Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

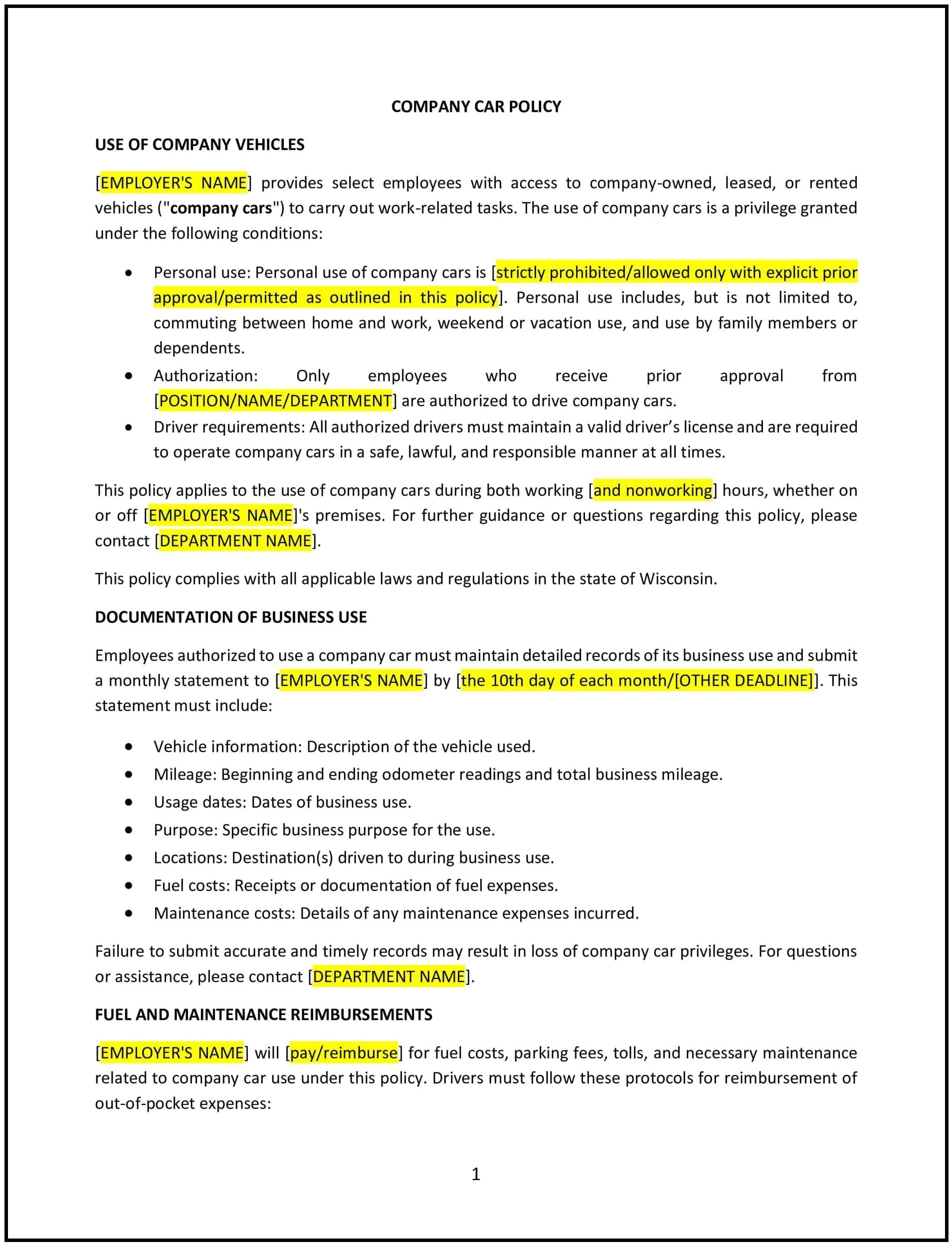

Company car policy (Wisconsin)

A company car policy helps Wisconsin businesses establish clear guidelines for employees who are provided with company-owned vehicles for work-related purposes. This policy outlines the terms and conditions of using a company car, including maintenance, usage expectations, and any personal use limitations, ensuring both the company and employees understand their rights and responsibilities.

By implementing this policy, businesses can ensure that company vehicles are used responsibly, reduce the risk of misuse, and comply with relevant insurance and tax regulations.

How to use this company car policy (Wisconsin)

- Define eligibility: Specify which employees are eligible to receive a company car based on factors such as job role, business needs, and performance.

- Set usage expectations: Outline the acceptable uses of the company car, including travel for business purposes, commuting, or attending meetings. Clarify any restrictions on personal use, and specify whether employees are allowed to use the car for non-business activities.

- Address maintenance and care: Define who is responsible for maintaining the company car, including routine maintenance, cleaning, and any repairs. Specify whether employees need to report issues or take the car to a specific service center for maintenance.

- Set mileage and fuel policies: Clarify whether employees are expected to cover the cost of fuel for personal trips and how mileage will be tracked. The policy should specify whether mileage limits apply and if there are any reimbursement rates for business travel.

- Clarify insurance and liability: Ensure that the company car is insured and outline the procedures to follow if an accident occurs, including reporting the incident, filing insurance claims, and any potential liability for damage caused by the employee.

- Address taxes and personal use: Explain how personal use of the company car will be taxed, including any fringe benefits or taxable amounts related to personal use. Specify whether the company will report the value of personal use on the employee’s tax forms.

- Outline driver responsibilities: Define the responsibilities of the employee while driving the company car, including adhering to traffic laws, avoiding risky driving behavior, and using the vehicle safely.

- Set vehicle return procedures: Specify what employees must do when the company car is no longer needed or when they leave the company, including returning the vehicle, cleaning it, and ensuring it is in good condition.

Benefits of using this company car policy (Wisconsin)

This policy offers several benefits for Wisconsin businesses:

- Ensures responsible use: Clear guidelines on acceptable use and maintenance help ensure that company vehicles are used appropriately and responsibly, reducing the risk of misuse or damage.

- Protects the company: By outlining insurance, liability, and safety expectations, the policy helps protect the company from financial and legal risks associated with accidents or misuse of company vehicles.

- Promotes consistency: The policy ensures that all employees are treated equally and fairly when it comes to the use of company vehicles, providing consistency in how vehicles are allocated and managed.

- Reduces administrative burden: Clear policies on mileage, fuel costs, and maintenance reduce the administrative burden of tracking and managing company cars, improving operational efficiency.

- Supports employee satisfaction: Providing a company car for eligible employees can serve as an attractive perk, improving job satisfaction and helping to retain talent.

Tips for using this company car policy (Wisconsin)

- Communicate the policy clearly: Ensure that all employees who are eligible for a company car fully understand the terms and conditions of its use, including maintenance responsibilities, insurance coverage, and mileage limits.

- Monitor usage: Regularly review vehicle usage to ensure compliance with the policy, track mileage, and ensure that personal use is limited as agreed upon.

- Provide clear reporting processes: Establish an easy process for employees to report accidents, vehicle damage, or maintenance issues, ensuring that the company can address concerns quickly.

- Offer training: Provide training on safe driving practices, company expectations for vehicle use, and how to handle situations like accidents or breakdowns.

- Review and update regularly: Regularly review the policy to monitor compliance with Wisconsin state laws, tax regulations, and business needs.