Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

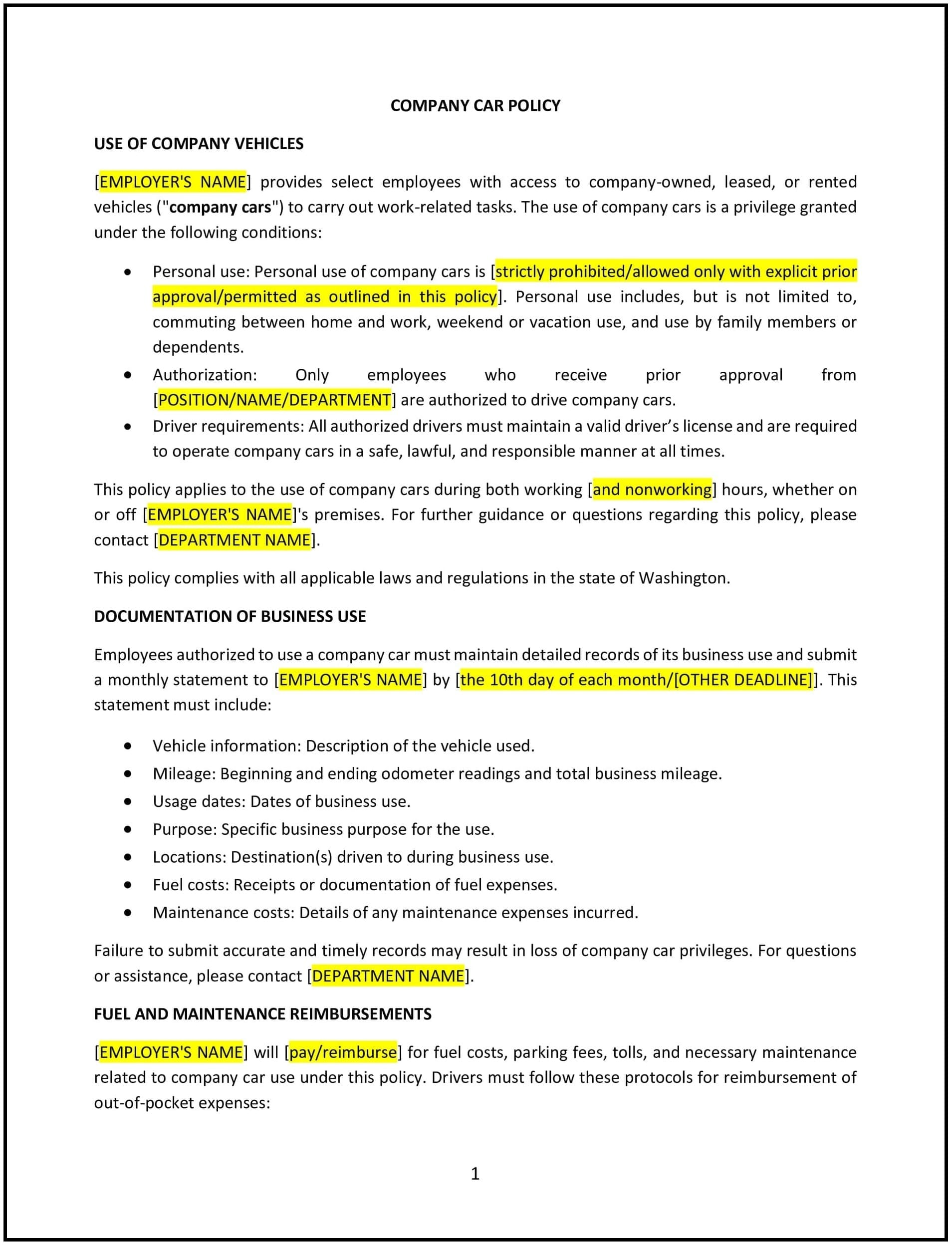

This company car policy is designed to help Washington businesses regulate the use of company-owned vehicles by employees. The policy outlines the responsibilities of employees when using company cars, including acceptable use, maintenance, and safety requirements. It also specifies how the company will manage vehicle-related expenses, insurance, and other liabilities, ensuring that both employees and the company adhere to legal and safety standards.

By adopting this policy, businesses can maintain a consistent approach to vehicle use, ensure the proper maintenance and care of company cars, and comply with Washington state laws related to driving and company vehicle usage.

How to use this company car policy (Washington)

- Define eligibility for company car use: Clearly outline which employees are eligible to use company vehicles, specifying any criteria such as job role, seniority, or the nature of their duties. The policy should indicate whether the use of company cars is a privilege or a requirement for certain positions.

- Set guidelines for personal use of company cars: The policy should specify whether employees are allowed to use company cars for personal purposes, and if so, under what conditions. For example, employees may be permitted to use the vehicle for commuting, but personal use may be limited or subject to additional charges.

- Address vehicle maintenance and care: Employees should be made aware of their responsibility for the proper care and maintenance of the company car. The policy should outline how often vehicles should be serviced, the process for reporting vehicle issues, and the company’s expectations for keeping the vehicle in good working condition.

- Specify driving and safety requirements: The policy should set expectations for safe driving practices, including adherence to traffic laws, seatbelt use, and restrictions on driving under the influence of alcohol or drugs. It should also clarify any restrictions on using company cars in unsafe conditions or for illegal activities.

- Address vehicle-related expenses: The policy should specify which expenses the company will cover (e.g., fuel, repairs, maintenance) and which costs the employee is responsible for (e.g., parking tickets, tolls). It should also address whether employees are reimbursed for fuel used during business trips.

- Define insurance coverage: The policy should clarify the company’s insurance coverage for the vehicle and the employee’s liability in the event of an accident. It should also specify the procedures employees should follow in the event of an accident, including how to report the incident and whom to contact.

- Set rules for vehicle return: The policy should outline the procedure for returning a company car, including conditions under which the vehicle must be returned (e.g., when an employee leaves the company or when the car is no longer required for business use).

- Ensure compliance with Washington and federal laws: The policy must comply with Washington state driving laws, insurance regulations, and safety standards. It should also address any legal requirements regarding company vehicle use, such as tax implications for personal use of company cars.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s vehicle usage practices or operations.

Benefits of using this company car policy (Washington)

This policy offers several benefits for Washington businesses:

- Reduces legal risks: By setting clear guidelines and safety expectations, businesses can minimize the risk of accidents, injuries, or legal issues related to company car use.

- Promotes vehicle care and maintenance: Clear expectations for vehicle care ensure that company cars are well-maintained, reducing the likelihood of breakdowns, extending vehicle lifespan, and avoiding unnecessary repair costs.

- Increases accountability: The policy establishes clear responsibilities for both the company and the employee, ensuring that company cars are used appropriately and in accordance with company standards.

- Protects the company’s assets: The policy helps protect the company’s vehicles from misuse or damage, while ensuring that employees are held accountable for any damages or misuse.

- Enhances employee safety: By specifying safe driving practices and requirements for maintaining the vehicle, the policy helps ensure that employees are safe when using company cars.

- Supports tax and insurance compliance: The policy helps achieve compliance with Washington state and federal laws regarding company car usage, insurance coverage, and tax reporting for personal use.

Tips for using this company car policy (Washington)

- Communicate the policy clearly: Ensure that all employees who are eligible for company cars understand the policy and their responsibilities when using a company vehicle. Include the policy in the employee handbook and review it during onboarding or at regular team meetings.

- Provide training on vehicle use: Offer training on safe driving practices, vehicle maintenance, and reporting procedures for employees who use company cars. This will help reduce accidents and improve compliance with the policy.

- Regularly inspect and maintain vehicles: Ensure that company cars are regularly inspected and maintained to meet safety standards. Set up a maintenance schedule and track the condition of each vehicle.

- Monitor personal use: If employees are allowed to use company cars for personal purposes, ensure that personal use is reasonable and does not interfere with business needs. The policy should clearly outline any restrictions or limitations on personal use.

- Track expenses: Keep records of all vehicle-related expenses, including fuel, repairs, and maintenance. Ensure that employees submit reimbursement requests according to the policy and that business and personal expenses are properly separated.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Washington state laws, federal regulations, and any changes in the company’s vehicle usage practices. Regular updates will help ensure the policy stays effective and relevant.