Pay advances and loan policy (New Jersey): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (New Jersey)

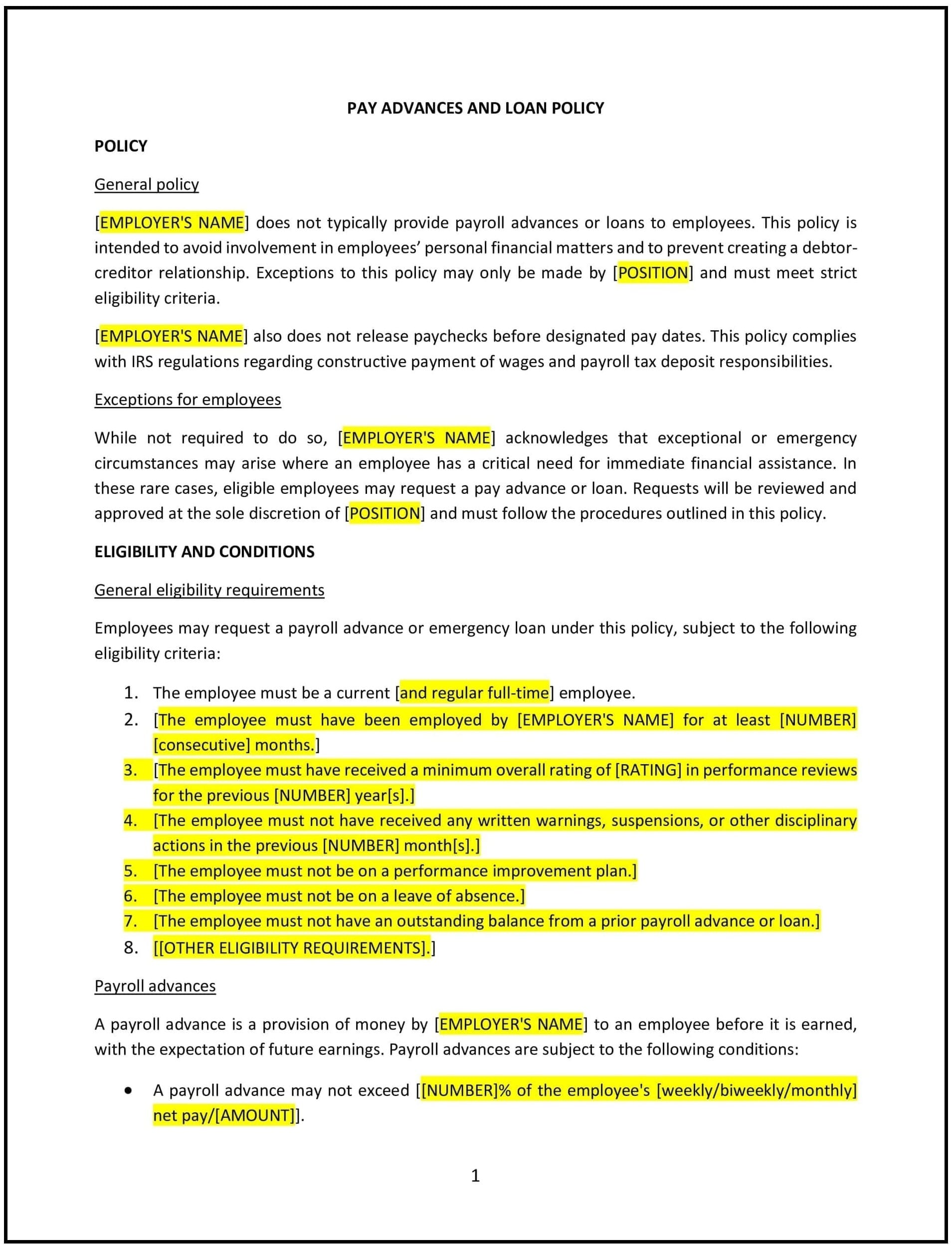

A pay advances and loan policy helps New Jersey businesses manage the practice of providing financial assistance to employees in the form of pay advances or loans. This policy outlines eligibility, repayment terms, the application process, and any associated fees or interest. It also defines the circumstances under which pay advances and loans are granted, ensuring fair and consistent treatment for all employees.

By adopting this policy, businesses in New Jersey can assist employees facing financial difficulties while safeguarding the company’s financial interests and ensuring clear expectations around repayment.

How to use this pay advances and loan policy (New Jersey)

- Define eligibility criteria: Establish guidelines for which employees are eligible to request pay advances or loans, such as tenure, employment status, and financial need.

- Set the maximum advance or loan amount: Specify the limits on how much an employee can request based on their salary and business policy.

- Outline the application process: Require employees to submit formal requests, providing information about the purpose of the advance or loan and the repayment plan.

- Establish repayment terms: Set clear terms for repayment, including payroll deductions, repayment schedules, and interest rates (if applicable).

- Specify approval procedures: Define the process for managers or HR to review and approve or deny pay advance or loan requests.

- Address late payments or defaults: Provide consequences for employees who fail to meet repayment terms, including deductions from future wages or other legal actions.

- Communicate the policy clearly: Ensure that employees are aware of the policy and understand the terms of any pay advances or loans they receive.

- Review and update: Regularly assess the policy to reflect changes in legal requirements, employee needs, and business practices.

Benefits of using this pay advances and loan policy (New Jersey)

This policy provides several benefits for New Jersey businesses:

- Provides financial support: Helps employees manage unexpected financial hardships or emergencies.

- Improves employee satisfaction: Demonstrates the company’s commitment to supporting employees during difficult times.

- Reduces financial stress: Helps employees address urgent financial needs without resorting to external loans or high-interest credit.

- Ensures clear terms: Establishes transparent expectations regarding repayment, avoiding misunderstandings.

- Protects business interests: Provides a framework for managing the risk associated with offering financial assistance to employees.

Tips for using this pay advances and loan policy (New Jersey)

- Communicate the policy clearly: Ensure employees understand the eligibility requirements, application process, and repayment terms.

- Monitor repayment: Keep track of repayment schedules and ensure timely deductions to avoid financial discrepancies.

- Offer guidance: Provide employees with information on how to manage finances and explore other support resources when necessary.

- Use discretion: Consider individual circumstances when granting loans or pay advances and apply the policy consistently.

- Review the policy regularly: Update the policy to reflect changes in state regulations, employee needs, or financial best practices.