Pay advances and loan policy (Michigan): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Michigan)

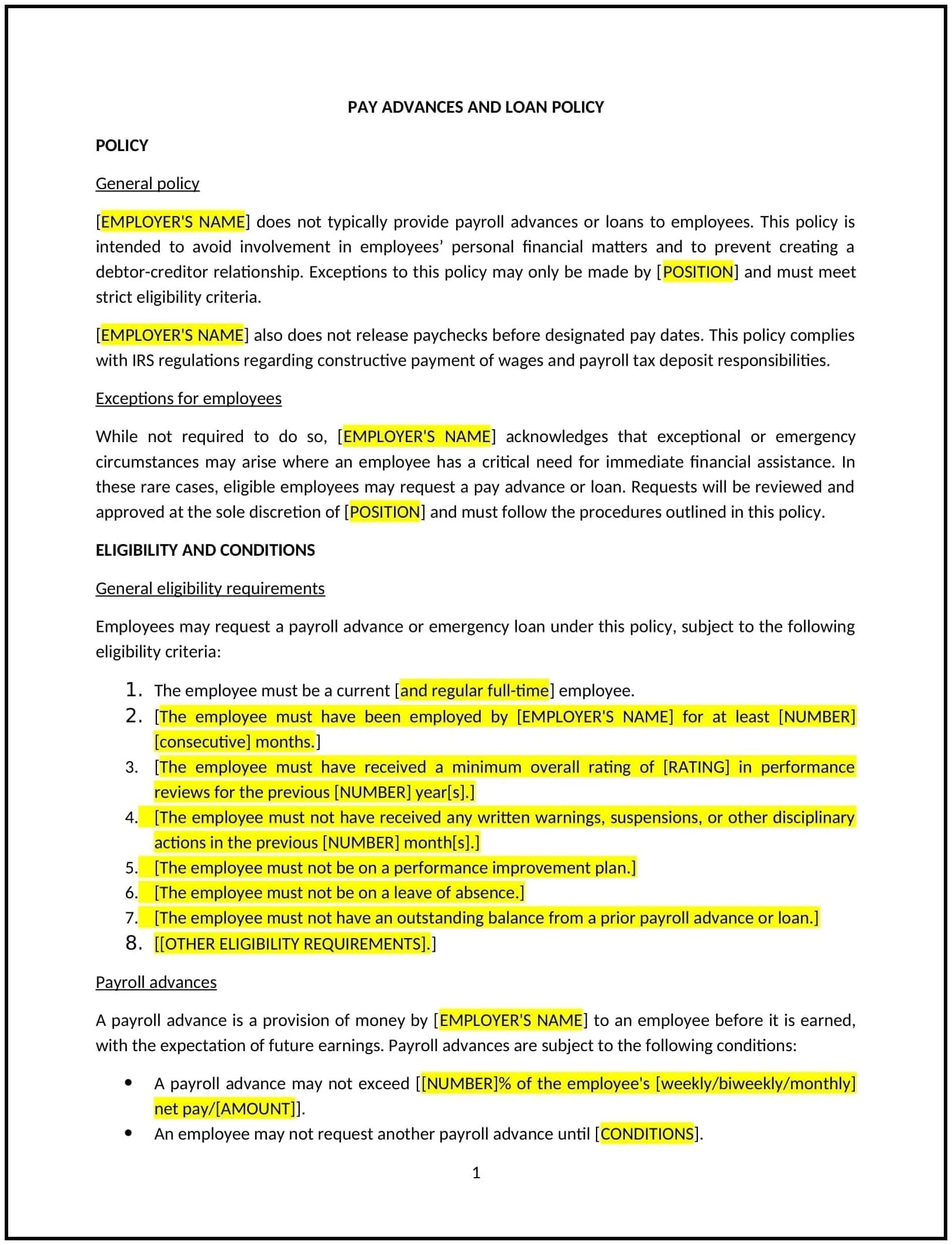

A pay advances and loan policy provides Michigan businesses with clear guidelines on when and how employees can request pay advances or loans from the business. This policy outlines the process for requesting and approving such advances or loans, the terms and conditions, and the repayment process. It helps businesses ensure transparency, fairness, and supports legal compliance when providing financial assistance to employees.

By adopting this policy, businesses can address employees' financial needs while protecting their own interests, maintaining appropriate records, and avoiding potential abuse of the system.

How to use this pay advances and loan policy (Michigan)

- Define eligibility: Clearly define which employees are eligible to request a pay advance or loan, such as those who have been employed for a certain period (e.g., 6 months) and are in good standing with the business.

- Set criteria for requests: Outline the types of situations in which pay advances or loans may be granted, such as unexpected emergencies or personal hardships. Specify the circumstances under which requests may be approved or denied.

- Establish approval process: Describe the process for requesting and approving pay advances or loans, including who employees should contact, what documentation is required, and how long the approval process will take.

- Specify repayment terms: Set clear terms for repayment of pay advances or loans, such as the maximum amount that can be requested, repayment schedules, and whether the loan will be deducted from future paychecks.

- Address interest rates and fees: If applicable, specify any interest rates or fees associated with loans, ensuring that they comply with Michigan state laws and federal regulations.

- Document loans and advances: Ensure that all pay advances or loans are documented in writing, including the amount, repayment terms, and any conditions attached. The documentation should be signed by both the employee and the business to confirm the agreement.

- Prevent misuse: Establish safeguards to prevent abuse of the system, such as limiting the number of pay advances or loans an employee can request within a specific period and requiring managers to review each request thoroughly.

- Review and update the policy regularly: Periodically review and update the policy to ensure it remains compliant with Michigan state laws and reflects the business’s evolving financial needs and employee welfare strategies.

Benefits of using this pay advances and loan policy (Michigan)

This policy provides several key benefits for Michigan businesses:

- Provides financial support: The policy allows businesses to offer financial assistance to employees in times of need, supporting employee well-being and reducing financial stress that may impact work performance.

- Promotes fairness and transparency: By setting clear guidelines and criteria for pay advances and loans, businesses can ensure that all employees are treated fairly and consistently when requesting financial assistance.

- Reduces risk of exploitation: The policy helps protect the business from potential misuse of the system by establishing safeguards and clear repayment terms, reducing the risk of employees taking advantage of the policy.

- Enhances employee retention: Offering pay advances or loans demonstrates a commitment to employees' financial security, which can foster loyalty and improve job satisfaction.

- Complies with legal requirements: The policy ensures that the business is compliant with Michigan state laws and federal regulations regarding loans, interest rates, and financial assistance.

Tips for using this pay advances and loan policy (Michigan)

- Communicate the policy: Ensure all employees are aware of the pay advances and loan policy by including it in the employee handbook, during onboarding, and in regular communications regarding employee benefits.

- Offer financial education: Consider offering financial education resources or workshops to employees to help them manage their finances, which may reduce the need for pay advances or loans.

- Monitor requests: Track requests for pay advances and loans to ensure they are being handled in a fair and consistent manner. Regularly review approval and repayment processes to identify any potential issues.

- Be clear about terms: Ensure that employees fully understand the terms of the loan or advance, including repayment schedules, interest rates (if applicable), and any potential consequences of failing to repay.

- Review the policy regularly: Periodically review and update the policy to ensure it aligns with changes in Michigan state laws, business practices, or employee needs.