Payroll and compensation policy (Pennsylvania): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

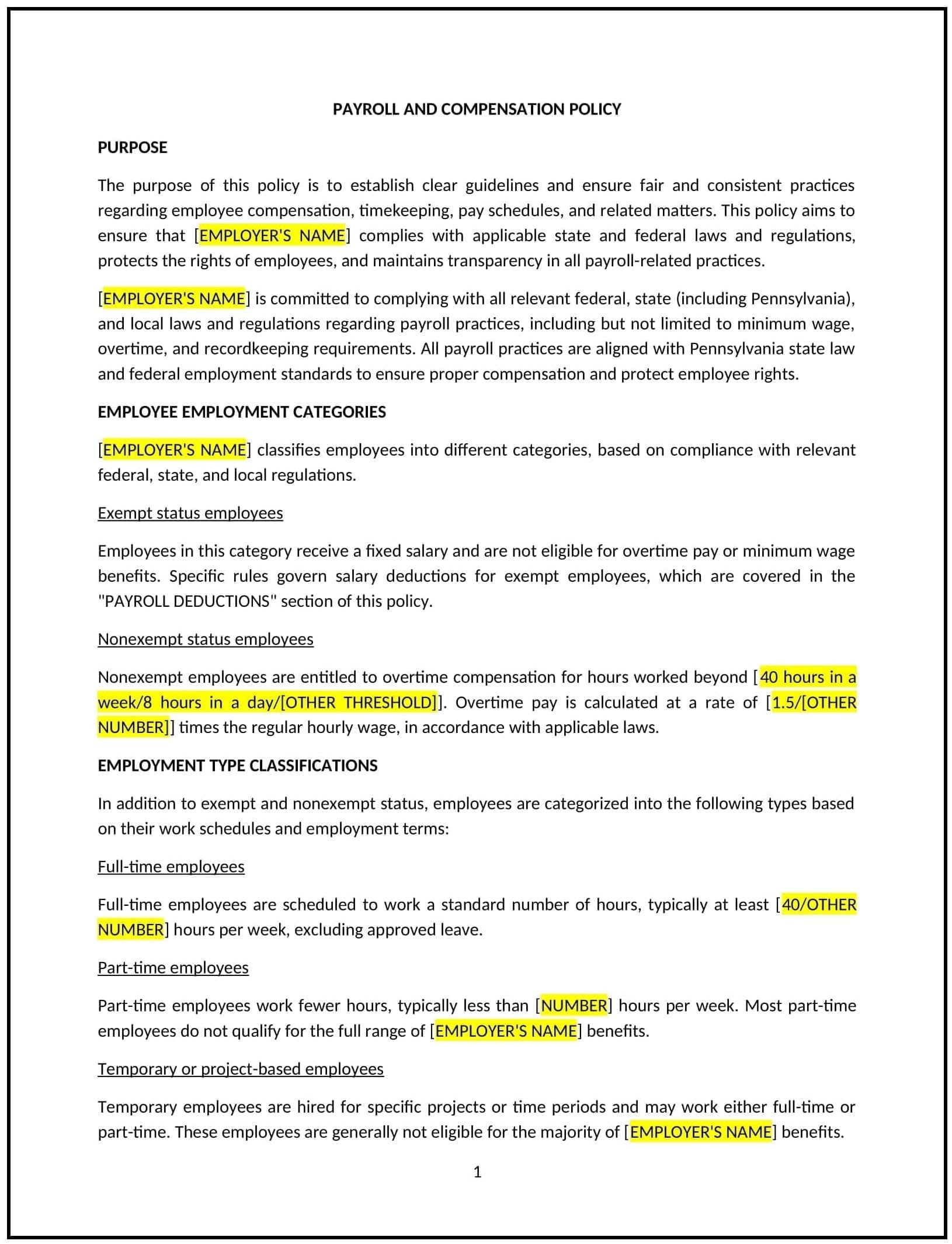

Payroll and compensation policy (Pennsylvania)

This payroll and compensation policy is designed to help businesses in Pennsylvania outline clear guidelines for employee compensation, including pay schedules, overtime, deductions, and other related practices. By providing transparency and ensuring compliance with federal and Pennsylvania-specific labor laws, this template promotes consistency, fairness, and employee trust.

By using this template, businesses can manage payroll effectively, reduce errors, and foster a positive work environment.

How to use this payroll and compensation policy (Pennsylvania)

- Define pay structure: Clearly specify how employees are compensated, including hourly wages, salaries, or commission-based pay.

- Establish pay schedules: Provide details on pay frequency, such as weekly, biweekly, or monthly, and the methods of payment (e.g., direct deposit, checks).

- Address overtime: Outline rules for calculating and compensating overtime in compliance with Pennsylvania and federal labor laws.

- Include deductions and withholdings: Specify mandatory and voluntary deductions, such as taxes, benefits, or garnishments.

- Reflect Pennsylvania-specific considerations: Tailor the policy to include state-specific wage laws, such as minimum wage requirements and final paycheck rules.

Benefits of using a payroll and compensation policy (Pennsylvania)

A well-structured payroll and compensation policy supports fairness and operational efficiency. Here's how it helps:

- Enhances transparency: Provides employees with clear information about how and when they will be compensated.

- Reduces errors: Establishes consistent payroll practices to minimize mistakes and disputes.

- Supports compliance: Aligns with Pennsylvania and federal wage and hour laws to reduce the risk of legal issues.

- Promotes fairness: Ensures all employees are compensated accurately and consistently.

- Reflects local needs: Addresses Pennsylvania-specific labor laws and workplace practices, ensuring relevance for businesses operating in the state.

Tips for using a payroll and compensation policy (Pennsylvania)

- Communicate the policy: Share the policy with employees during onboarding and provide ongoing access to ensure understanding.

- Monitor compliance: Regularly audit payroll processes to ensure adherence to Pennsylvania wage laws and federal regulations.

- Use reliable systems: Implement payroll software or services to streamline payroll processing and reduce errors.

- Address disputes promptly: Establish a process for employees to report and resolve payroll discrepancies quickly.

- Review periodically: Update the policy as needed to reflect changes in Pennsylvania laws, tax requirements, or business practices.