Pay advances and loan policy (New York): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (New York)

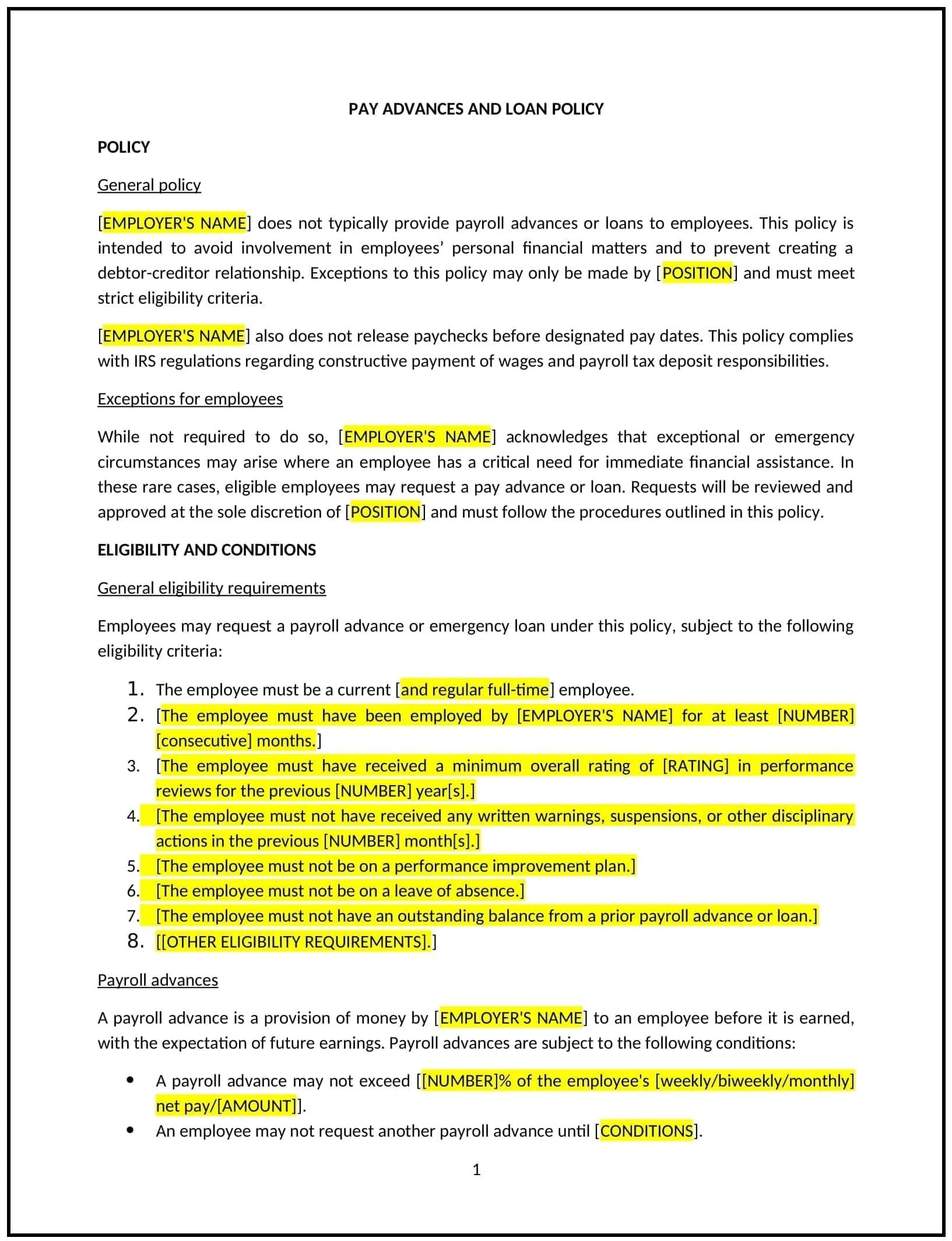

This pay advances and loan policy is designed to help New York businesses establish clear guidelines for offering pay advances or loans to employees. Whether businesses are managing cash flow, addressing employee requests for financial support, or preventing abuse, this template provides a structured approach for handling pay advances and loans.

By adopting this template, businesses can clarify their policies, ensure fairness, and minimize financial risks.

How to use this pay advances and loan policy (New York)

- Define eligibility: Clearly state the criteria for employees to qualify for pay advances or loans, including length of employment, job performance, and financial need.

- Specify loan terms: Outline the terms and conditions for pay advances or loans, such as repayment schedules, interest rates, and the maximum amount available.

- Address repayment methods: Provide clear instructions on how employees will repay advances or loans, including payroll deductions or other acceptable payment methods.

- Include approval processes: Establish procedures for requesting and approving pay advances or loans, including required documentation and points of contact.

- Detail consequences for non-repayment: Specify the actions that will be taken if an employee fails to repay a loan or advance, such as deductions from final pay or legal actions.

Benefits of using a pay advances and loan policy (New York)

This policy offers several benefits for New York businesses:

- Promotes fairness: Clear guidelines ensure that all employees have equal access to financial assistance when needed.

- Reduces financial risks: Setting clear terms and repayment processes helps mitigate the financial risk associated with advances and loans.

- Encourages transparency: Employees understand the expectations and consequences related to pay advances, reducing misunderstandings.

- Supports employee well-being: Offering financial assistance can help employees manage personal financial challenges, improving job satisfaction and retention.

- Maintains business continuity: A structured process for handling pay advances and loans helps businesses maintain proper financial controls and budgeting.

Tips for using this pay advances and loan policy (New York)

- Communicate clearly: Share the policy during onboarding and through employee handbooks to ensure employees understand how the process works.

- Review requests carefully: Evaluate each request for a pay advance or loan based on the employee’s financial need, job performance, and company policies.

- Monitor repayment schedules: Keep track of outstanding loans or advances and ensure repayment is occurring as agreed upon.

- Offer support: If repayment issues arise, engage in open discussions with employees to find mutually beneficial solutions before escalating the matter.

- Review regularly: Update the policy periodically to reflect changes in financial conditions, employee needs, or applicable laws.