Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

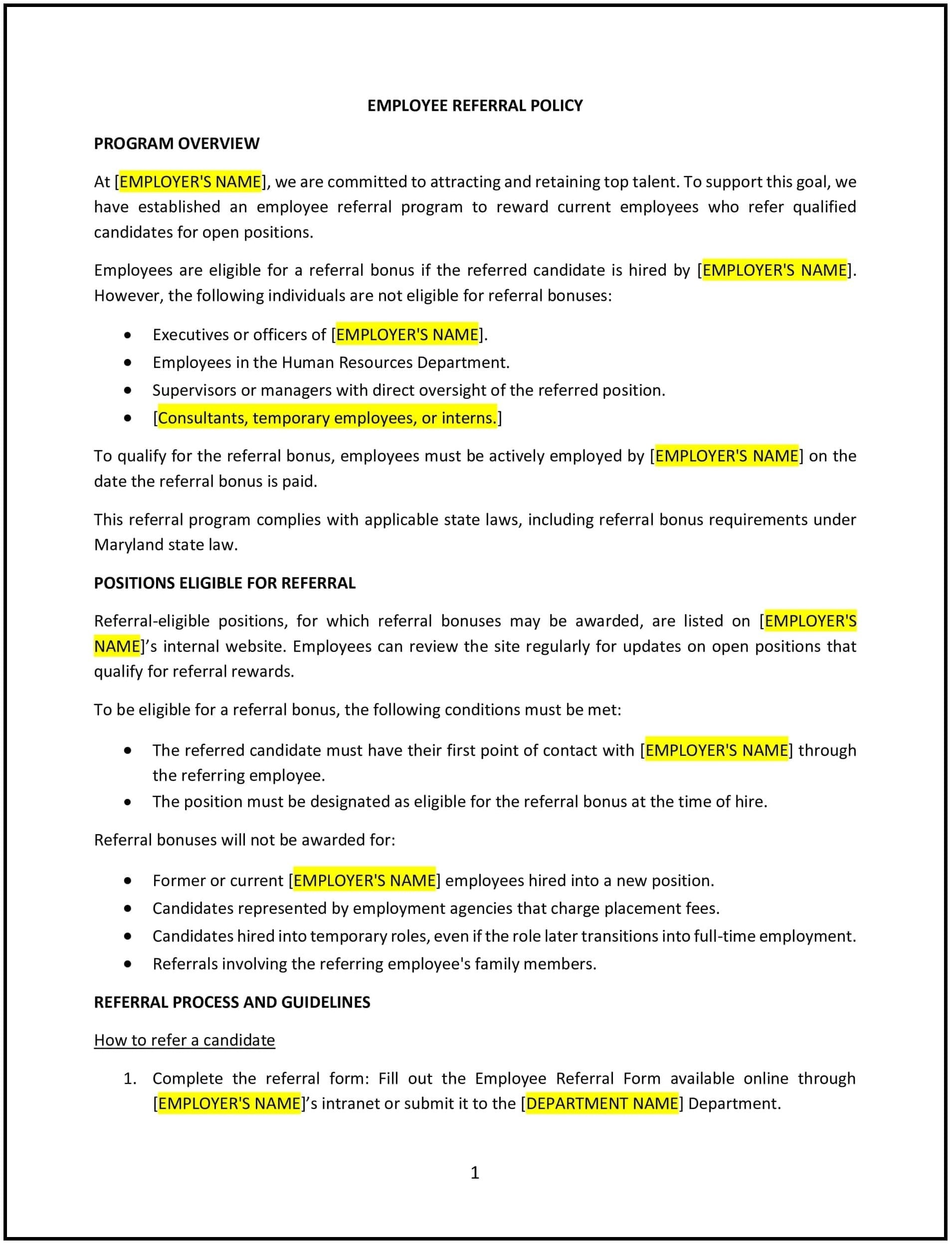

Employee referral policy (Maryland)

This employee referral policy is designed to help Maryland businesses encourage employees to refer qualified candidates for open positions. It establishes a framework for managing referrals, incentivizing participation, and ensuring fairness in the hiring process.

By adopting this policy, Maryland businesses can enhance recruitment efforts, reduce hiring costs, and engage employees in building a stronger team.

How to use this employee referral policy (Maryland)

- Define eligibility: Specify which employees can participate in the referral program and which positions are eligible for referrals.

- Outline referral incentives: Provide details on rewards, such as bonuses, gift cards, or extra leave, and the conditions for earning them.

- Establish referral submission procedures: Describe how employees can submit referrals, including forms, online platforms, or direct communication with HR.

- Include hiring criteria: Emphasize that all referred candidates will be evaluated based on the business’s hiring standards and Maryland employment laws.

- Address reward timelines: Specify when referral rewards will be issued, such as after the referred candidate completes a probationary period.

- Prohibit conflicts of interest: State that referrals involving family members or close friends must adhere to established guidelines to avoid bias.

- Reflect Maryland-specific considerations: Ensure compliance with state labor laws, such as those addressing equal opportunity employment.

Benefits of using this employee referral policy (Maryland)

Implementing this policy provides Maryland businesses with several advantages:

- Improves recruitment quality: Encourages referrals from employees who understand the business’s needs and culture.

- Reduces hiring costs: Minimizes reliance on external recruitment services.

- Increases employee engagement: Motivates employees to participate in building a stronger team.

- Promotes inclusivity: Reinforces hiring practices that prioritize diversity and equal opportunity.

- Streamlines the hiring process: Simplifies candidate sourcing through trusted employee networks.

Tips for using this employee referral policy (Maryland)

- Communicate the program: Share details of the referral program during onboarding and through internal communications.

- Monitor outcomes: Track the performance and retention of referred hires to assess the program’s effectiveness.

- Encourage diversity: Remind employees to refer candidates from varied backgrounds to support inclusive hiring practices.

- Regularly update rewards: Adjust incentives to keep employees motivated and aligned with business goals.

- Stay informed: Reflect changes in Maryland employment laws or recruitment best practices in the policy.