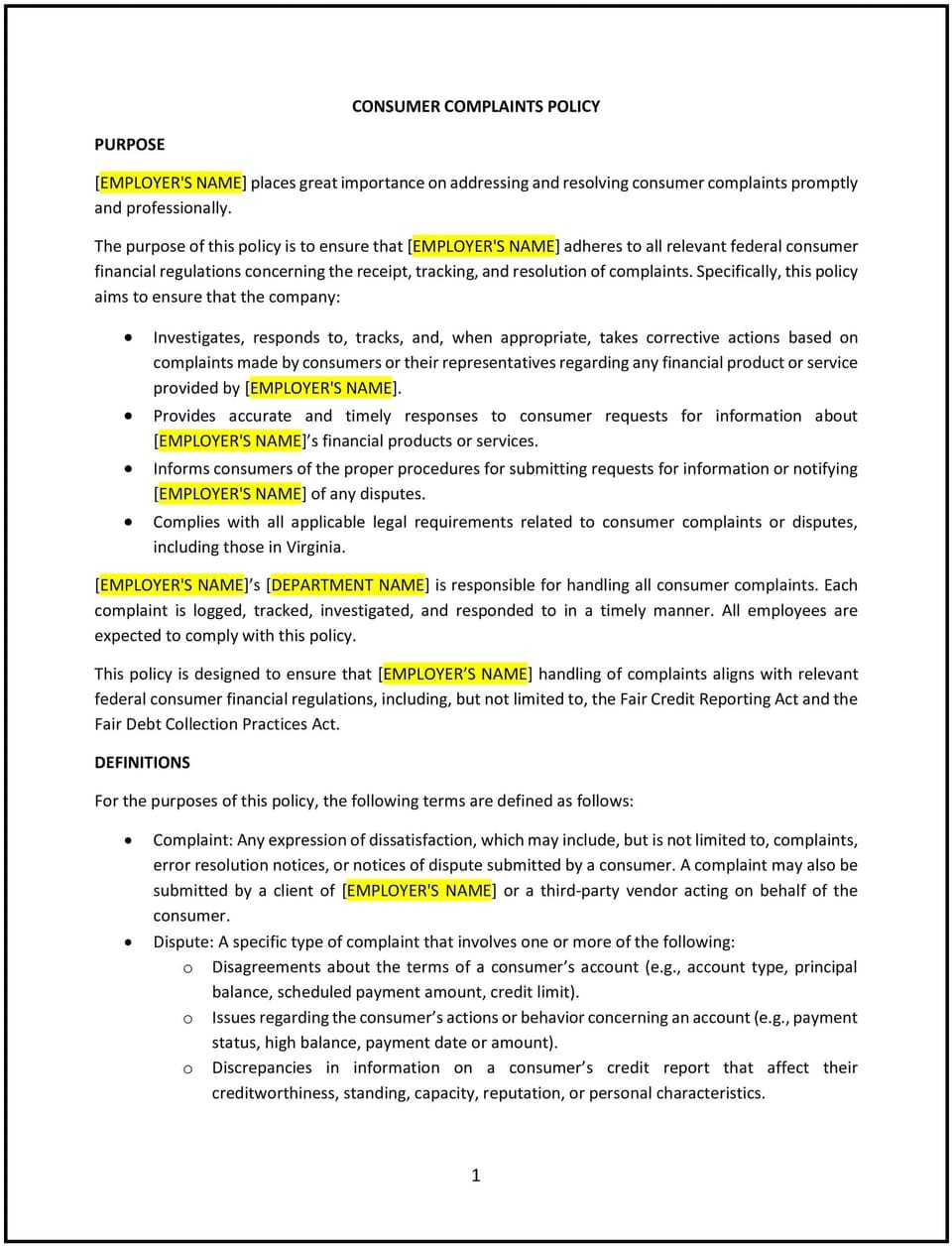

Consumer complaints policy (Virginia): Free template

This consumer complaints policy is designed to help Virginia businesses manage and respond to customer complaints effectively. It outlines the procedures for receiving, reviewing, and resolving customer complaints in a timely and professional manner. The policy ensures that consumers can express their concerns, and businesses have a structured process to address and resolve issues, improving customer satisfaction and trust.

By implementing this policy, businesses can foster a positive relationship with their customers, reduce the risk of reputational damage, and comply with applicable consumer protection laws.

How to use this consumer complaints policy (Virginia)

- Define the scope of consumer complaints: The policy should specify what types of complaints are covered, including issues related to product quality, service, billing, customer service, and any other aspects of the business that may lead to consumer dissatisfaction.

- Establish a clear reporting process: The policy should outline the steps consumers should take to file a complaint. This includes providing contact details for the company, specifying acceptable methods of communication (e.g., phone, email, online forms), and ensuring that complaints are logged and tracked.

- Set a response timeline: The policy should specify how long it will take the business to acknowledge and respond to consumer complaints. Typically, businesses should aim to respond to complaints within a certain time frame (e.g., 24-48 hours) and outline the expected resolution time based on the complexity of the issue.

- Designate responsible parties: The policy should designate specific individuals or departments responsible for handling consumer complaints. This could include customer service representatives, managers, or a dedicated complaints department.

- Provide guidelines for resolving complaints: The policy should outline the process for investigating complaints, including how the issue will be assessed, potential resolutions (e.g., refunds, replacements, or service improvements), and how the consumer will be informed of the resolution.

- Address escalation procedures: The policy should describe how complaints that cannot be resolved at the initial level will be escalated to higher management or alternative dispute resolution (ADR) methods, such as mediation or arbitration.

- Document complaints and resolutions: The policy should specify the process for documenting consumer complaints and their resolutions. This documentation should be kept confidential and stored for future reference in case of recurring issues or legal requirements.

- Ensure compliance with Virginia consumer protection laws: The policy should ensure compliance with Virginia state consumer protection laws, such as the Virginia Consumer Protection Act, as well as federal regulations related to fair business practices, product safety, and consumer rights.

- Review and update regularly: Periodically review and update the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in company operations. Regular updates will help ensure the policy stays relevant and effective.

Benefits of using this consumer complaints policy (Virginia)

This policy offers several benefits for Virginia businesses:

- Improves customer satisfaction: By having a clear and structured process for addressing consumer complaints, businesses can resolve issues more efficiently and increase customer satisfaction, leading to improved retention and loyalty.

- Mitigates reputational risks: Addressing complaints promptly and professionally helps prevent negative reviews or publicity that could harm the business's reputation. It demonstrates the company’s commitment to customer service and quality.

- Enhances compliance with consumer protection laws: The policy helps businesses stay compliant with Virginia state and federal consumer protection laws, reducing the risk of legal actions or fines related to unfair practices.

- Provides valuable feedback: Complaints can serve as valuable feedback for businesses to identify areas for improvement, such as product defects, service delays, or gaps in customer service, leading to enhanced quality and customer experience.

- Strengthens customer trust: When consumers see that their concerns are taken seriously and handled efficiently, trust in the company grows, leading to stronger long-term customer relationships.

- Streamlines complaint resolution: A formalized process ensures that complaints are handled consistently, reducing confusion, preventing unresolved issues, and improving operational efficiency.

Tips for using this consumer complaints policy (Virginia)

- Communicate the policy clearly: Ensure that consumers are aware of how to file a complaint and the process for resolution. This can be done by displaying the complaint procedure on the company website, including it in terms and conditions, and making it available at points of customer contact.

- Train staff on complaint handling: Ensure that employees are trained on how to handle consumer complaints, from acknowledging the complaint to resolving the issue efficiently. This training should emphasize the importance of professionalism, empathy, and following the company’s procedures.

- Use complaints as a tool for improvement: Regularly review complaints to identify recurring issues or patterns. Use this information to improve products, services, or customer interactions and reduce future complaints.

- Respond promptly: Aim to acknowledge complaints quickly and keep the consumer informed about the status of their issue. Timely responses show consumers that their concerns are taken seriously and that the company is committed to resolving them.

- Review and update regularly: Periodically review the policy to ensure it remains compliant with Virginia state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.

Q: How can consumers file a complaint?

A: The policy outlines the methods for consumers to file a complaint, including via phone, email, or an online form. The company should ensure that these methods are easily accessible and that consumers are informed on how to contact the company.

Q: What should consumers expect after submitting a complaint?

A: The policy specifies that consumers will receive an acknowledgment of their complaint within a certain time frame (e.g., 24-48 hours). The company will then investigate the issue and provide a resolution, which may include a refund, replacement, or service improvement.

Q: How does the company handle unresolved complaints?

A: If a complaint cannot be resolved at the initial level, the policy describes the escalation process, including the involvement of higher management or alternative dispute resolution methods, such as mediation or arbitration.

Q: Can consumers file complaints anonymously?

A: The policy should specify whether consumers can file complaints anonymously, and how those complaints will be handled. While anonymous complaints can be submitted, it is often more effective to have contact information for follow-up purposes.

Q: What happens if the company doesn’t resolve a complaint in time?

A: The policy should outline the expected timelines for resolving complaints and the steps the company will take if a resolution cannot be achieved within the stated time frame. This may include further escalation or compensation where appropriate.

Q: How often should this policy be reviewed?

A: The policy should be reviewed periodically, at least annually, to ensure it is compliant with Virginia state laws, federal regulations, and any changes in the company’s operations. Regular updates will help keep the policy relevant and effective.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.