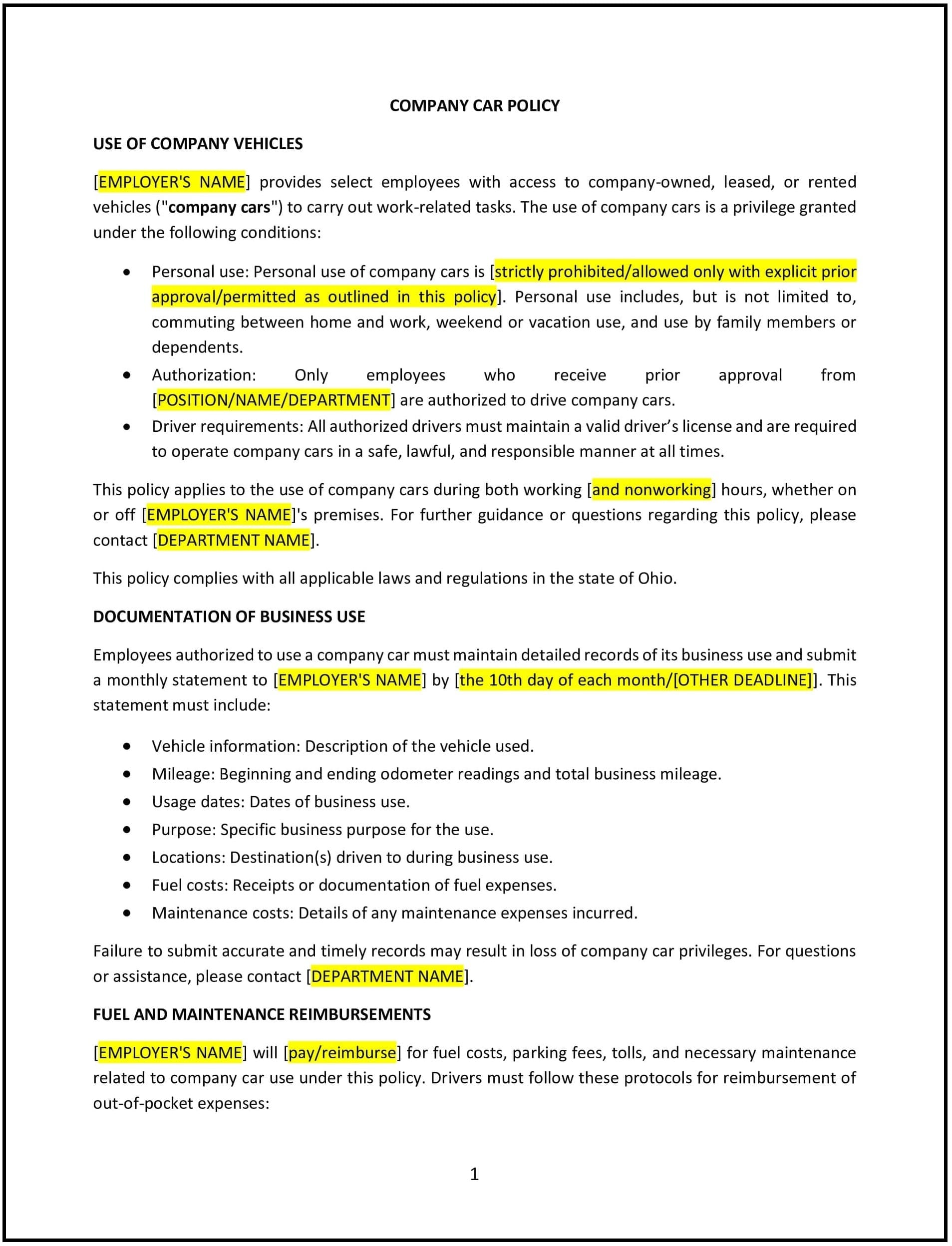

Company car policy (Ohio)

A company car policy outlines the guidelines for Ohio businesses regarding the use of company-owned vehicles for business-related tasks. This policy sets clear expectations about when and how company cars can be used, who is eligible for the use of a vehicle, and the responsibilities of employees who drive company cars. It includes rules for maintaining the vehicle, proper use, and insurance coverage. The policy also addresses personal use of the vehicle, mileage tracking, and reporting requirements, as well as any restrictions that apply to the vehicle’s use.

By implementing this policy, Ohio businesses can ensure that their vehicles are used efficiently, maintain compliance with insurance and safety regulations, and set clear guidelines that protect both the company and employees using company vehicles.

How to use this company car policy (Ohio)

- Define eligible employees: Specify which employees are eligible for using company cars, such as those in certain roles that require frequent travel for work. The policy should clearly outline the criteria for eligibility based on business needs.

- Set rules for vehicle usage: Clearly define when and how company vehicles may be used, including guidelines for business use versus personal use. The policy should specify whether employees can use company cars for personal errands and the extent of such use.

- Address vehicle maintenance and care: Specify the employee’s responsibility for maintaining the company car, including routine maintenance, keeping the vehicle clean, and reporting any damage. The policy should outline the company’s role in providing regular maintenance and handling repairs.

- Establish mileage tracking: Employees using company cars should be required to track business mileage and submit regular reports. The policy should outline the process for reporting mileage, including the frequency of submissions and any software or systems used.

- Set insurance and liability requirements: Specify the insurance coverage provided by the company for the vehicle and the employee’s role in ensuring proper insurance coverage, including personal liability for accidents while using the company car.

- Address personal use of company cars: Clarify the rules regarding personal use of company vehicles, such as whether employees are allowed to use them for non-business-related activities and if there are restrictions or costs associated with personal use (e.g., taxable benefits).

- Outline the process for returning vehicles: The policy should specify what employees should do when the company car is no longer needed or when they leave the company, including the process for returning the vehicle in good condition and any final inspections that may occur.

- Ensure compliance with Ohio state laws: The policy should ensure that all practices comply with Ohio state laws regarding vehicle use, insurance, and employee driving regulations, as well as any federal requirements for business vehicles.

- Review and update regularly: Regularly review and update the policy to reflect changes in business needs, vehicle requirements, and Ohio state laws regarding vehicle use and insurance.

Benefits of using this company car policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Increases efficiency: By providing company cars for business use, employees can perform their job duties more efficiently, especially when regular travel is required.

- Reduces liability: A clear policy on vehicle usage and insurance ensures that both the business and employees are protected in the event of an accident or damage.

- Promotes accountability: Clear guidelines on vehicle use and maintenance encourage employees to take responsibility for the care of company cars, reducing wear and tear and lowering costs associated with repairs.

- Ensures proper insurance coverage: The policy helps ensure that all company vehicles are properly insured and that employees are aware of their responsibilities in case of an accident or damage.

- Saves costs: The policy helps control costs by outlining how company cars should be used and by whom, avoiding unnecessary expenses and ensuring that the vehicles are used efficiently.

- Attracts top talent: Offering a company car can be an attractive perk for employees, especially for roles that involve a significant amount of travel, helping businesses to recruit and retain top talent.

- Maintains compliance: By aligning the policy with Ohio state laws and federal regulations, the business can minimize risks and avoid potential legal issues regarding vehicle use, insurance, and liability.

Tips for using this company car policy (Ohio)

- Communicate the policy clearly: Ensure that all employees eligible for company car use understand the policy by including it in the employee handbook, discussing it during onboarding, and providing periodic reminders.

- Be transparent about personal use: If employees are allowed to use company cars for personal reasons, ensure they understand the boundaries of this use and whether there are any costs or taxable benefits associated with it.

- Provide clear guidelines for maintenance: Employees should be informed about their responsibilities for regular vehicle maintenance, reporting issues promptly, and keeping the vehicle clean. Provide employees with resources or contacts for maintenance or repairs when needed.

- Use a mileage tracking system: Implement a system for employees to track and report their business mileage consistently. This can include digital tools or simple forms that ensure accurate tracking and reporting.

- Monitor insurance compliance: Ensure that employees using company cars understand the insurance coverage provided by the business and their role in maintaining the necessary insurance for their use of the vehicle.

- Regularly review the policy: The policy should be reviewed periodically to ensure it remains in line with Ohio state laws, evolving business needs, and any changes in vehicle-related regulations.