Pay advances and loan policy (Nebraska): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Nebraska)

A pay advances and loan policy helps Nebraska businesses establish clear guidelines for providing financial assistance to employees in the form of pay advances or loans. This policy is designed to support employees during times of financial need while maintaining transparency, fairness, and accountability. Tailored to Nebraska’s workforce, this policy reflects the state’s values of community support and employee well-being.

By implementing this policy, businesses in Nebraska can foster trust, improve employee morale, and provide a structured approach to handling financial assistance requests.

How to use this pay advances and loan policy (Nebraska)

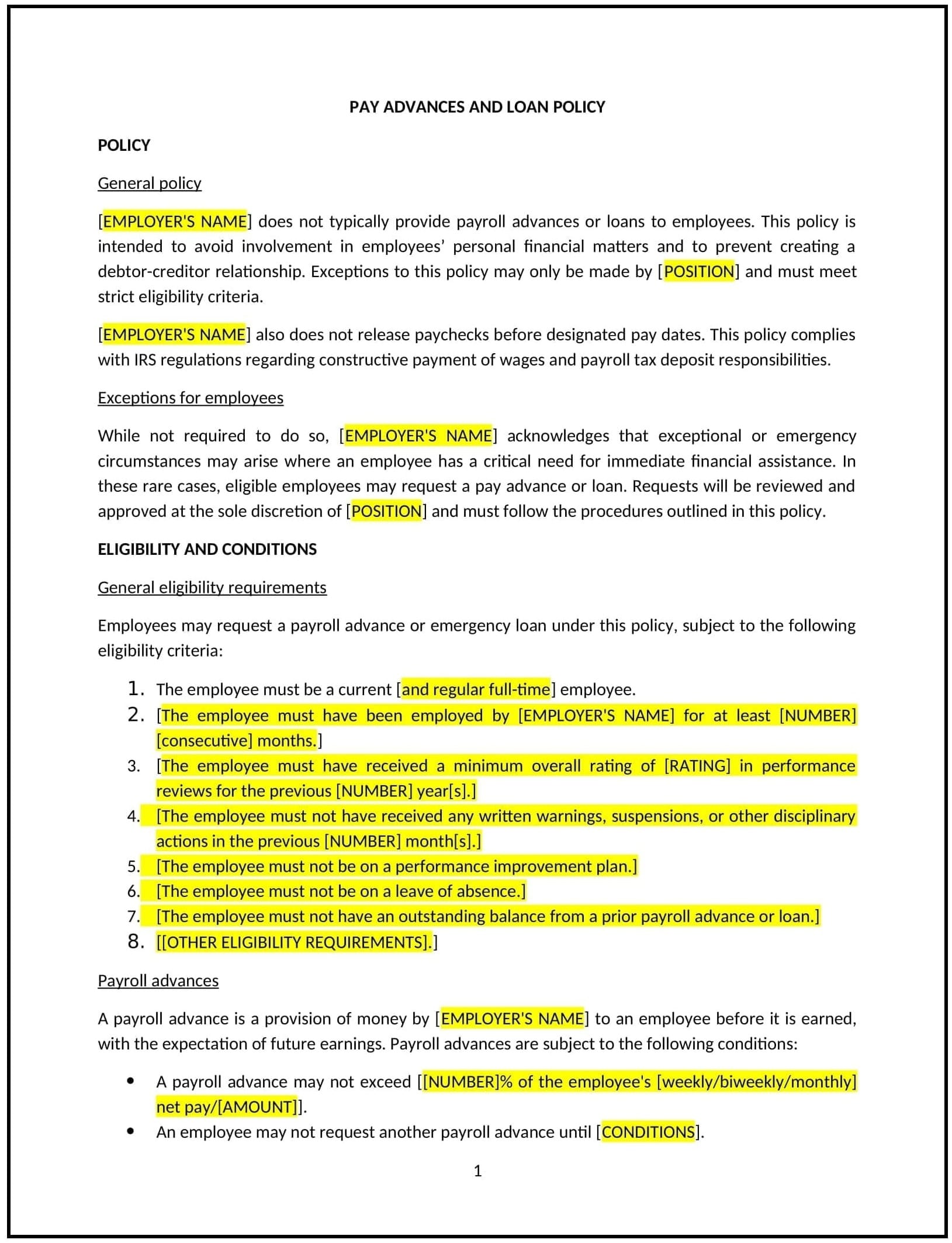

- Define pay advances and loans: Clearly explain the difference between pay advances (short-term advances on earned wages) and loans (longer-term financial assistance).

- Establish eligibility criteria: Specify which employees are eligible for pay advances or loans, such as full-time or part-time staff with a minimum tenure.

- Set limits: Outline the maximum amount employees can request as a pay advance or loan, ensuring it aligns with the business’s financial capacity.

- Create a repayment plan: Provide guidelines for repayment, including timelines, deductions from payroll, and any applicable interest or fees.

- Develop an approval process: Define the steps employees must follow to request financial assistance, including documentation and approval workflows.

- Communicate the policy: Share the policy with employees during onboarding and through internal communications to ensure awareness and understanding.

- Train managers: Educate supervisors on how to handle pay advance and loan requests fairly and consistently.

- Monitor and enforce the policy: Regularly review requests and repayments to ensure compliance with the policy and address any issues promptly.

- Review and update the policy: Periodically assess the policy’s effectiveness and make adjustments as needed to reflect changes in business needs or employee feedback.

Benefits of using this pay advances and loan policy (Nebraska)

This policy offers several advantages for Nebraska businesses:

- Supports employee well-being: Providing financial assistance can help employees manage unexpected expenses and reduce financial stress.

- Improves morale: A supportive policy demonstrates the business’s commitment to employee welfare, boosting morale and loyalty.

- Enhances workplace culture: Transparent and fair guidelines foster trust and respect between employees and management.

- Aligns with Nebraska values: The policy reflects the state’s emphasis on community support and mutual assistance.

- Reduces turnover: Employees are more likely to stay with a business that supports them during challenging times.

- Provides structure: Clear guidelines ensure that financial assistance is handled consistently and responsibly.

- Builds trust: A formal policy demonstrates transparency and accountability in managing employee financial needs.

Tips for using this pay advances and loan policy (Nebraska)

- Communicate the policy effectively: Share the policy with employees during onboarding and through regular reminders, such as emails or training sessions.

- Provide training: Educate managers on how to handle pay advance and loan requests fairly and consistently.

- Set clear limits: Define reasonable limits for pay advances and loans to protect the business’s financial stability.

- Document requests: Maintain records of all pay advance and loan requests, approvals, and repayments to ensure accountability.

- Offer flexibility: Consider allowing employees to repay loans through payroll deductions over a manageable period.

- Monitor repayments: Regularly review repayment schedules to ensure employees are meeting their obligations.

- Review the policy periodically: Update the policy as needed to reflect changes in business needs, employee feedback, or legal requirements.