Ethics and conflict of interest policy (New York): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Ethics and conflict of interest policy (New York)

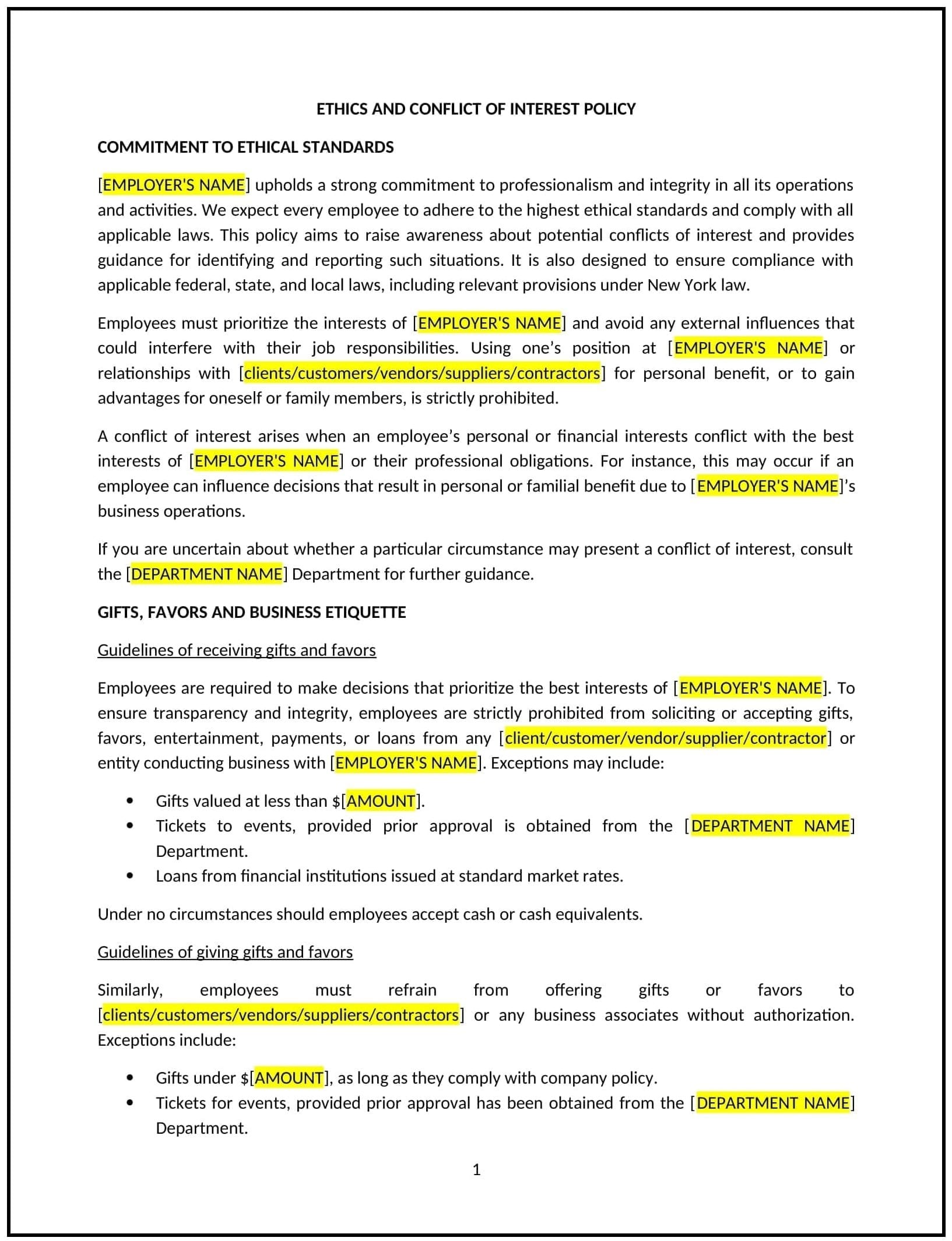

This ethics and conflict of interest policy is designed to help New York businesses promote ethical behavior and address potential conflicts of interest in the workplace. Whether businesses are ensuring fair decision-making, managing relationships with vendors, or safeguarding confidential information, this template provides clear guidelines to uphold integrity and accountability.

By using this template, businesses can reinforce a culture of ethical conduct, protect organizational interests, and reduce risks associated with unethical behavior.

How to use this ethics and conflict of interest policy (New York)

- Define ethical standards: Clearly outline the principles of ethical behavior expected from employees, such as honesty, fairness, and transparency.

- Identify potential conflicts: Provide examples of common conflicts of interest, such as personal relationships with vendors, financial investments, or accepting gifts from stakeholders.

- Establish disclosure procedures: Specify how businesses will collect and review conflict disclosures from employees, including timelines and required documentation.

- Address non-compliance: Detail the steps businesses will take to address policy violations, including internal reviews and disciplinary actions where appropriate.

- Include confidentiality requirements: Highlight the importance of safeguarding sensitive company information to prevent conflicts and ensure compliance with privacy standards.

Benefits of using an ethics and conflict of interest policy (New York)

This policy offers several benefits for New York businesses:

- Promotes accountability: Establishing clear ethical standards ensures that employees understand their responsibilities and act in the best interests of the organization.

- Reduces risks: Addressing conflicts of interest proactively helps businesses avoid reputational damage, financial losses, or legal issues.

- Enhances trust: A strong ethics policy fosters trust among employees, stakeholders, and clients by demonstrating a commitment to fairness and integrity.

- Encourages transparency: Requiring disclosure of potential conflicts ensures decisions are made openly and without bias.

- Supports compliance: Aligning the policy with New York state laws helps businesses navigate regulatory requirements effectively.

Tips for using this ethics and conflict of interest policy (New York)

- Provide real-world examples: Include scenarios that illustrate potential conflicts of interest to help employees better understand and identify them.

- Communicate clearly: Ensure the policy is included in onboarding materials and discussed during training sessions to promote awareness and adherence.

- Create a safe reporting environment: Encourage employees to report potential conflicts without fear of retaliation or negative consequences.

- Monitor and review: Regularly evaluate the policy’s effectiveness and update it to address emerging risks or changes in business operations.

- Lead by example: Encourage management and leadership to model ethical behavior, reinforcing the importance of the policy across the organization.