Pay advances and loan policy (Oklahoma): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Oklahoma)

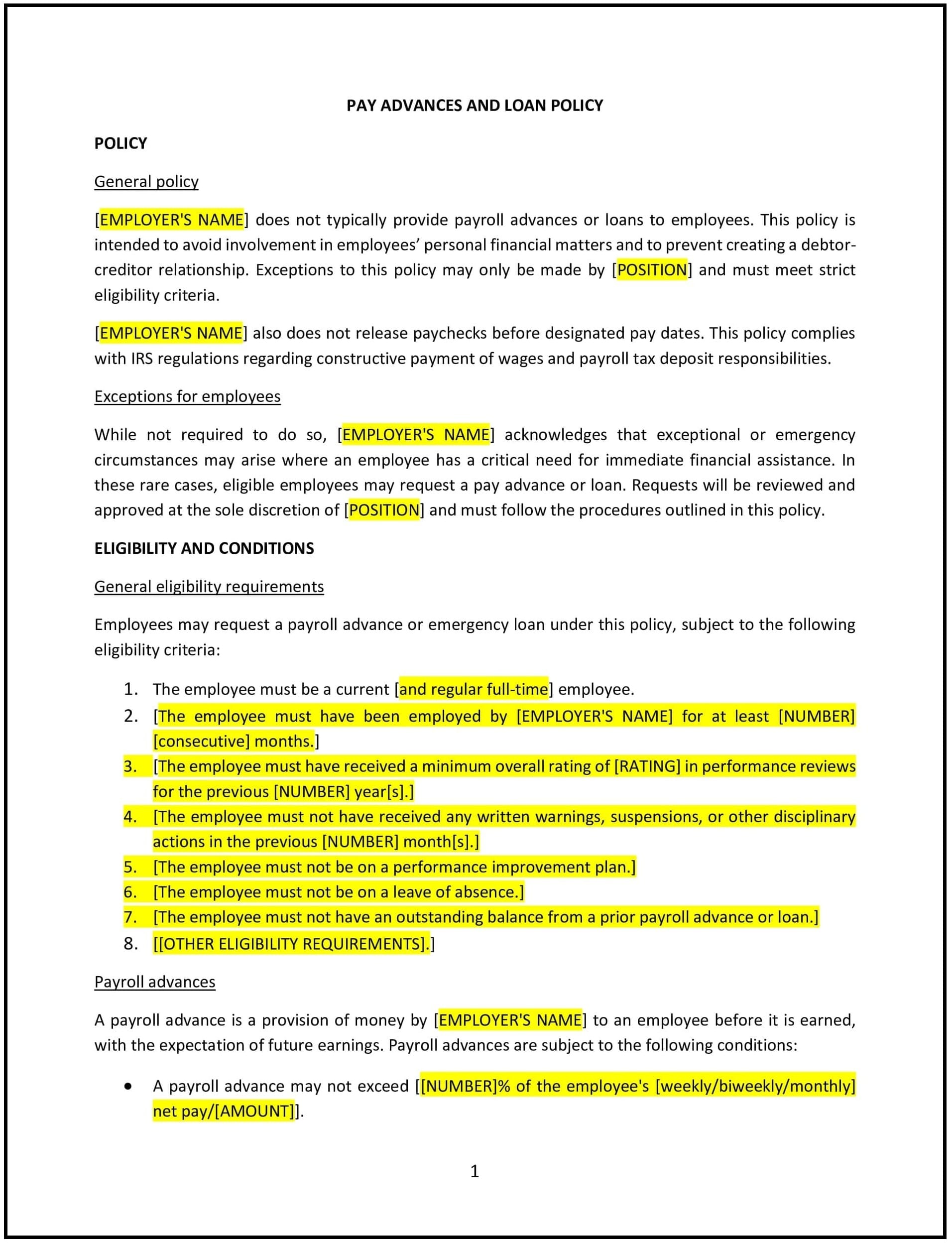

This pay advances and loan policy is designed to help Oklahoma businesses establish guidelines for providing financial assistance to employees in the form of pay advances or loans. It outlines eligibility, repayment terms, and procedures for requesting assistance.

By adopting this policy, businesses can support employees during financial hardships while maintaining clear and fair procedures.

How to use this pay advances and loan policy (Oklahoma)

- Define eligibility: Specify which employees are eligible for pay advances or loans, such as full-time or long-term staff.

- Outline types of assistance: Describe the types of financial assistance available, such as pay advances against earned wages or small loans.

- Establish request procedures: Provide steps for employees to request assistance, including required documentation and approval processes.

- Address repayment terms: Explain how and when the advance or loan will be repaid, such as through payroll deductions.

- Set limits: Specify the maximum amount that can be advanced or loaned and the frequency of requests.

- Train managers: Educate supervisors on handling assistance requests and ensuring consistency.

- Review and update: Assess the policy annually to ensure it aligns with evolving workplace needs and financial practices.

Benefits of using this pay advances and loan policy (Oklahoma)

This policy offers several advantages for Oklahoma businesses:

- Supports employees: Provides financial assistance to employees during times of need, improving morale and loyalty.

- Enhances trust: Demonstrates a commitment to supporting employees’ well-being.

- Reduces stress: Helps employees manage financial challenges, reducing distractions and improving productivity.

- Promotes fairness: Ensures consistent and transparent procedures for providing financial assistance.

- Mitigates risks: Reduces the likelihood of misunderstandings or disputes related to pay advances or loans.

Tips for using this pay advances and loan policy (Oklahoma)

- Communicate clearly: Ensure all employees understand the policy and their eligibility for financial assistance.

- Provide training: Educate managers on handling assistance requests and maintaining consistency.

- Monitor usage: Track pay advances and loans to ensure compliance with the policy and identify trends.

- Encourage financial literacy: Offer resources or workshops to help employees manage their finances effectively.

- Update regularly: Review the policy annually to ensure it remains effective and aligned with business needs.