Pay advances and loan policy (New Mexico): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (New Mexico)

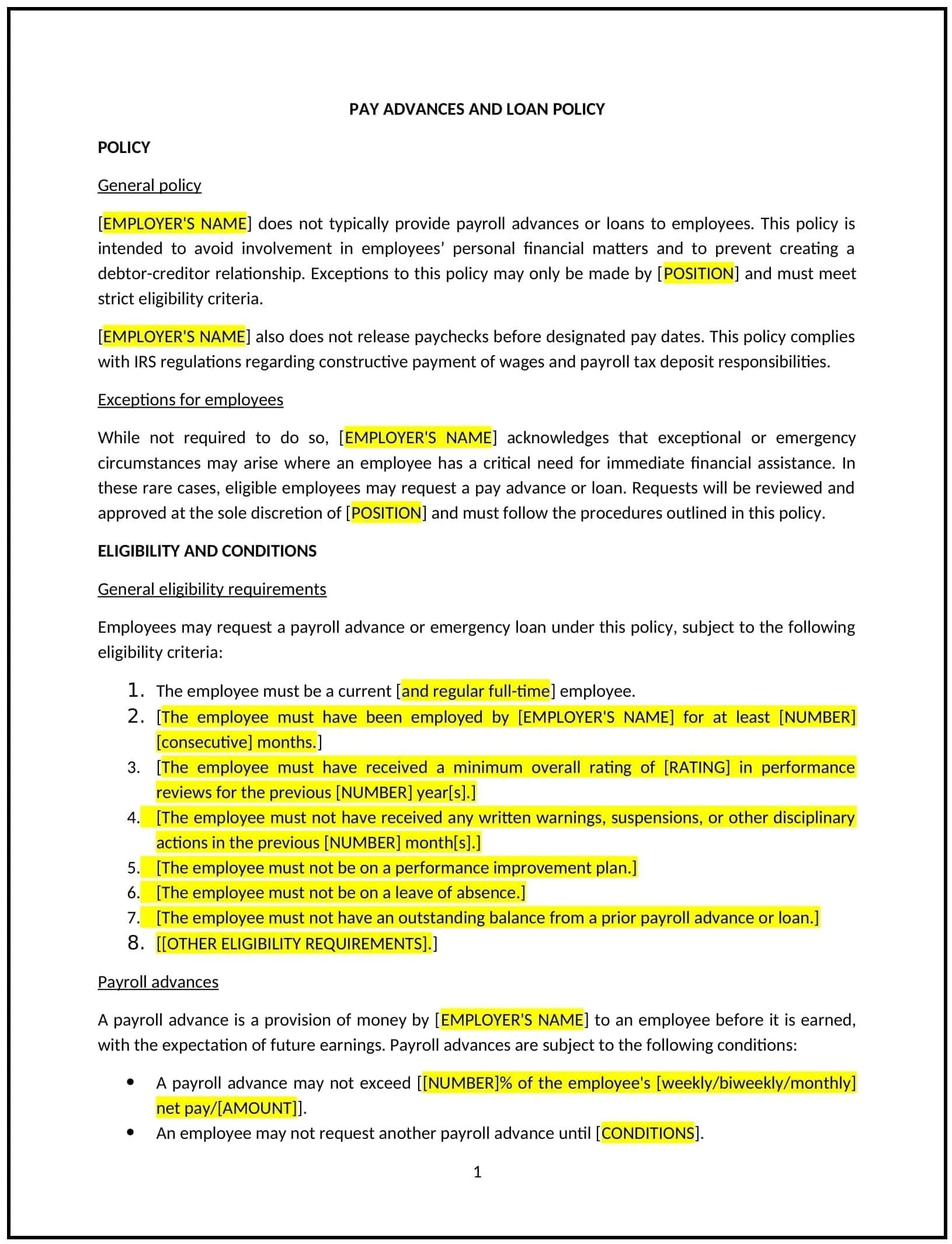

This pay advances and loan policy is designed to help New Mexico businesses manage requests for financial assistance from employees, including pay advances and loans. The policy outlines the conditions under which employees may request an advance on their wages or a loan from the company, the approval process, and the terms for repayment.

By adopting this policy, New Mexico businesses can provide a supportive financial safety net for employees during emergencies while maintaining clear expectations and protecting the company’s financial interests.

How to use this pay advances and loan policy (New Mexico)

- Define eligibility: Clearly outline the criteria for employees to request pay advances or loans. This may include factors such as length of employment, performance, and the reason for the request.

- Establish the application process: Set out the procedure for requesting a pay advance or loan, including the necessary documentation (e.g., proof of need, emergency situation) and approval steps.

- Set repayment terms: Define the repayment schedule for any advances or loans, including how deductions from future paychecks will be handled and the timeline for full repayment.

- Outline loan amounts and limits: Specify the maximum amount that can be requested for both advances and loans. The policy should make it clear that loans or advances are not intended to replace regular income but should only be used for emergency situations.

- Reflect New Mexico-specific considerations: Include any New Mexico-specific labor laws or financial regulations that apply to loans or pay advances, such as applicable interest rates or mandatory deductions from wages.

Benefits of using this pay advances and loan policy (New Mexico)

Implementing this policy provides New Mexico businesses with several advantages:

- Reduces financial strain on employees: Offering pay advances or loans can provide employees with quick access to funds in emergency situations, which can reduce stress and improve overall well-being.

- Promotes fairness and transparency: By establishing clear guidelines for pay advances and loans, businesses ensure that all employees have equal access to this benefit, helping to prevent favoritism or misunderstandings.

- Protects company interests: The policy helps businesses protect their financial interests by setting clear repayment terms and limits on the amounts that can be borrowed.

- Increases employee loyalty: By providing financial support in times of need, businesses can foster goodwill and increase employee satisfaction, leading to improved retention and engagement.

- Minimizes legal risks: Clear terms and conditions around loans and advances help businesses avoid potential legal issues related to wage garnishments, interest rates, or violations of New Mexico’s wage and labor laws.

Tips for using this pay advances and loan policy (New Mexico)

- Communicate the policy clearly: Ensure all employees understand how and when they can request pay advances or loans. The policy should be included in the employee handbook and reviewed during onboarding.

- Keep repayment terms reasonable: Set repayment schedules that are manageable for employees, ensuring that deductions from paychecks are fair and do not create financial hardship.

- Monitor employee requests: Track all pay advance or loan requests and ensure that they are handled consistently and fairly. Consider keeping records of all loan agreements, including repayment schedules and amounts.

- Be cautious of excessive loans: Monitor the number and size of loans or advances being requested to ensure that employees are not relying on these payments as a regular source of income.

- Review the policy regularly: Periodically review the policy to ensure it is aligned with New Mexico laws, company financial goals, and the needs of employees. Update the policy as necessary to address any changes in business practices or financial regulations.