Pay advances and loan policy (Nevada): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Nevada)

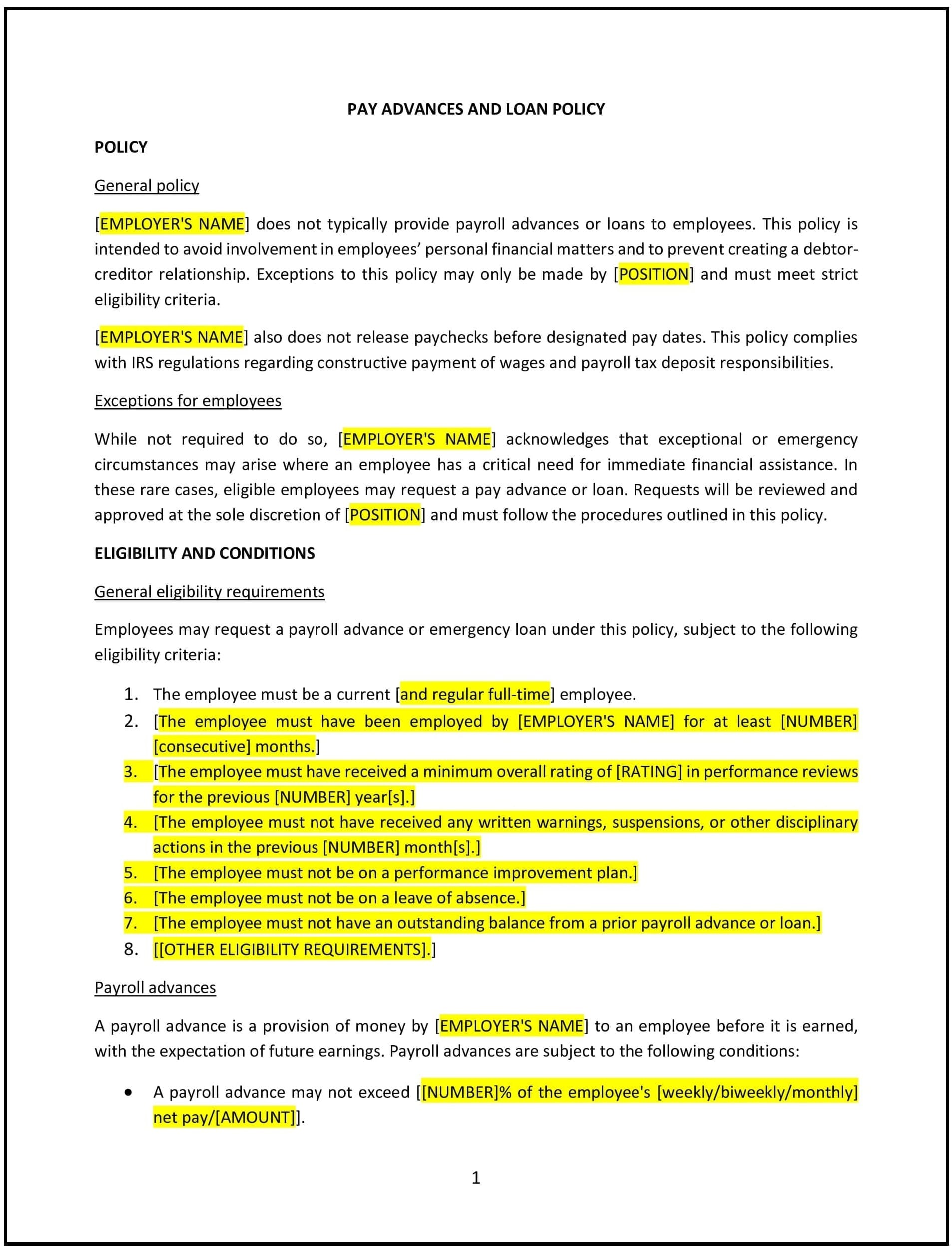

This pay advances and loan policy is designed to help Nevada businesses manage employee requests for financial assistance in the form of pay advances or company-provided loans. It establishes guidelines for eligibility, approval, repayment, and compliance with state and federal laws to ensure fairness and transparency.

By adopting this policy, businesses can support employees facing financial challenges while protecting the company’s financial interests.

How to use this pay advances and loan policy (Nevada)

- Define eligibility: Specify the criteria employees must meet to qualify for a pay advance or loan, such as employment tenure or financial need.

- Set limits on advances and loans: Outline the maximum amount employees can request as an advance or loan, ensuring it aligns with company resources and legal guidelines.

- Establish approval procedures: Detail the process for requesting an advance or loan, including submitting a formal request to HR or management for review and approval.

- Outline repayment terms: Specify repayment conditions, including repayment schedules, methods (e.g., payroll deductions), and any applicable interest rates or fees.

- Include confidentiality provisions: Emphasize that all requests for advances or loans will be handled confidentially to protect employee privacy.

- Address tax and compliance requirements: Ensure that advances and loans comply with Nevada and federal laws, including tax reporting obligations.

- Prohibit repeated or excessive requests: Set limits on the frequency of pay advances or loans to maintain financial stability for both the company and employees.

- Include default and recovery measures: Outline the steps the company will take if an employee fails to repay the advance or loan, such as withholding final paychecks or other legal actions.

Benefits of using this pay advances and loan policy (Nevada)

This policy provides several benefits for Nevada businesses:

- Supports employee well-being: Offers a structured way to provide financial assistance to employees in times of need.

- Ensures fairness: Establishes consistent guidelines for evaluating and approving requests.

- Protects company finances: Maintains financial stability by setting limits on advances and loans and ensuring timely repayments.

- Reduces workplace stress: Helps employees address financial emergencies, promoting productivity and morale.

- Complies with legal requirements: Aligns with state and federal regulations, reducing the risk of legal or tax-related issues.

Tips for using this pay advances and loan policy (Nevada)

- Communicate the policy: Ensure all employees understand the policy and the process for requesting advances or loans.

- Train managers and HR: Provide training to ensure consistent and fair evaluation of requests, including assessing financial need and compliance with company guidelines.

- Monitor repayment schedules: Track repayments to ensure timely compliance and avoid potential conflicts or disputes.

- Maintain confidentiality: Protect employee privacy by handling requests and repayment details discreetly.

- Update as needed: Review the policy periodically to reflect changes in company financial practices, employee needs, or legal requirements.