Pay advances and loan policy (Massachusetts): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

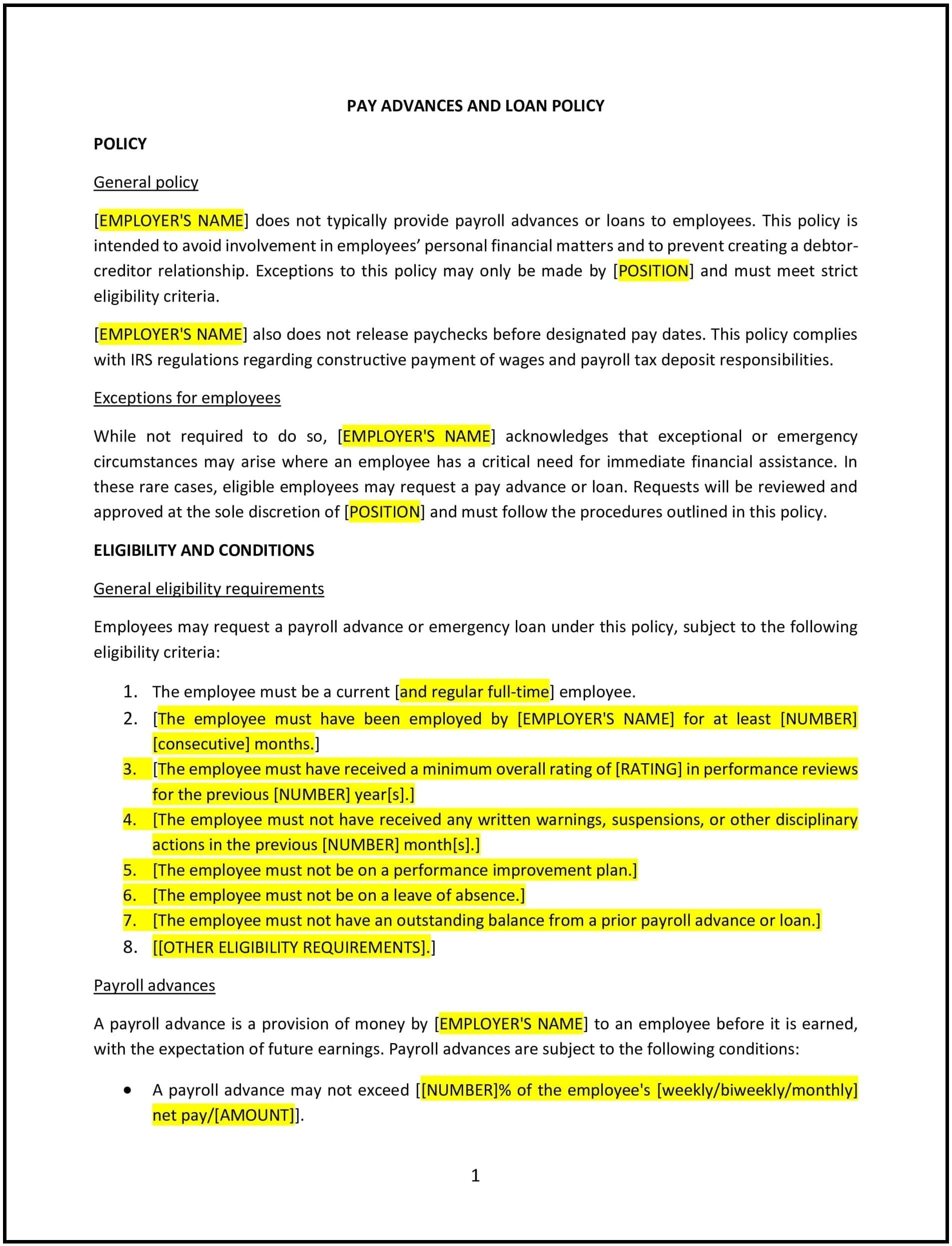

This pay advances and loan policy is designed to help Massachusetts businesses establish clear guidelines regarding pay advances and loans provided to employees. The policy outlines the conditions under which employees may request a pay advance or loan, the process for approval, repayment terms, and any restrictions on the amount or frequency of such advances or loans. It ensures that businesses comply with Massachusetts state laws regarding wages and advances while maintaining fairness and transparency in managing employee financial assistance.

By adopting this policy, businesses can provide a clear, consistent approach to employee financial support while protecting both the company and the employees from potential misunderstandings or legal issues.

How to use this pay advances and loan policy (Massachusetts)

- Define eligibility for pay advances and loans: Specify which employees are eligible to request pay advances or loans. This could include full-time, part-time, or temporary employees, and the policy should outline any length-of-service requirements or other conditions for eligibility.

- Outline the types of pay advances and loans: Clarify whether the company offers pay advances (a portion of an employee’s earned wages before payday) or loans (monetary assistance that must be repaid over time). The policy should also specify if there are any limits to the amounts employees can request.

- Set guidelines for requesting pay advances or loans: The policy should detail the process for requesting a pay advance or loan, including who the request should be submitted to (e.g., HR, payroll department), any required documentation (e.g., explanation for the advance or loan request), and the timeline for submitting requests.

- Establish repayment terms: Specify how and when pay advances or loans will be repaid. For pay advances, this may involve deducting the amount from future paychecks, while loans may require employees to agree to a specific repayment schedule. The policy should clarify how these deductions will be managed and whether any interest is charged.

- Address potential interest or fees: If applicable, the policy should specify whether any interest or administrative fees will be charged on loans or pay advances. Massachusetts law limits how much can be charged in interest for loans, so the policy must comply with state regulations.

- Protect against over-burdening employees: The policy should ensure that the terms of repayment are fair and do not place undue financial burden on the employee. This includes setting reasonable repayment amounts and timelines to avoid financial hardship.

- Ensure compliance with Massachusetts and federal laws: Ensure that the policy complies with Massachusetts state laws regarding wages, pay advances, and loans, such as the Massachusetts Wage Act. It should also align with any applicable federal regulations regarding wage deductions and lending.

- Review and update regularly: Periodically review and update the policy to ensure it is in compliance with any changes in Massachusetts state law or federal regulations, as well as the company's evolving financial assistance practices.

Benefits of using this pay advances and loan policy (Massachusetts)

This policy offers several benefits for Massachusetts businesses:

- Promotes fairness and transparency: The policy ensures that all employees are treated fairly and equally when requesting pay advances or loans, reducing the risk of bias or misunderstandings.

- Protects the business: By setting clear guidelines for pay advances and loans, the company reduces the risk of legal issues related to improper deductions or lending practices. The policy helps achieve compliance with Massachusetts state laws and federal regulations.

- Supports employees in need: Offering pay advances or loans helps employees manage unexpected financial challenges without having to resort to high-interest lending options, promoting employee well-being and morale.

- Reduces financial risk: By setting limits on the amount of pay advances or loans that employees can request and requiring repayment terms, businesses can manage their financial exposure and reduce the risk of non-payment.

- Enhances employee trust: A clear, consistent approach to pay advances and loans builds trust between the company and employees, fostering a positive work environment where employees feel supported during difficult times.

- Improves financial management: The policy establishes a formal process for managing employee financial assistance, allowing the company to track advances and loans, maintain proper documentation, and avoid potential financial disputes.

Tips for using this pay advances and loan policy (Massachusetts)

- Communicate the policy clearly: Ensure that all employees understand the pay advance and loan policy and the procedures for requesting financial assistance. The policy should be clearly communicated through employee handbooks, orientation, or HR meetings.

- Provide training for HR and payroll staff: Train HR and payroll personnel on how to manage requests for pay advances and loans, ensuring they follow the policy and handle repayment schedules accurately.

- Monitor repayment schedules: Keep track of all pay advances and loans given to employees, ensuring timely repayments and preventing any issues with deductions from paychecks. Review records regularly to ensure compliance with the policy.

- Evaluate the financial impact: Periodically evaluate the impact of pay advances and loans on the company’s cash flow and finances. This can help identify any adjustments needed to ensure the business can manage the financial assistance program effectively.

- Review and update regularly: Periodically review the policy to ensure it is compliant with Massachusetts state laws, federal regulations, and any changes in company practices. Make updates as necessary to reflect changes in financial assistance needs or legal requirements.