Pay advances and loan policy (New Hampshire): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (New Hampshire)

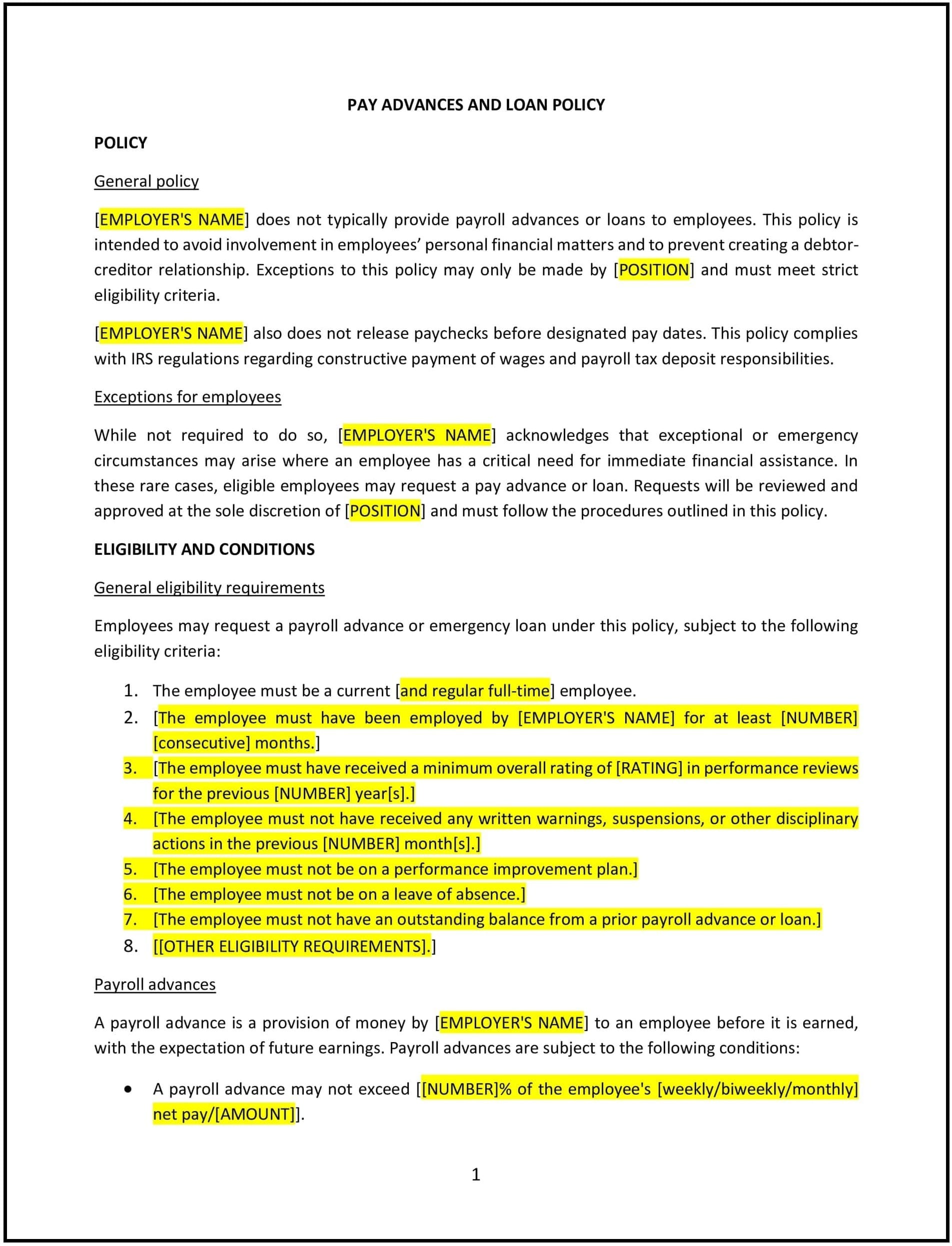

A pay advances and loan policy helps New Hampshire businesses establish clear guidelines for when and how employees can request financial assistance through pay advances or company loans. This policy provides transparency around the process, the eligibility criteria, repayment terms, and any potential interest or fees associated with such advances.

By implementing this policy, businesses can offer financial support to employees in need, while maintaining consistency and protecting the company's financial interests.

How to use this pay advances and loan policy (New Hampshire)

- Define pay advances and loans: Clearly define what constitutes a pay advance and a loan, including the difference between the two, such as advances being temporary amounts paid against future earnings and loans being amounts borrowed with repayment terms.

- Set eligibility criteria: Specify which employees are eligible for pay advances or loans, considering factors such as length of employment, job performance, and financial need.

- Establish request procedures: Outline the process employees must follow to request a pay advance or loan, including required documentation, notice period, and approval process.

- Define repayment terms: Specify how and when repayment will occur, including any payroll deductions, the repayment schedule, and any interest or fees charged. Be clear about whether the repayment will occur through regular payroll deductions or other arrangements.

- Set limits on amounts: Define the maximum amount an employee can borrow or receive as an advance to prevent financial strain on the business and ensure fairness across all employees.

- Address non-repayment: Clearly state the actions that will be taken if an employee fails to repay the loan or advance, including deductions from final paychecks, collection processes, or other consequences.

- Offer alternatives: Provide information about other financial assistance options, such as employee assistance programs (EAPs), in case employees are not eligible for a pay advance or loan.

- Review and update: Regularly review the policy to ensure it is in line with any changes in business practices, legal requirements, or employee needs.

Benefits of using this pay advances and loan policy (New Hampshire)

This policy offers several benefits for New Hampshire businesses:

- Provides financial support: The policy offers employees a structured way to access financial support during times of need, which can help reduce stress and improve employee well-being.

- Reduces ambiguity: Clear guidelines on when and how employees can request pay advances or loans helps ensure consistency and fairness in decision-making, reducing the likelihood of misunderstandings or disputes.

- Protects the business: The policy protects the company’s financial interests by setting clear repayment terms, limits on amounts, and consequences for non-repayment.

- Promotes employee retention: By offering assistance in times of financial need, businesses can demonstrate care for employees, leading to improved loyalty and retention.

- Supports budgeting: Clear repayment terms and set amounts help businesses manage their cash flow and reduce the risk of financial strain.

Tips for using this pay advances and loan policy (New Hampshire)

- Communicate the policy clearly: Ensure that all employees are aware of the pay advances and loan policy, especially new hires, so they understand the process and eligibility criteria from the start.

- Be transparent with repayment terms: Clearly communicate repayment terms upfront to avoid confusion, including the duration of repayment and whether any interest or fees apply.

- Ensure fair and consistent treatment: Apply the policy consistently to all eligible employees, ensuring that decisions about pay advances or loans are made equitably.

- Review financial health regularly: Regularly assess whether the company can continue offering pay advances or loans based on the overall financial health of the business.

- Provide alternative resources: Make employees aware of other resources, such as employee assistance programs (EAPs) or financial counseling, to help them manage financial stress.