Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

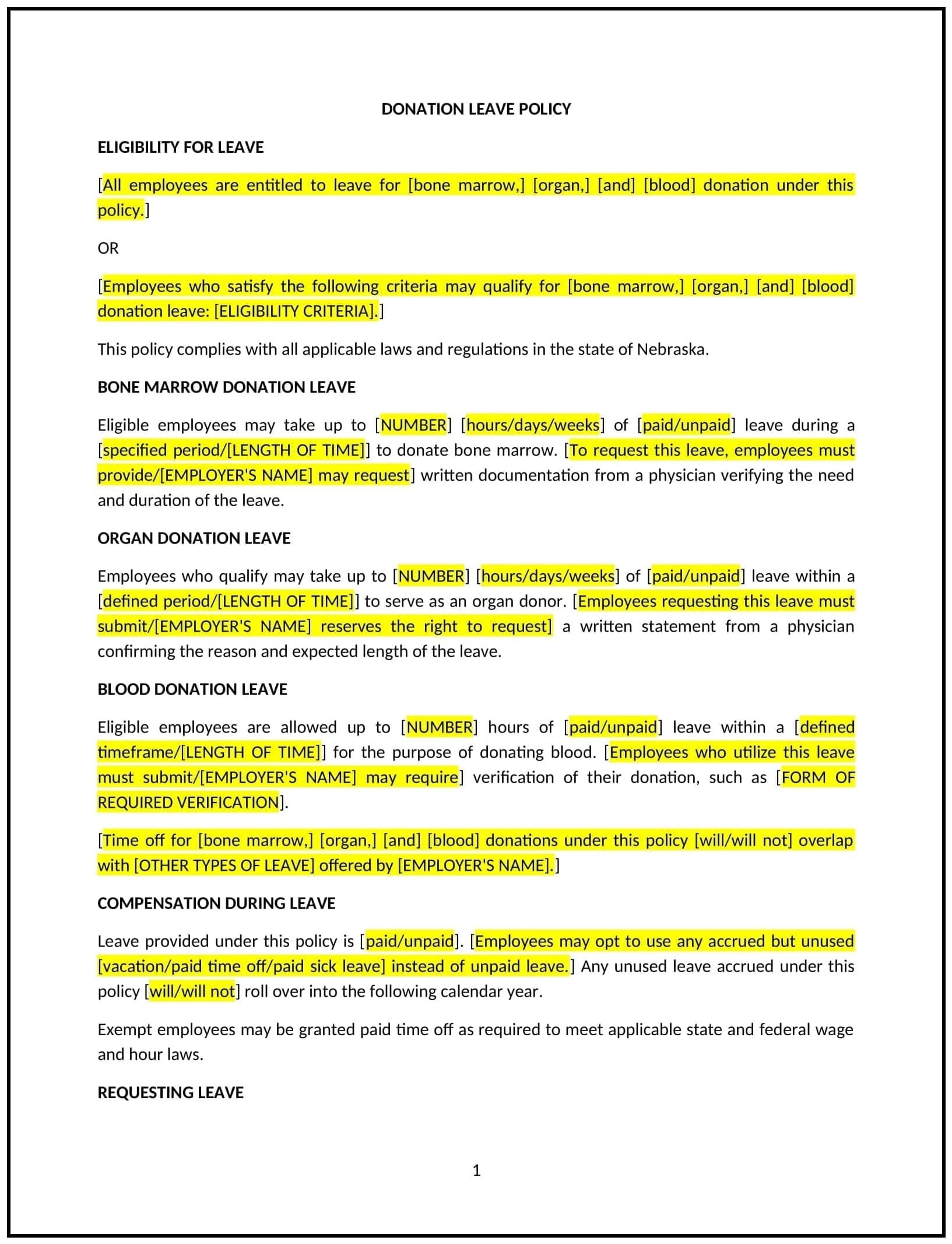

Donation leave policy (Nebraska)

A donation leave policy helps Nebraska businesses establish guidelines for employees who wish to donate paid leave time to their colleagues or other employees in need, such as during personal crises, emergencies, or health-related events. This policy outlines the conditions under which leave can be donated, the process for donating leave time, and how the business will administer the program. It is designed to foster a supportive and compassionate workplace, allowing employees to help one another in times of need.

By adopting this policy, businesses in Nebraska can create a caring work environment, enhance employee morale, and promote a culture of solidarity and teamwork.

How to use this donation leave policy (Nebraska)

- Define eligibility: Specify who is eligible to donate and receive leave time. For example, define whether both full-time and part-time employees can donate leave and whether only employees facing certain types of hardship can receive donations.

- Set guidelines for donations: Outline the minimum and maximum amounts of leave that can be donated by any employee, and clarify whether leave donations will be deducted from the donor’s paid time off (PTO) balance or vacation days.

- Determine the process for donating leave: Provide clear instructions for how employees can donate their leave time, including who they should contact, the form or documentation needed, and any deadlines for submitting donations.

- Specify when leave can be donated: Explain when and why donated leave can be used, such as in cases of medical emergencies, personal crises, or the need for extended time off due to illness or other qualifying circumstances.

- Address confidentiality: Ensure that the donation process respects the privacy of the employee receiving donations, and specify how sensitive information will be handled to protect confidentiality.

- Provide guidelines for managing donated leave: Clarify how donated leave will be tracked and managed, including the roles of HR or relevant personnel in overseeing the program.

- Address any tax implications: Inform employees about any tax considerations related to donating or receiving leave time, as donated leave may be subject to different tax treatments depending on the circumstances.

- Review and update: Periodically review and update the policy to ensure it aligns with Nebraska laws, business practices, and the evolving needs of employees.

Benefits of using this donation leave policy (Nebraska)

This policy provides several benefits for Nebraska businesses:

- Fosters a compassionate workplace: A donation leave policy helps employees support one another in times of need, strengthening the overall workplace culture and enhancing employee morale.

- Improves employee retention: Providing employees with the opportunity to donate leave demonstrates that the business cares about their well-being, which can improve loyalty and retention.

- Increases productivity and engagement: Employees who feel supported during personal crises are more likely to return to work when they are able, leading to higher productivity and engagement.

- Demonstrates corporate social responsibility: A donation leave policy reflects the business’s commitment to supporting employees, which can enhance the company’s reputation as a responsible and caring employer.

- Enhances team cohesion: By allowing employees to help each other, the policy can promote collaboration and a sense of teamwork within the workplace.

Tips for using this donation leave policy (Nebraska)

- Communicate the policy clearly: Ensure that all employees understand the donation leave policy and are aware of how they can participate, whether as donors or recipients. This can be done through employee handbooks, meetings, and other communication channels.

- Ensure transparency: Regularly update employees on how the donation leave program is being used and how it benefits the workforce. This helps build trust and encourages participation.

- Provide support for the process: Offer assistance to employees who wish to donate or receive leave, such as explaining how to fill out the necessary paperwork or answering questions about the policy.

- Monitor program usage: Track the amount of leave donated and used, and ensure that the program is administered fairly and in line with the business’s objectives.

- Keep the process simple: Streamline the donation process to make it as easy as possible for employees to participate, including creating a simple donation form or an online platform for tracking leave donations.