Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Ohio)

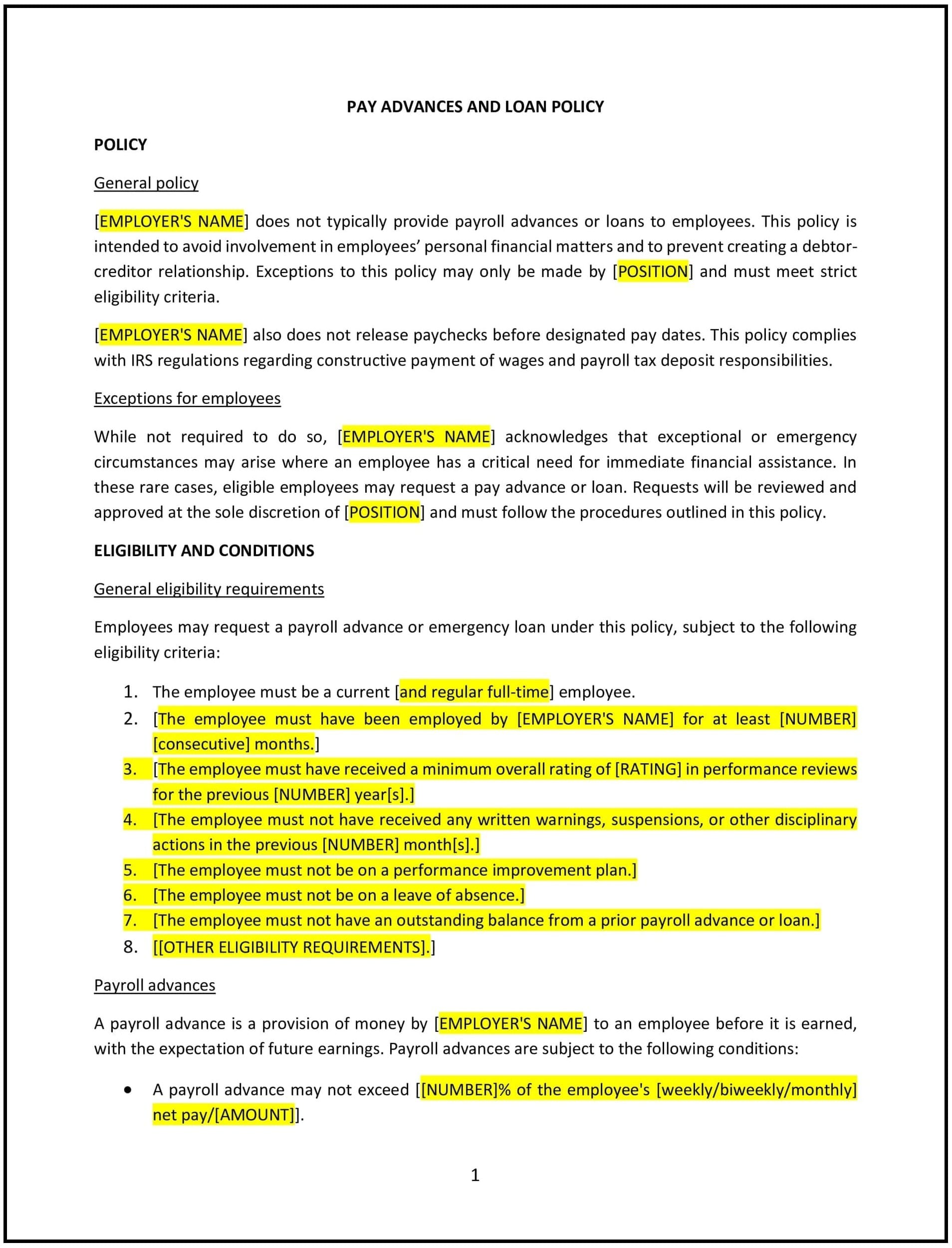

A pay advances and loan policy provides Ohio businesses with guidelines regarding the provision of pay advances or loans to employees. This policy outlines the conditions under which employees may request financial assistance, the approval process, repayment terms, and any restrictions on offering such assistance. It also addresses the circumstances under which pay advances or loans may be granted and specifies whether these are deducted from future paychecks, the repayment schedule, and any interest charges or fees that may apply.

By implementing this policy, Ohio businesses can manage financial assistance to employees fairly, ensure transparency in the process, and avoid potential misuse or confusion.

How to use this pay advances and loan policy (Ohio)

- Define eligibility criteria: The policy should outline the criteria employees must meet to qualify for a pay advance or loan. This may include the length of employment, the employee’s current financial need, and the reason for the request.

- Set limits on the amount of financial assistance: The policy should specify the maximum amount of a pay advance or loan that can be granted to an employee. It should also define any circumstances where the amount could be adjusted, such as special circumstances requiring more assistance.

- Outline the approval process: The policy should explain how employees can request a pay advance or loan, including the forms or documentation required to submit the request, and who will be responsible for approving the request (e.g., HR or management).

- Address repayment terms: The policy should specify how repayment will occur, whether it will be through payroll deductions, lump-sum payments, or other methods. It should also include the schedule and timeline for repayment, such as a fixed number of pay periods.

- Clarify interest rates or fees: If applicable, the policy should define whether interest or fees will be charged on the loan, how the interest rate is calculated, and any other associated costs.

- Address consequences for non-repayment: The policy should outline what happens if an employee is unable to repay the loan or advance according to the agreed terms, such as further deductions from future paychecks or other actions.

- Maintain transparency: The policy should ensure that all employees are aware of the process and conditions for receiving a pay advance or loan. This should include providing access to a written copy of the policy and reviewing it during onboarding.

- Review and update regularly: The policy should be reviewed periodically to ensure it remains compliant with Ohio state laws, reflects current business practices, and meets the evolving needs of the business.

Benefits of using this pay advances and loan policy (Ohio)

This policy provides several key benefits for Ohio businesses:

- Provides financial support to employees: The policy allows businesses to offer financial assistance to employees in times of need, helping to alleviate personal financial stress and improve employee satisfaction.

- Prevents misuse: By establishing clear guidelines and approval processes, the policy ensures that pay advances and loans are used appropriately and only when necessary.

- Maintains transparency: Clear repayment terms and conditions help prevent misunderstandings and ensure that employees are fully aware of their responsibilities.

- Protects the business’s financial interests: The policy helps manage the risk of non-repayment by setting out strict repayment terms and consequences for defaulting.

- Improves employee retention: Providing financial assistance when needed can strengthen employee loyalty and improve retention by demonstrating the business’s commitment to supporting its workforce.

- Enhances trust: The policy fosters trust between the business and its employees by providing a structured, transparent way to request and manage financial assistance.

- Reduces legal risk: By clearly defining the terms and conditions of pay advances and loans, the policy helps the business comply with Ohio state laws and reduces the risk of legal challenges related to financial transactions.

Tips for using this pay advances and loan policy (Ohio)

- Communicate the policy clearly: Ensure that all employees are aware of the pay advances and loan policy by including it in the employee handbook, reviewing it during onboarding, and regularly reminding employees about the process.

- Evaluate requests on a case-by-case basis: Ensure that requests for pay advances or loans are evaluated fairly and consistently, considering the employee’s financial need, work history, and any other relevant factors.

- Set clear repayment terms: Be transparent with employees about how repayment will occur, including the amount deducted from each paycheck and the repayment timeline. This clarity helps prevent misunderstandings later on.

- Maintain proper documentation: Keep accurate records of all pay advances and loans, including the amount granted, repayment terms, and any interest or fees charged. This documentation will be useful for tracking payments and managing any disputes.

- Monitor for potential abuse: While pay advances and loans can be helpful, the policy should also be designed to prevent frequent requests from the same employees, which could indicate potential financial mismanagement or abuse of the system.

- Review regularly: Regularly review the policy to ensure it is aligned with Ohio state laws, the company’s financial practices, and any changes in employee needs or expectations.