Pay advances and loan policy (Maryland): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Maryland)

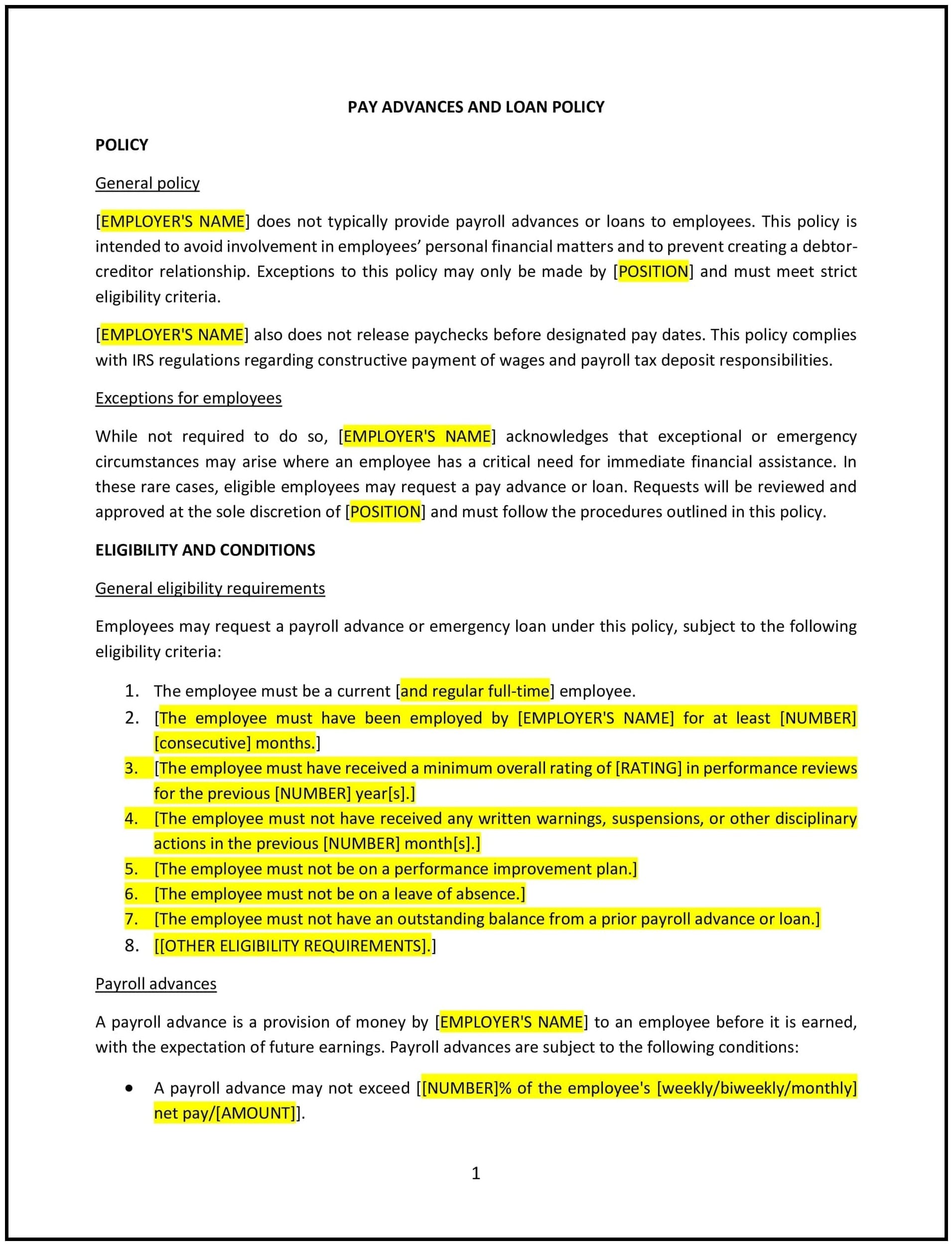

This pay advances and loan policy is designed to help Maryland businesses manage employee requests for financial assistance through advances on pay or company-provided loans. It establishes clear guidelines for eligibility, application, repayment terms, and limits to maintain fairness and transparency.

By adopting this policy, Maryland businesses can support employees facing financial hardships while safeguarding company resources.

How to use this pay advances and loan policy (Maryland)

- Define pay advances and loans: Clearly distinguish between pay advances (early access to earned wages) and loans (company-provided financial assistance with repayment terms).

- Outline eligibility: Specify which employees are eligible to request pay advances or loans, considering factors such as employment duration and financial need.

- Provide application procedures: Detail how employees can request assistance, including required forms and documentation.

- Establish limits: Set maximum amounts for advances or loans and restrict the frequency of requests to prevent misuse.

- Include repayment terms: Clearly define repayment schedules, methods (e.g., payroll deductions), and interest rates, if applicable.

- Address confidentiality: Emphasize the importance of keeping financial assistance requests confidential.

- Reflect Maryland-specific considerations: Ensure compliance with state laws regarding wage deductions, interest rates, and employee rights.

Benefits of using this pay advances and loan policy (Maryland)

Implementing this policy provides Maryland businesses with several advantages:

- Supports employees: Offers financial assistance during emergencies or unexpected hardships.

- Promotes transparency: Establishes clear and consistent procedures for managing requests.

- Reduces disputes: Minimizes misunderstandings by clearly outlining terms and conditions.

- Safeguards resources: Ensures responsible allocation of company funds and repayment security.

- Aligns with Maryland laws: Reflects state-specific regulations on wage practices and employee rights.

Tips for using this pay advances and loan policy (Maryland)

- Communicate clearly: Ensure employees understand the terms and conditions before requesting financial assistance.

- Train managers: Educate supervisors on how to handle requests and maintain confidentiality.

- Monitor repayment: Use payroll systems to track repayment progress and address any discrepancies promptly.

- Limit liability: Set clear boundaries on the frequency and amount of assistance offered to avoid financial strain on the business.

- Review regularly: Update the policy to reflect changes in Maryland laws or business practices.