Pay advances and loan policy (Montana): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Montana)

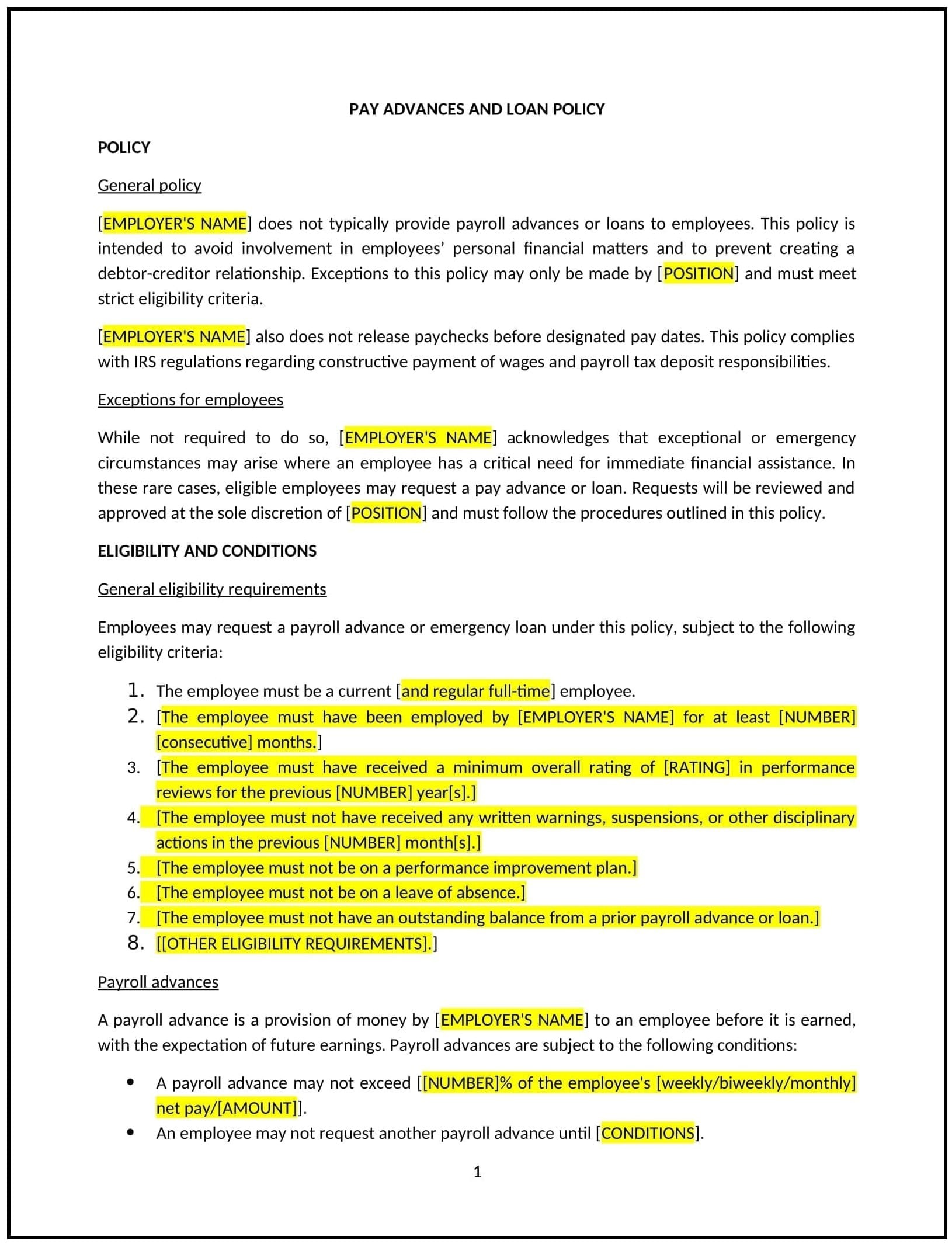

A pay advances and loan policy helps Montana businesses manage requests for pay advances or loans by employees, outlining the terms and conditions under which such requests may be granted. This policy ensures that both the employer and employee understand the expectations, repayment schedules, and potential consequences associated with pay advances or loans, while maintaining fairness and financial responsibility.

By implementing this policy, businesses can provide financial assistance to employees when needed while minimizing the risk of financial strain or misunderstandings, protecting both the business and its employees.

How to use this pay advances and loan policy (Montana)

- Define eligibility: The policy should specify who is eligible for pay advances or loans, including any requirements such as length of employment or employment status. It should also outline any exceptions or exclusions for certain roles or circumstances.

- Set guidelines for loan requests: The policy should establish the process by which employees can request pay advances or loans, including how they should submit requests, what documentation or justification is required, and the timeline for approval.

- Outline repayment terms: The policy should specify the repayment terms for any advances or loans, including the repayment schedule, interest rates (if applicable), and the method of repayment (e.g., through payroll deductions or lump-sum payments).

- Address loan limits: The policy should specify any limits on the amount of a pay advance or loan, ensuring that the amounts are reasonable and do not put undue strain on the employee’s finances or the company’s cash flow.

- Clarify consequences of non-repayment: The policy should outline the consequences if an employee is unable or unwilling to repay the advance or loan according to the agreed-upon terms, including potential deductions from future paychecks or other legal remedies.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains in line with business practices, legal requirements, and employee needs.

Benefits of using this pay advances and loan policy (Montana)

This policy provides several key benefits for Montana businesses:

- Supports employee financial well-being: Offering pay advances or loans can help employees manage unexpected financial challenges, increasing job satisfaction and reducing stress.

- Reduces the risk of misunderstandings: A clear policy ensures both the employer and employee understand the terms and conditions of any loan or advance, preventing conflicts and confusion over repayment.

- Protects the business’s financial interests: By setting clear limits and repayment schedules, the policy helps ensure that pay advances or loans do not put the business’s cash flow or financial stability at risk.

- Increases transparency and fairness: The policy promotes fairness by ensuring all employees are subject to the same terms and conditions when requesting pay advances or loans, preventing favoritism or discrimination.

- Encourages responsible borrowing: The policy helps employees make informed decisions about borrowing by setting reasonable limits and encouraging them to repay the advances or loans in a timely manner.

Tips for using this pay advances and loan policy (Montana)

- Communicate the policy clearly: Ensure that all employees are aware of the policy, including how to request pay advances or loans, the eligibility criteria, and the repayment terms.

- Be transparent about interest and fees: If interest or fees are charged on loans or advances, make sure employees understand these costs upfront and are aware of how they will affect the total repayment amount.

- Monitor repayment schedules: Regularly track the repayment of loans or advances to ensure that payments are being made on time. If an employee misses a payment, address the issue promptly to prevent further complications.

- Consider financial counseling: Consider offering employees access to financial counseling or resources to help them manage their finances and avoid needing pay advances or loans in the future.

- Review and update the policy regularly: Regularly review the policy to ensure it is still aligned with the company’s financial objectives, legal requirements, and employee needs.