Got contracts to review? While you're here for policies, let Cobrief make contract review effortless—start your free review now.

Customize this template for free

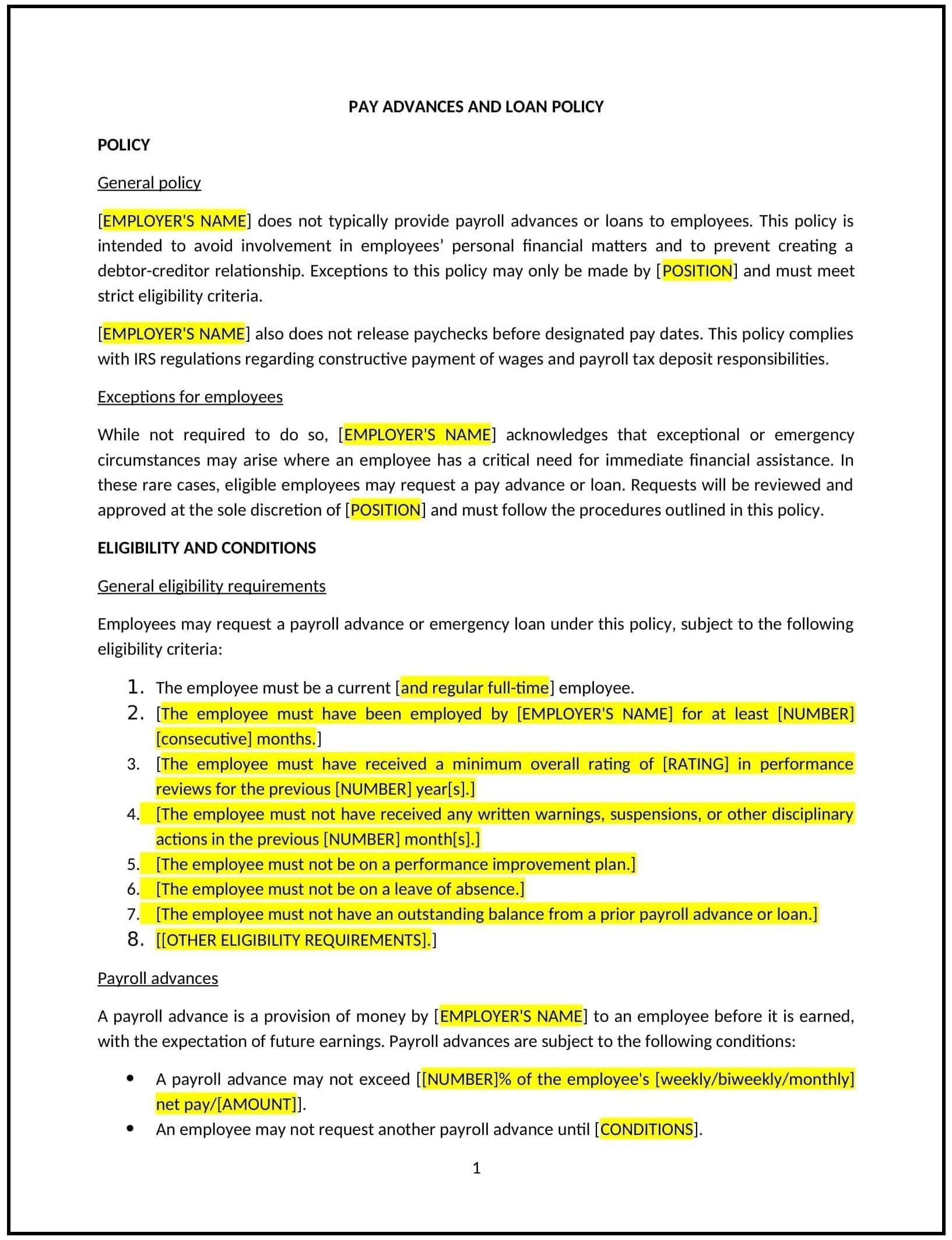

Pay advances and loan policy (Utah)

This pay advances and loan policy is designed to help Utah businesses establish guidelines for providing employees with pay advances or loans. It outlines procedures for requesting, approving, and repaying advances or loans to ensure fairness and financial responsibility.

By adopting this policy, businesses can support employees in financial need, maintain transparency, and align with general best practices for financial management.

How to use this pay advances and loan policy (Utah)

- Define pay advances and loans: Explain what constitutes a pay advance or loan and the differences between the two.

- Establish eligibility criteria: Specify which employees are eligible for pay advances or loans, such as full-time or part-time staff.

- Set limits: Define the maximum amount employees can request as a pay advance or loan.

- Outline request procedures: Provide steps for employees to request pay advances or loans, including required documentation.

- Address repayment terms: Specify the repayment schedule, interest rates (if applicable), and consequences for non-repayment.

- Train managers: Educate supervisors on handling pay advance or loan requests and maintaining financial records.

- Review and update: Assess the policy annually to ensure it aligns with evolving business needs and financial practices.

Benefits of using this pay advances and loan policy (Utah)

This policy offers several advantages for Utah businesses:

- Supports employees: Provides financial assistance to employees in need, enhancing morale and loyalty.

- Maintains transparency: Ensures clear guidelines for requesting, approving, and repaying pay advances or loans.

- Aligns with best practices: Offers a structured approach to managing employee pay advances or loans.

- Reduces financial risks: Minimizes the potential for disputes or losses related to unpaid advances or loans.

- Enhances trust: Demonstrates a commitment to supporting employees during financial challenges.

Tips for using this pay advances and loan policy (Utah)

- Communicate the policy: Share the policy with employees and include it in the employee handbook.

- Provide training: Educate managers on handling pay advance or loan requests and maintaining financial records.

- Monitor compliance: Regularly review pay advance or loan requests to ensure adherence to the policy.

- Address issues promptly: Take corrective action if repayments are missed or disputes arise.

- Update regularly: Assess the policy annually to ensure it aligns with evolving business needs and financial practices.