Pay advances and loan policy (Vermont): Free template

Pay advances and loan policy (Vermont)

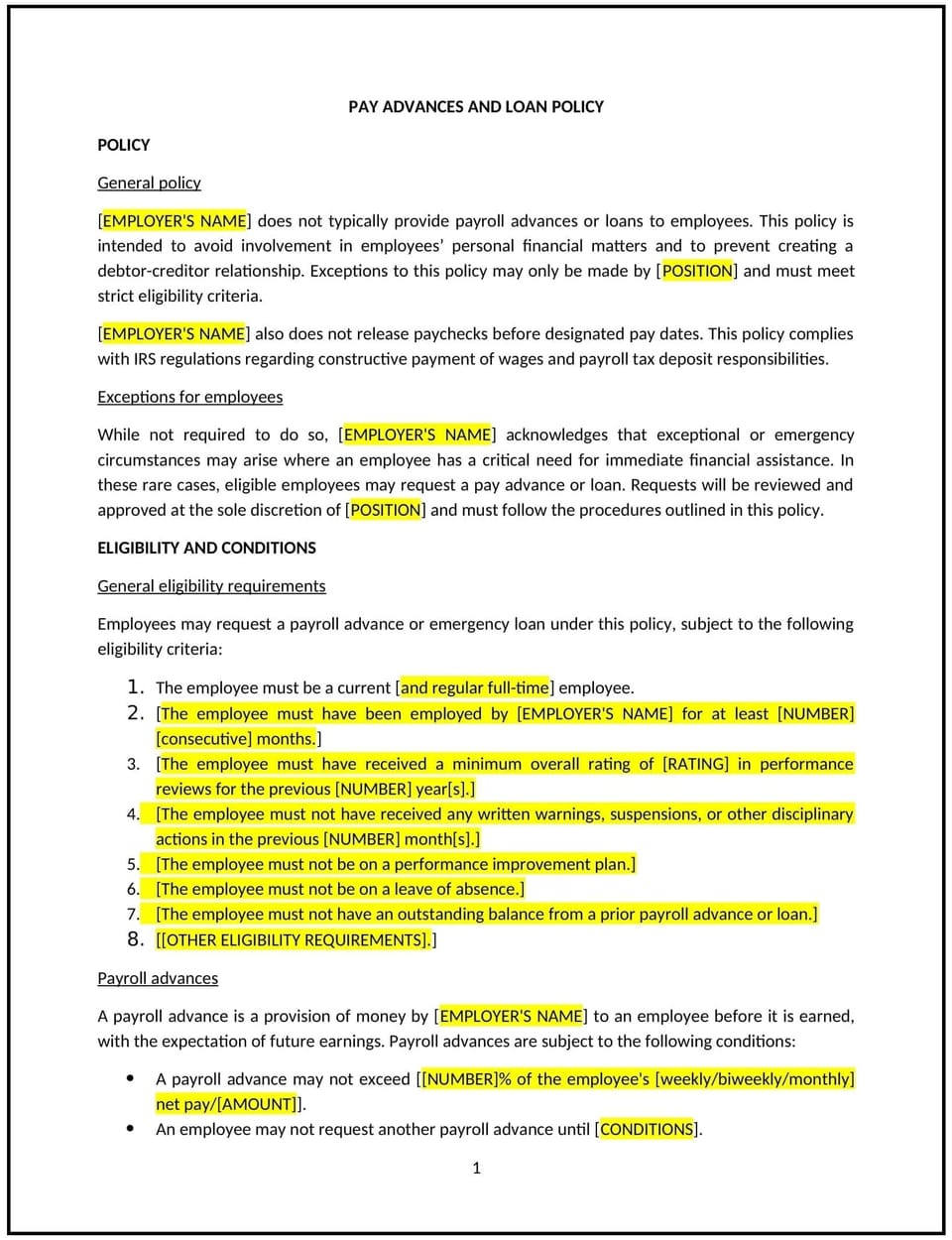

This pay advances and loan policy is designed to help Vermont businesses establish guidelines for offering financial support to employees through salary advances or company-provided loans. It outlines eligibility, repayment terms, and approval processes while supporting compliance with Vermont labor laws and company practices.

By adopting this policy, businesses can provide employees with financial flexibility while managing risks and maintaining transparency.

How to use this pay advances and loan policy (Vermont)

- Define eligibility: Specify which employees are eligible for pay advances or loans, such as those with a certain length of service or in good standing.

- Include application procedures: Outline steps for employees to request an advance or loan, including required documentation and the reason for the request.

- Address approval processes: Detail the criteria and authority for approving requests, such as HR or management review.

- Clarify repayment terms: Provide clear terms for repayment, including timelines, deduction methods, and consequences for missed payments.

- Emphasize confidentiality: Ensure that all financial assistance requests and approvals are handled confidentially.

- Include limits and restrictions: Specify maximum amounts for advances or loans and any restrictions, such as frequency of requests.

- Monitor compliance: Regularly review the policy and practices to align with Vermont laws and workplace standards.

Benefits of using this pay advances and loan policy (Vermont)

This policy provides several benefits for Vermont businesses:

- Supports employee well-being: Offers financial flexibility for employees facing unexpected expenses or emergencies.

- Promotes transparency: Establishes clear and consistent guidelines for financial assistance requests.

- Enhances compliance: Aligns with Vermont labor laws, reducing legal risks.

- Manages risks: Mitigates potential financial losses through defined repayment terms and approval processes.

- Builds trust: Demonstrates the company’s commitment to supporting employees during financial challenges.

Tips for using this pay advances and loan policy (Vermont)

- Communicate the policy: Share the policy with employees and include it in the employee handbook or internal resources.

- Educate managers: Train managers on the process for reviewing and approving financial assistance requests.

- Maintain documentation: Keep detailed records of all advances and loans, including agreements and repayment schedules.

- Encourage responsible use: Highlight that financial assistance is intended for genuine emergencies or critical needs.

- Update regularly: Revise the policy to reflect changes in Vermont laws, workplace practices, or employee needs.

Q: Why should businesses offer pay advances or loans?

A: Providing financial assistance can help employees manage unexpected expenses, improve morale, and reduce workplace stress.

Q: What criteria should businesses use to approve requests?

A: Requests should be evaluated based on the employee’s tenure, reason for the request, and the company’s ability to provide financial assistance.

Q: How should repayment terms be structured?

A: Repayment terms should be clear and manageable, typically involving payroll deductions over an agreed-upon period, with no interest or fees unless specified.

Q: What risks do businesses face in offering financial assistance?

A: Risks include potential non-repayment, administrative burden, and promoting compliance with Vermont labor laws. These risks can be mitigated with proper documentation and approval processes.

Q: Can businesses set limits on the amount of financial assistance?

A: Yes, businesses can set limits on the maximum amount employees may request to manage risk and maintain financial stability.

Q: How can businesses ensure confidentiality?

A: Financial assistance requests should be handled discreetly, with information shared only with those directly involved in the review and approval process.

Q: How often should this policy be reviewed?

A: This policy should be reviewed annually or whenever significant changes occur in Vermont labor laws or company financial practices.

Q: Are part-time employees eligible for financial assistance?

A: Eligibility for part-time employees should be specified in the policy and depend on meeting criteria such as tenure or consistent work hours.

This article contains general legal information and does not contain legal advice. Cobrief is not a law firm or a substitute for an attorney or law firm. The law is complex and changes often. For legal advice, please ask a lawyer.