Pay advances and loan policy (Tennessee): Free template

Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

Pay advances and loan policy (Tennessee)

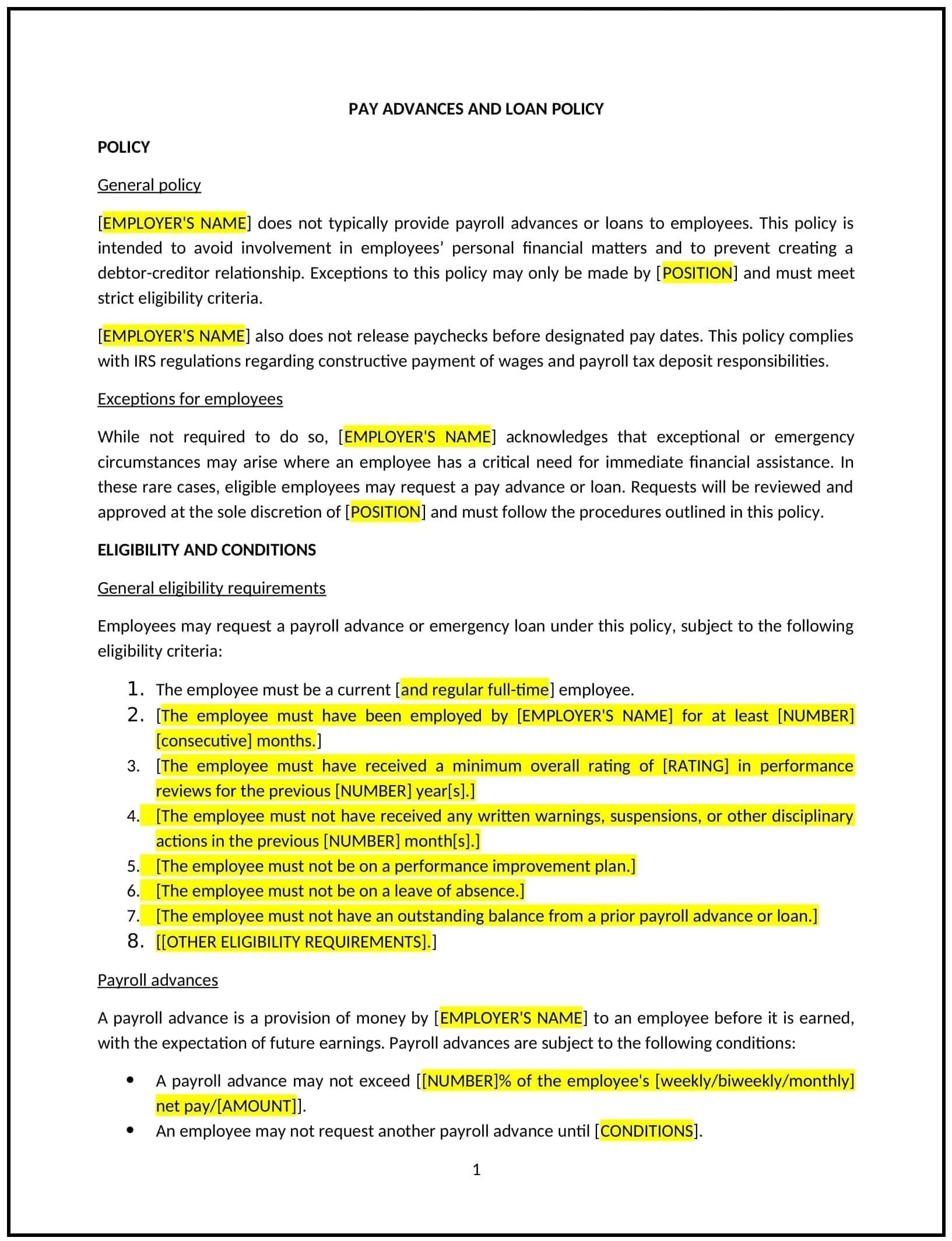

This pay advances and loan policy is designed to help Tennessee businesses establish guidelines for providing employees with pay advances or loans. It outlines procedures for requesting, approving, and repaying advances or loans to ensure fairness and financial responsibility.

By adopting this policy, businesses can support employees in financial need while maintaining clear boundaries and accountability.

How to use this pay advances and loan policy (Tennessee)

- Define eligibility: Specify which employees are eligible for pay advances or loans, such as full-time staff with a minimum tenure.

- Set request procedures: Provide steps for employees to request advances or loans, including required documentation and approvals.

- Address repayment terms: Outline how and when advances or loans will be repaid, such as through payroll deductions.

- Establish limits: Specify the maximum amount that can be advanced or loaned to an employee.

- Train managers: Educate supervisors on handling advance or loan requests and maintaining financial accountability.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and financial practices.

Benefits of using this pay advances and loan policy (Tennessee)

This policy offers several advantages for Tennessee businesses:

- Supports employees: Provides financial assistance to employees in need, fostering goodwill and loyalty.

- Maintains accountability: Ensures clear repayment terms and limits to protect the business’s financial interests.

- Enhances transparency: Provides clear guidelines for employees and managers regarding pay advances or loans.

- Reduces risks: Minimizes the potential for disputes or financial losses related to unpaid advances or loans.

- Aligns with best practices: Encourages a structured approach to managing employee financial assistance.

Tips for using this pay advances and loan policy (Tennessee)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate managers on handling advance or loan requests and maintaining financial accountability.

- Monitor compliance: Regularly review advance or loan requests and repayments to ensure adherence.

- Address issues promptly: Take corrective action if advances or loans are mishandled or unpaid.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs.