Pay advances and loan policy (Pennsylvania): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Pennsylvania)

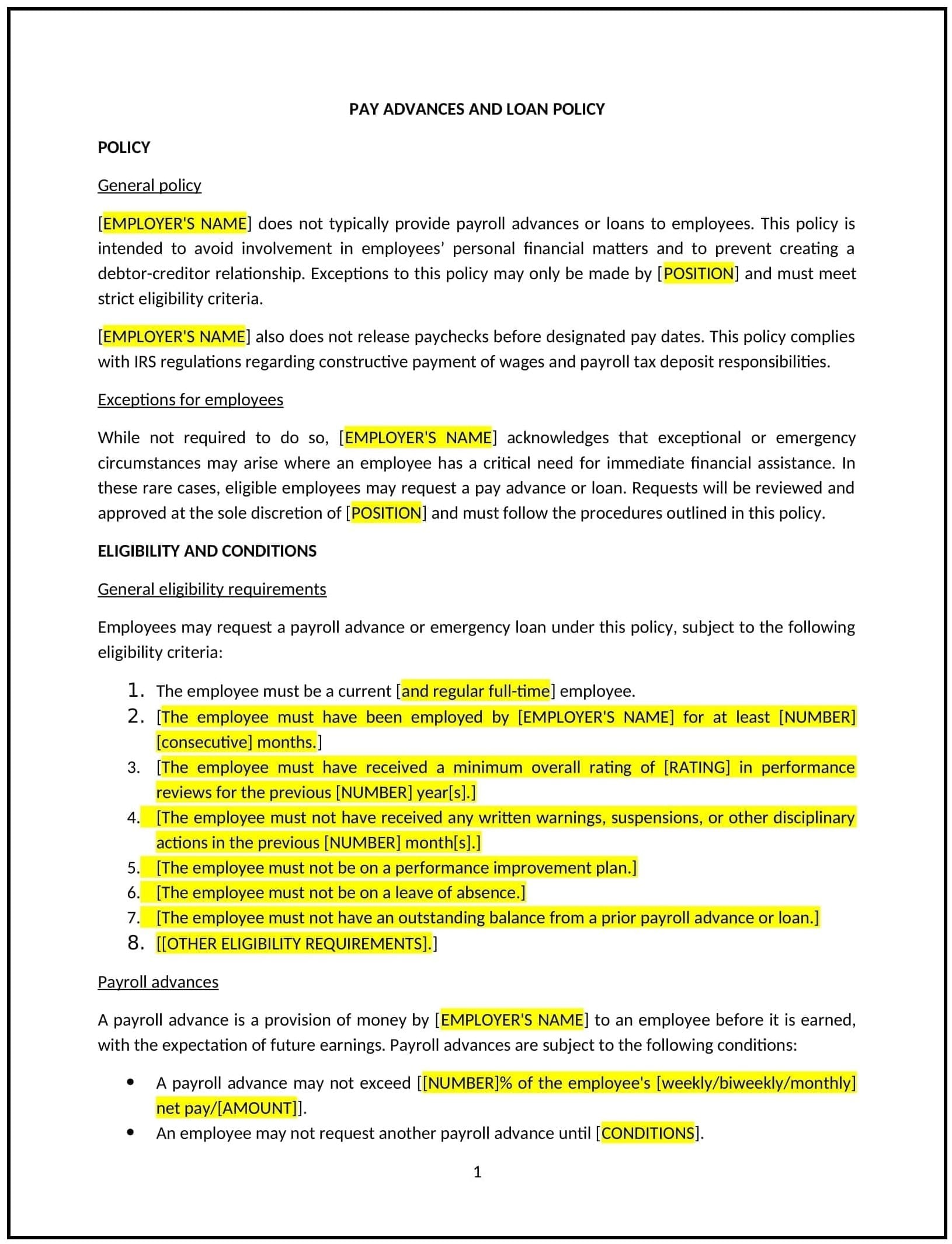

This pay advances and loan policy is designed to help businesses in Pennsylvania provide clear guidelines for offering employees financial support through pay advances or short-term loans. Whether addressing unexpected expenses, emergencies, or financial hardships, this template ensures transparency and consistency while aligning with Pennsylvania labor laws.

By using this template, businesses can support employee well-being, promote fairness, and manage financial risks effectively.

How to use this pay advances and loan policy (Pennsylvania)

- Define eligibility: Clearly specify which employees are eligible for pay advances or loans, including criteria such as employment status and tenure.

- Outline application procedures: Provide steps for employees to request financial assistance, including forms, required documentation, and submission timelines.

- Set repayment terms: Detail how advances or loans will be repaid, such as through payroll deductions, and include timelines for repayment.

- Include limits and conditions: Specify limits on the amount that can be requested and any restrictions on the frequency of requests.

- Reflect Pennsylvania-specific considerations: Tailor the policy to comply with state labor laws, such as ensuring voluntary repayment agreements and adherence to wage payment regulations.

Benefits of using a pay advances and loan policy (Pennsylvania)

A well-structured pay advances and loan policy supports employee well-being and organizational consistency. Here's how it helps:

- Supports employee well-being: Provides financial assistance to employees during emergencies or unforeseen circumstances.

- Promotes fairness: Establishes transparent and consistent guidelines for offering financial support to employees.

- Reduces financial risks: Includes repayment terms and conditions to protect the business from financial losses.

- Encourages accountability: Ensures employees understand their responsibilities when requesting pay advances or loans.

- Aligns with local needs: Reflects Pennsylvania labor laws and workplace dynamics, ensuring compliance and relevance.

Tips for using a pay advances and loan policy (Pennsylvania)

- Communicate the policy: Share the policy with employees during onboarding and make it accessible for reference when financial assistance is needed.

- Use written agreements: Require employees to sign written agreements outlining repayment terms and conditions for pay advances or loans.

- Monitor usage: Track pay advances and loans to ensure requests align with the policy’s guidelines and limits.

- Protect confidentiality: Handle employee requests and financial information with discretion to maintain privacy and trust.

- Review periodically: Update the policy to reflect changes in Pennsylvania labor laws, workplace practices, or financial regulations.